Answered step by step

Verified Expert Solution

Question

1 Approved Answer

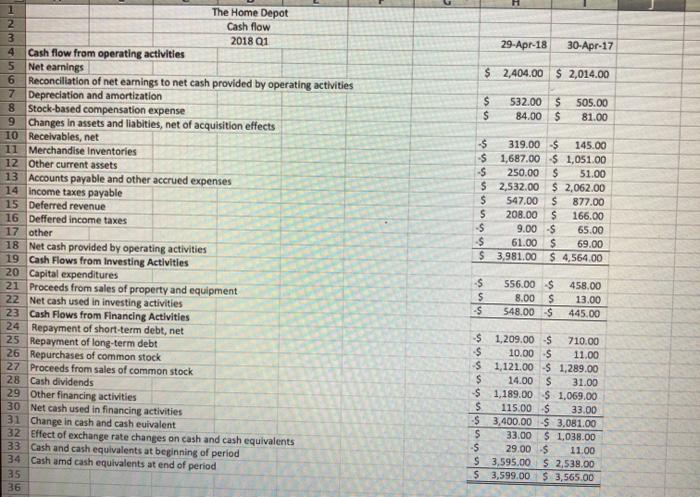

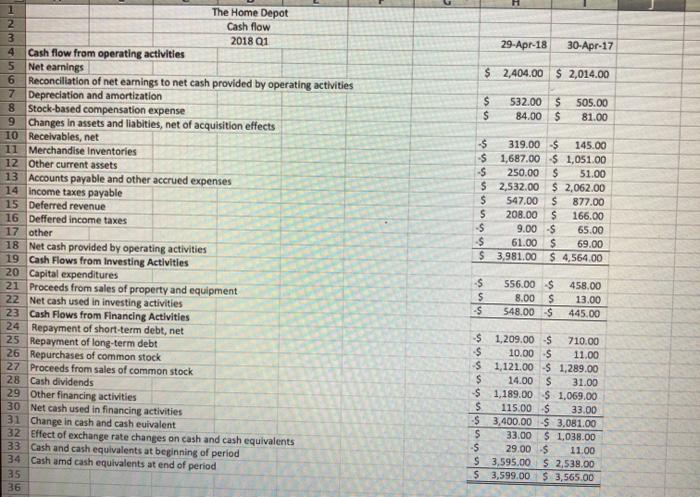

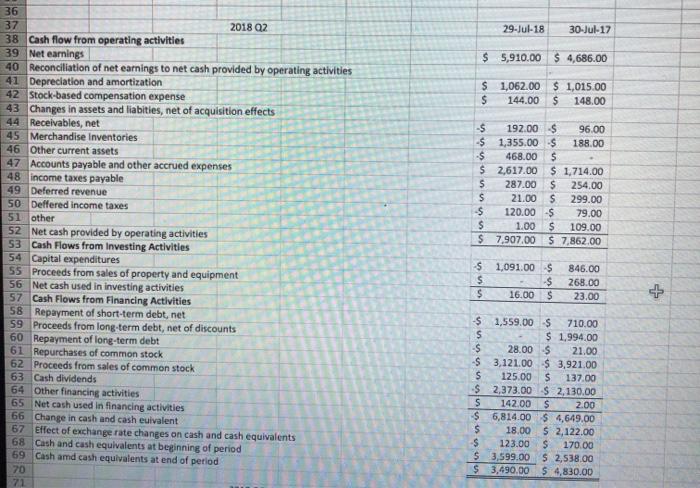

compute the casg flows from assets (CFFA) with the schedules a) operate cash fkoe ( OCF) schedule should compute OCF b) Net capital spending (NCS)

compute the casg flows from assets (CFFA) with the schedules

a) operate cash fkoe ( OCF) schedule should compute OCF

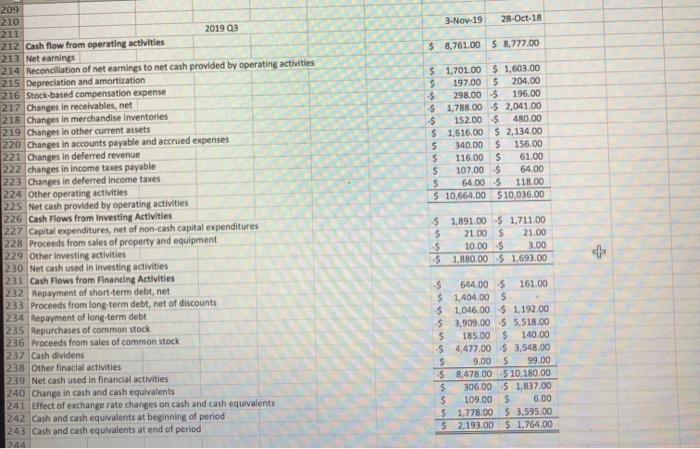

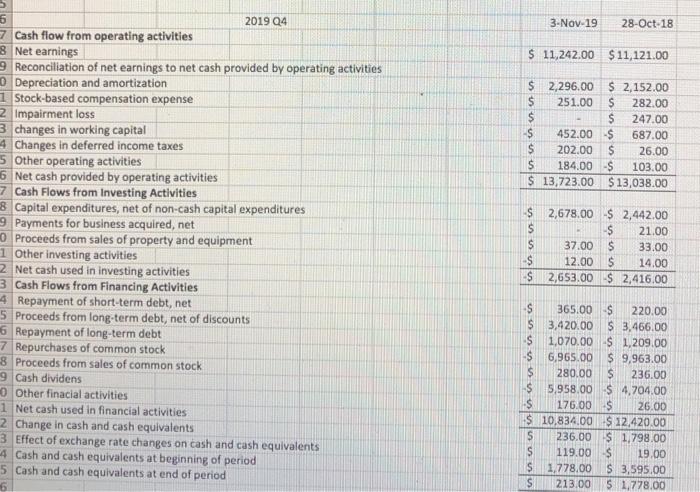

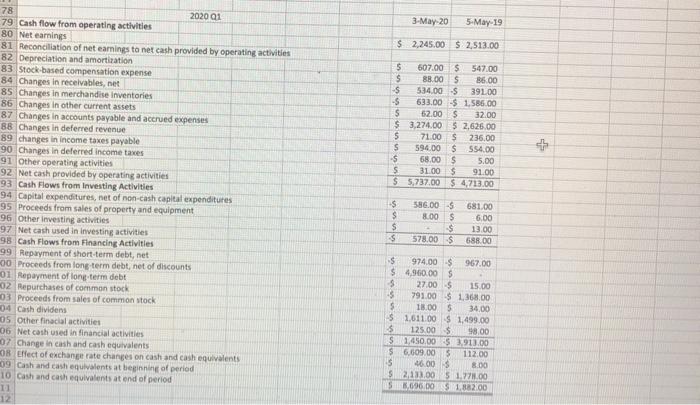

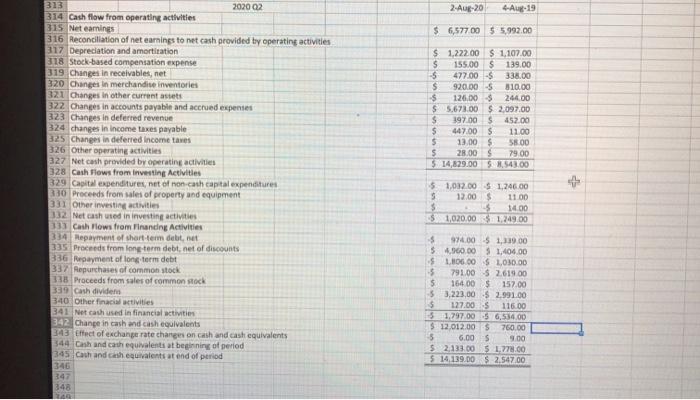

29-Apr-18 30-Apr-17 $ 2,404.00 $ 2,014.00 $ $ 532.00 $ 84.00 $ 505.00 81.00 9 1 The Home Depot 2 Cash flow 3 2018 Q1 4 Cash flow from operating activities 5 Net earnings 6 Reconciliation of net earnings to net cash provided by operating activities 7 Depreciation and amortization Stock-based compensation expense Changes in assets and liabities, net of acquisition effects 10 Receivables, net 11 Merchandise Inventories 12 Other current assets 13 Accounts payable and other accrued expenses 14 income taxes payable 15 Deferred revenue 16 Deffered income taxes 17 other 18 Net cash provided by operating activities 19 Cash Flows from Investing Activities 20 Capital expenditures 21 Proceeds from sales of property and equipment 22 Net cash used in investing activities 23 Cash Flows from Financing Activities 24 Repayment of short-term debt, net 25 Repayment of long-term debt 26 Repurchases of common stock 27 Proceeds from sales of common stock 28 Cash dividends 29 Other financing activities 30 Net cash used in financing activities 31 Change in cash and cash euivalent 32 Effect of exchange rate changes on cash and cash equivalents 33 Cash and cash equivalents at beginning of period 34 Cash amd cash equivalents at end of period 35 36 -$ 319.00 $ 145.00 $ 1,687.00 $ 1.051.00 -S 250.00 $ 51.00 $ 2,532.00 $ 2,062.00 S 547.00 S 877.00 S 208.00 $ 166.00 -5 9.00 S 65.00 $ 61.00 $ 69.00 $ 3,981.00 $ 4.564.00 $ 5 $ 556.00 $ 8.00 $ 548.00 $ 458.00 13.00 445.00 $ 1,209.00 $ 710.00 $ 10.00 $ 11.00 $ 1,121.00 $ 1,289.00 $ 14.00 S 31.00 $ 1,189.00 $ 1,069.00 $ 115.00$ 33.00 $ 3,400.00 $ 3,081.00 S 33.00 $ 1.038.00 -S 29.00 S 11.00 $ 3,595.00 $ 2,538.00 $ 3,599.00 $ 3,565.00 29-Jul-18 30-Jul-17 $ 5,910.00 $ 4,686.00 $ 1,062.00 $ 1,015.00 $ 144.00 $ 148.00 unui 36 37 2018 Q2 38 Cash flow from operating activities 39 Net earnings 40 Reconciliation of net earnings to net cash provided by operating activities 41 Depreciation and amortization 42 Stock-based compensation expense 43 Changes in assets and liabities, net of acquisition effects 44 Receivables, net 45 Merchandise Inventories 46 Other current assets 47 Accounts payable and other accrued expenses 48 income taxes payable 49 Deferred revenue 50 Deffered income taxes 51 other 52 Net cash provided by operating activities 53 Cash Flows from Investing Activities 54 Capital expenditures 55 Proceeds from sales