Answered step by step

Verified Expert Solution

Question

1 Approved Answer

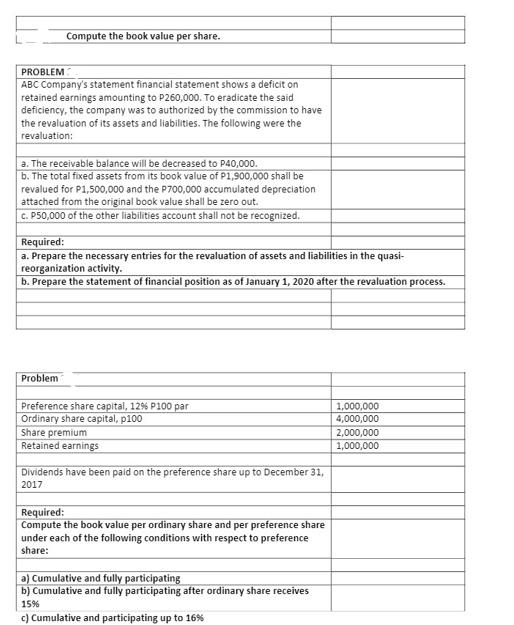

Compute the book value per share. PROBLEM ABC Company's statement financial statement shows a deficit on retained earnings amounting to P260,000. To eradicate the

Compute the book value per share. PROBLEM ABC Company's statement financial statement shows a deficit on retained earnings amounting to P260,000. To eradicate the said deficiency, the company was to authorized by the commission to have the revaluation of its assets and liabilities. The following were the revaluation: a. The receivable balance will be decreased to P40,000. b. The total fixed assets from its book value of P1,900,000 shall be revalued for P1,500,000 and the P700,000 accumulated depreciation attached from the original book value shall be zero out. c. P50,000 of the other liabilities account shall not be recognized. Required: a. Prepare the necessary entries for the revaluation of assets and liabilities in the quasi- reorganization activity. b. Prepare the statement of financial position as of January 1, 2020 after the revaluation process. Problem Preference share capital, 12% P100 par Ordinary share capital, p100 Share premium Retained earnings Dividends have been paid on the preference share up to December 31, 2017 Required: Compute the book value per ordinary share and per preference share under each of the following conditions with respect to preference share: a) Cumulative and fully participating b) Cumulative and fully participating after ordinary share receives 15% c) Cumulative and participating up to 16% 1,000,000 4,000,000 2,000,000 1,000,000

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer entries for revaluation Entry Debit P Credit P a Decrease in receivable balance Receivable 220000 Retained Earnings b Revaluation of fixed asse...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started