of property and equipment 56 Net cash used in investing activities 57 Cash Flows from Financing Activities 58 Repayment of short-term debt, net 59 Proceeds from long-term debt, net of discounts 60 Repayment of long-term debt 61 Repurchases of common stock 62 Proceeds from sales of common stock 63 Cash dividends 64 Other financing activities 65 Net cash used in financing activities 66 Change in cash and cash euivalent 67 Effect of exchange rate changes on cash and cash equivalents 68 Cash and cash equivalents at beginning of period 69 Cash amd cash equivalents at end of period 70 71 -$ 192.00 $ 96.00 -$ 1,355.00 $ 188.00 468.00 $ $ 2,617.00 $ 1,714.00 287.00 $ 254.00 21.00 $ 299.00 120.00 $ 79.00 1.00 $ 109.00 $ 7,907.00 $ 7,862.00 ni -$ 1,091.00$ $ $ 16.00 $ 846.00 268.00 23.00 + -$1,559.00 $ 710.00 $ $ 1,994.00 $ 28.00 $ 21.00 3,121.00$ 3,921.00 $ 125.00 $ 137.00 $ 2,373.00 $2,130.00 S 142.00 S 2.00 $ 6,814.00 $4,649.00 $ 18.00 $ 2,122.00 $ 123.00 S 170.00 $ 3,599.00 $ 2,538.00 $ 3,490.00 $4,830.00 28-Oct-18 29-Oct-17 $ 8,777.00 $ 6,851.00 $ 1,603.00 $ 1,533.00 $ 204.00 $ 214.00 $ 196.00 $ 95.00 $ 2,041.00 $ 776.00 $ 480.00 $ 75.00 $ 2,134.00 $ 1.597.00 $ 156.00 $ 115.00 S 61.00 5 113.00 $ 64.00 $ 76.00 $ 118.00 $ 190,00 $ 10,036.00 $ 9,741.00 20 71 2018 Q3 72 Cash flow from operating activities 73. Net earnings 74 Reconciliation of net earnings to net cash provided by operating activities 75 Depreciation and amortization 76 Stock-based compensation expense 77 Changes in assets and liabities, net of acquisition effects 78 Receivables, net 79 Merchandise Inventories 80 Other current assets 81 Accounts payable and other accrued expenses 82 Deferred revenue 83 Income taxes payable 84 Deffered income taxes 85 other 86 Net cash provided by operating activities 87 Cash Flows from Investing Activities 88 Capital expenditures 89 Payments for business acuired, net 90 Proceeds from sales of property and equipment 91 Other investments activities 92 Net cash used in investung activities 93 Cash Flows from Financial Activities 94 Repayments of short-term debt, net 95 Proceeds from long-term debt, net of discount 96 Repayments of long-term debt, net 97 Repurchases of common stock 98 Proceeds from sales of common stock 99 Cash dividends 100 Other financial activities 101 Net cash used in financial activities 102 Change in cash and cash equivalents 103 Effect of exchange rate changes on cash and cash equivalents 104 Cash and cash equivalents at beginning of period 105 Cash and cash equivalents at end of period $ 1,711.00 $ 1,354,00 $ $ 260.00 $ 21.00 $ 38.00 $ 3.00 $ S 1,693.00 $ 1.576.00 $ 161.00 $ 585.00 5 $ 2,991.00 $ 1,192.00 $ 534,00 $ 5,518.00 $ 6,067,00 $ 140.00 $ 157.00 $ 3.548.00 $ 3, 174,00 $ 99.00 $ 41.00 $ 10,180.00 $ 7,253.00 $ 1,837.00 $ 912.00 $ 6.00 $ 99.00 $3,595.00 52.538.00 $ 1,764,00 S 3,549.00 29-Jul-18 30-Jul-17 $ 11,121.00 $ 8,630.00 $ 2,152.00 $ 2.062.00 $ 282.00 $ 273.00 $ 247.00 $ $ 687.00 $ 554,00 $ 26.00 $ 92.00 $ 103.00 $ 420.00 $ 13,038.00 $12,031.00 107 108 2018 Q4 109 Cash flow from operating activities 110 Net earnings 111 Reconciliation of net earnings to net cash provided by operating activities 112 Depreciation and amortization 113 Stock-based compensation expense 114 Impairment loss 115 Changes in working capital, net of acquisition effects 116 Changes in deferred income taxes 117 Other operating activities 118 Net cash provided by operating activities 119 120 Cash Flows from Investing Activities 121 Capital expenditures, net of non-cash capital expenditures 122 Payments for business acquired, net 123 Proceeds from sales of property and equipment 124 Other investing activities 125 Net cash used in investing activities 126 Cash Flows from Financing Activities 127 Repayment of short-term debt, net 128 Proceeds from long-term debt, net of discounts 129 Repayment of long-term debt 130 Repurchases of common stock 131 Proceeds from sales of common stock 132 Cash dividends 133 Other financing activities 134 Net cash used in financing activities 135 Change in cash and cash euivalent 136 Effect of exchange rate changes on cash and cash equivalents 137 Cash and cash equivalents at beginning of period 138 Cash amd cash equivalents at end of period $ 2,442.00 $ 1,897.00 s 21.00 5 374.00 $ 33.00 $ 47.00 S 14.00 $ 4.00 $ 2,416.00 $ 228.00 + 5 220.00 $ 850.00 $ 3,466.00 $ 2,991.00 S 1,209.00 $ 543.00 $ 9,963.00 S 8,000.00 $ 236.00 $ 255.00 $4,704.00 $ 4,212.00 -S 26.00 $ 211.00 $ 12.420.00 $ 8,870.00 $ 1.798.00 5 933.00 -S 19.00 S 124.00 S 3,595.00 $. 2.538.00 $ 1.778.00 5 3.595.00 29-Jul-18 30-Jul-17 $ 2,513.00 $ 2,404.00 $ 547.00 $ 532.00 $ 86.00 $ 84.00 $ 391.00 $ 319.00 $ 1,586.00 $ 1,687.00 32.00 $ 250.00 2,488.00 $ 2,532.00 $ 236.00 $ 208.00 $ 554.00 $ 547.00 $ 5.00 $ 9.00 $ 91.00 $ 61.00 $ 4,575.00 $ 3,981.00 141 2019 Q1 142 Cash flow from operating activities 143 Net eamings 144 Reconciliation of net earnings to net cash provided by operating activities 145 Depreciation and amortization 146 Stock-based compensation expense 147 Changes in receivables, net 148 Changes in merchandise inventories 149 Changes in other current assets 150 Changes in accounts payable and accrued expenses 151 Changes in deferred revenue 152 changes in income taxes payable 153 Changes in deferred income taxes 154 Other operating activities 155 Net cash provided by operating activities 156 Cash Flows from Investing Activities 157 Capital expenditures, net of non-cash capital expenditures 158 Proceeds from sales of property and equipment 159 Other investing activities 160 Net cash used in investing activities 161 Cash Flows from Financing Activities 162 Repayment of short-term debt, net 163 Proceeds from long-term debt, net of discounts 164 Repurchases of common stock 165 Proceeds from sales of common stock 166 Cash dividends 167 Other financing activities 168 Net cash used in financing activities 169 Change in cash and cash euivalent 170 Effect of exchange rate changes on cash and cash equivalents 171 Cash and cash equivalents at beginning of period 172 Cash amd cash equivalents at end of period 173 556.00 8.00 linis 681.00 $ 6.00 $ 13.00 $ 688.00 $ 548.00 uus S 967.00 $ 1.209.00 $ 15.00 $ 10.00 S 1,368.00 $ 1,121.00 34.00 5 14.00 $ 1,499.00 $ 1,189.00 $ 40.00 5 115.00 $ 3.775.00$ 3,400.00 S 112.00 S 33.00 8.00 $ 29.00 $1,278,00 5 3.595.00 $ 1.8B2.00 S 3,599.00 leslas is liste 4-Aug-19 29-Jul-18 $ 5,992.00 S 5,910.00 onunun 1:107 $ 1,062.00 $ 139.00 $ 144.00 $ 338.00 $ 192.00 $ 810.00 $ 1,355.00 244.00 $ 468.00 $ 2,051.00 $ 2,617.00 452.00 $ 287.00 $ 11.00 S 21.00 $ 58.00-S 120.00 $ 79.00 $ 1.00 $ 8,497.00 $ 7,907.00 + 5 2019 Q2 6 Cash flow from operating activities 7 Net earnings 8 Reconciliation of net earnings to net cash provided by operating activities 9 Depreciation and amortization 0 Stock-based compensation expense 1 Changes in receivables, net 2 Changes in merchandise inventories 33 Changes in other current assets 34 Changes in accounts payable and accrued expenses 35 Changes in deferred revenue 36 changes in income taxes payable 37 Changes in deferred income taxes 38 Other operating activities 39 Net cash provided by operating activities 30 Cash Flows from Investing Activities 21 Capital expenditures, net of non-cash capital expenditures 92 Proceeds from sales of property and equipment 33 Other investing activities 94 Net cash used in investing activities 95 Cash Flows from Financing Activities 96 Repayment of short-term debt, net 97 Proceeds from long term debt, net of discounts 98 Repayment of long-term debt 99 Repurchases of common stock 00 Proceeds from sales of common stock 201 Cash dividens 302 Other finacial activities 203 Net cash used in financial activities 204 Change in cash and cash equivalents 205 Effect of exchange rate changes on cash and cash equivalents 206 Cash and cash equivalents at beginning of period 207 Cash and cash equivalents at end of period 208 209 $ 1,246.00 $ 1.091.00 $ 11.00 $ 16.00 $ 14.00 $ $ 1,249.00 $ 1.075.00 $ 1,339.00 $ 1,559.00 S 1,404.00 S $ 1,030.00 S 28.00 S 2,619.00$ 3,121.00 S 157.00 $ 125.00 $ 2.991.00 $ 2,373.00 $ 70.005 142.00 S 6,488.00$ 6,814.00 S 760.00 s 18.00 s 9.00 $ 123.00 S 1.778.00 $ 3,595.00 5 2.547.00 $ 3,490.00 3-Nov-19 28-Oct-18 $ 8,761.00 $8,777.00 $ 1,701.00 $ 1,603.00 $ 197.00 $ 204.00 $ 298.00 $ 196.00 $ 1,788.00 $ 2,041.00 -$ 152.00 5 480.00 $ 1,616.00 $ 2,134.00 $ 340.00 $ 156.00 $ 116.00 5 61.00 $ 107.00 $ 64.00 S 64.00 118.00 $ 10,664.00 $10,036.00 209 210 211 2019 Q3 212 Cash flow from operating activities 213 Net earnings 214 Reconciliation of net earnings to net cash provided by operating activities 215 Depreciation and amortization 216 Stock-based compensation expense 217 Changes in receivables, net 218 Changes in merchandise inventories 219 Changes in other current assets 220 Changes in accounts payable and accrued expenses 221 Changes in deferred revenue 222 changes in income taxes payable 223 Changes in deferred income taxes 224 Other operating activities 225 Net cash provided by operating activities 226 Cash Flows from Investing Activities 2 Capital expenditures, net of non-cash capital expenditures 228 Proceeds from sales of property and equipment 229 Other investing activities 230 Net cash used in investing activities 231 Cash Flows from Financing Activities 232 Repayment of short-term debt, net 233 Proceeds from long-term debt, net of discounts 234 Repayment of long-term debt 235 Repurchases of common stock 236 Proceeds from sales of common stock 237 Cash dividens 238 Other finacial activities 239 Net cash used in financial activities 240 Change in cash and cash equivalents 241 Effect of exchange rate changes on cash and cash equivalents 242 Cash and cash equivalents at beginning of period 243 Cash and cash equivalents at end of period $ 1,891.00 $ 1.711.00 $ 21.00 S 21.00 $ 10.00 $ 3.00 $ 1,850.00 $ 1,693.00 4 $ 544.00 $ 161.00 $1,404.00 $ $ 1,046,00 $ 1.192.00 $ 3,909.00 $ 5,518.00 S 185.00 $ 140.00 $ 4,477.00$ 3,548.00 5 9.00 $ 99.00 S 8,478.00 $10,180.00 S 306.00 5 1,837.00 $ 109.00 $ 6.00 $ 1.778.00 $ 3,595.00 5 2,193.00 $ 1.764,00 3-Nov-19 28-Oct-18 $ 11,242.00 $11,121.00 $ 2,296.00 $ 2,152.00 S 251.00 $ 282.00 $ $ 247.00 -S 452.00 $ 687.00 S 202.00 S 26.00 $ 184.00 $ 103.00 $ 13,723.00 $13,038.00 6 2019 Q4 7 Cash flow from operating activities 3 Net earnings 9 Reconciliation of net earnings to net cash provided by operating activities 0 Depreciation and amortization Stock-based compensation expense 2 Impairment loss 3 changes in working capital 4 Changes in deferred income taxes 5 Other operating activities 16 Net cash provided by operating activities 7 Cash Flows from Investing Activities 8 Capital expenditures, net of non-cash capital expenditures 9 Payments for business acquired, net Proceeds from sales of property and equipment 1 Other investing activities z Net cash used in investing activities 3 Cash Flows from Financing Activities 4 Repayment of short-term debt, net 5 Proceeds from long-term debt, net of discounts 6 Repayment of long-term debt 7 Repurchases of common stock 8 Proceeds from sales of common stock 9 Cash dividens Other finacial activities 1 Net cash used in financial activities 2 Change in cash and cash equivalents 3 Effect of exchange rate changes on cash and cash equivalents 4 Cash and cash equivalents at beginning of period 5 Cash and cash equivalents at end of period $ 2,678.00-2,442.00 $ $ 21.00 S 37.00 $ 33.00 S 12.00 S 14.00 S 2,653.00 $ 2,416.00 S 365.00 S 220.00 S 3,420.00 S 3,466.00 S 1.670.00 $ 1.209.00 -$ 6,965.00 $ 9,963.00 $ 280.00 $ 236.00 $ 5,958.00 $ 4,704.00 $ 176.00 $ 26.00 $ 10,834.00 $12.420.00 $ 236.00 1,798.00 S 119.00 $ 19.00 S 1,778.00 S 3,595.00 $ 213.00 $ 1.778.00 6 3-May-20 5-May-19 $ 2,245.00 $ 2,513.00 5 607.00 $ 547.00 $ 88.00 S 86.00 -S 534.00 5 39100 -S 633.00 $ 1.586.00 $ 52.00 $ 32.00 $ 3.274.00 $ 2,626.00 5 71.00 S 236,00 S 594,00 $ S54.00 $ 58.00 $ 5.00 s 31.00 $ 91.00 $ 5,737.00 $ 4,713.00 & 78 2020 21 79 Cash flow from operating activities 80 Net earnings 81 Reconciliation of net earnings to net cash provided by operating activities 82 Depreciation and amortization 83 Stock-based compensation expense 84 Changes in receivables, net 85 Changes in merchandise Inventories 86 Changes in other current assets 87 Changes in accounts payable and accrued expenses 88 Changes in deferred revenue 89 changes in income taxes payable 90 Changes in deferred income taxes 91 Other operating activities 92 Net cash provided by operating activities 93 Cash Flows from Investing Activities 94 Capital expenditures, net of non-cash capital expenditures 95 Proceeds from sales of property and equipment 96 Other investing activities 97 Net cash used in Investing activities 98 Cash Flows from Financing Activities 99 Repayment of short-term debt, net 00 Proceeds from long-term debt, net of discounts 01 Repayment of long-term debt 02 Repurchases of common stock 03 Proceeds from sales of common stock 04 Cash dividens 05 Other finacial activities 06 Net cash used in financial activities 07 Change in cash and cash equivalents OB Effect of exchange rate changes on cash and cash equivalents 09 Cash and cash equivalents at beginning of period 10 Cash and cash equivalents at end of period $ $ $ $ 586.00 5 8.00 $ $ 578.00 $ 681.00 6,00 13.00 588.00 s 974.00 $ 967.00 $ 4.960.00 $ $ 27.00 5 15.00 5 791.00 $ 1.368.00 115.00 5 34.00 S1,611.00 $ 1,499.00 $ 125.00 $ 98.00 $1,450.00 $ 3.913.00 $ 6.609.00 $ 112.00 5 46.00 8.00 S2,233.00 5 1.77.00 5.696.00 1.832.00 12 2-Aug-20 4-Aug-19 $ 6,577.00 $ 5,992.00 $ 1,222.00 $ 1,107.00 $ 155,00 $ 139.00 5 477.00 338.00 $ 920.005 310.00 $ 126.00 244.00 $ 5.673.00 $ 2,097.00 $ 197.00 $ 452.00 $ 447.00 $ 11.00 $ 13.00 $ 58.00 $ 28.00 $ 79.00 $14,829,005,543.00 + 313 202002 314 Cash flow from operating activities 315 Net earnings 316 Reconciliation of net earnings to net cash provided by operating activities 317 Depreciation and amortization 318 Stock-based compensation expense 319 Changes in receivables, net 320 Changes in merchandise inventories 321 Changes in other current assets 322 Changes in accounts payable and accrued expenses 323 Changes in deferred revenue 324 changes in income taxes payable 325 Changes in deferred Income taxes 326 Other operating activities 327 Net cash provided by operating activities 328 Cash Flows from investing Activities 329 Capital expenditures, net of non cash capital expenditures 330 Proceeds from sales of property and equipment 331 Other investing activities 332 Net cash used in investing activities 333 Cash Flows from Finandng Activities 334 Repayment of short-term debit, net 335 Proceeds from long-term debt.net of discounts 336 Repayment of long-term debt 337 Repurchases of common stock 338 Proceeds from sales of common stock 359 Cash divide 340 Other facilities 341 Net cash used in financial activities 342 Change in cash and cash equivalents 343 ffect of exchange rate changes on cash and cash equivalents 344 Cash and cash equivalents at beginning of period 345 Cash and cash equivalents at end of period 346 347 348 51,032.00 5 1,246.00 5 12.00 $ 11.00 $ 14.00 $1,020.00 1.249.00 $ 974.00 -5 1,339.00 $4.960.00 1,404.00 $ 100.00 $ 1.030.00 5 791.00 52.619.00 S 164.00 $157.00 5 3,223,00 $ 2.991.00 $ 127.00 $ 116.00 51,797.00 56,534.00 $12,012.00$ 760.00 5 6.00 $ 9.00 52.133.005 177.00 5 14 139.00 $ 2.547.00 29-Apr-18 30-Apr-17 $ 2,404.00 $ 2,014.00 $ $ 532.00 $ 84.00 $ 505.00 81.00 9 1 The Home Depot 2 Cash flow 3 2018 Q1 4 Cash flow from operating activities 5 Net earnings 6 Reconciliation of net earnings to net cash provided by operating activities 7 Depreciation and amortization Stock-based compensation expense Changes in assets and liabities, net of acquisition effects 10 Receivables, net 11 Merchandise Inventories 12 Other current assets 13 Accounts payable and other accrued expenses 14 income taxes payable 15 Deferred revenue 16 Deffered income taxes 17 other 18 Net cash provided by operating activities 19 Cash Flows from Investing Activities 20 Capital expenditures 21 Proceeds from sales of property and equipment 22 Net cash used in investing activities 23 Cash Flows from Financing Activities 24 Repayment of short-term debt, net 25 Repayment of long-term debt 26 Repurchases of common stock 27 Proceeds from sales of common stock 28 Cash dividends 29 Other financing activities 30 Net cash used in financing activities 31 Change in cash and cash euivalent 32 Effect of exchange rate changes on cash and cash equivalents 33 Cash and cash equivalents at beginning of period 34 Cash amd cash equivalents at end of period 35 36 -$ 319.00 $ 145.00 $ 1,687.00 $ 1.051.00 -S 250.00 $ 51.00 $ 2,532.00 $ 2,062.00 S 547.00 S 877.00 S 208.00 $ 166.00 -5 9.00 S 65.00 $ 61.00 $ 69.00 $ 3,981.00 $ 4.564.00 $ 5 $ 556.00 $ 8.00 $ 548.00 $ 458.00 13.00 445.00 $ 1,209.00 $ 710.00 $ 10.00 $ 11.00 $ 1,121.00 $ 1,289.00 $ 14.00 S 31.00 $ 1,189.00 $ 1,069.00 $ 115.00$ 33.00 $ 3,400.00 $ 3,081.00 S 33.00 $ 1.038.00 -S 29.00 S 11.00 $ 3,595.00 $ 2,538.00 $ 3,599.00 $ 3,565.00 29-Jul-18 30-Jul-17 $ 5,910.00 $ 4,686.00 $ 1,062.00 $ 1,015.00 $ 144.00 $ 148.00 unui 36 37 2018 Q2 38 Cash flow from operating activities 39 Net earnings 40 Reconciliation of net earnings to net cash provided by operating activities 41 Depreciation and amortization 42 Stock-based compensation expense 43 Changes in assets and liabities, net of acquisition effects 44 Receivables, net 45 Merchandise Inventories 46 Other current assets 47 Accounts payable and other accrued expenses 48 income taxes payable 49 Deferred revenue 50 Deffered income taxes 51 other 52 Net cash provided by operating activities 53 Cash Flows from Investing Activities 54 Capital expenditures 55 Proceeds from sales of property and equipment 56 Net cash used in investing activities 57 Cash Flows from Financing Activities 58 Repayment of short-term debt, net 59 Proceeds from long-term debt, net of discounts 60 Repayment of long-term debt 61 Repurchases of common stock 62 Proceeds from sales of common stock 63 Cash dividends 64 Other financing activities 65 Net cash used in financing activities 66 Change in cash and cash euivalent 67 Effect of exchange rate changes on cash and cash equivalents 68 Cash and cash equivalents at beginning of period 69 Cash amd cash equivalents at end of period 70 71 -$ 192.00 $ 96.00 -$ 1,355.00 $ 188.00 468.00 $ $ 2,617.00 $ 1,714.00 287.00 $ 254.00 21.00 $ 299.00 120.00 $ 79.00 1.00 $ 109.00 $ 7,907.00 $ 7,862.00 ni -$ 1,091.00$ $ $ 16.00 $ 846.00 268.00 23.00 + -$1,559.00 $ 710.00 $ $ 1,994.00 $ 28.00 $ 21.00 3,121.00$ 3,921.00 $ 125.00 $ 137.00 $ 2,373.00 $2,130.00 S 142.00 S 2.00 $ 6,814.00 $4,649.00 $ 18.00 $ 2,122.00 $ 123.00 S 170.00 $ 3,599.00 $ 2,538.00 $ 3,490.00 $4,830.00 28-Oct-18 29-Oct-17 $ 8,777.00 $ 6,851.00 $ 1,603.00 $ 1,533.00 $ 204.00 $ 214.00 $ 196.00 $ 95.00 $ 2,041.00 $ 776.00 $ 480.00 $ 75.00 $ 2,134.00 $ 1.597.00 $ 156.00 $ 115.00 S 61.00 5 113.00 $ 64.00 $ 76.00 $ 118.00 $ 190,00 $ 10,036.00 $ 9,741.00 20 71 2018 Q3 72 Cash flow from operating activities 73. Net earnings 74 Reconciliation of net earnings to net cash provided by operating activities 75 Depreciation and amortization 76 Stock-based compensation expense 77 Changes in assets and liabities, net of acquisition effects 78 Receivables, net 79 Merchandise Inventories 80 Other current assets 81 Accounts payable and other accrued expenses 82 Deferred revenue 83 Income taxes payable 84 Deffered income taxes 85 other 86 Net cash provided by operating activities 87 Cash Flows from Investing Activities 88 Capital expenditures 89 Payments for business acuired, net 90 Proceeds from sales of property and equipment 91 Other investments activities 92 Net cash used in investung activities 93 Cash Flows from Financial Activities 94 Repayments of short-term debt, net 95 Proceeds from long-term debt, net of discount 96 Repayments of long-term debt, net 97 Repurchases of common stock 98 Proceeds from sales of common stock 99 Cash dividends 100 Other financial activities 101 Net cash used in financial activities 102 Change in cash and cash equivalents 103 Effect of exchange rate changes on cash and cash equivalents 104 Cash and cash equivalents at beginning of period 105 Cash and cash equivalents at end of period $ 1,711.00 $ 1,354,00 $ $ 260.00 $ 21.00 $ 38.00 $ 3.00 $ S 1,693.00 $ 1.576.00 $ 161.00 $ 585.00 5 $ 2,991.00 $ 1,192.00 $ 534,00 $ 5,518.00 $ 6,067,00 $ 140.00 $ 157.00 $ 3.548.00 $ 3, 174,00 $ 99.00 $ 41.00 $ 10,180.00 $ 7,253.00 $ 1,837.00 $ 912.00 $ 6.00 $ 99.00 $3,595.00 52.538.00 $ 1,764,00 S 3,549.00 29-Jul-18 30-Jul-17 $ 11,121.00 $ 8,630.00 $ 2,152.00 $ 2.062.00 $ 282.00 $ 273.00 $ 247.00 $ $ 687.00 $ 554,00 $ 26.00 $ 92.00 $ 103.00 $ 420.00 $ 13,038.00 $12,031.00 107 108 2018 Q4 109 Cash flow from operating activities 110 Net earnings 111 Reconciliation of net earnings to net cash provided by operating activities 112 Depreciation and amortization 113 Stock-based compensation expense 114 Impairment loss 115 Changes in working capital, net of acquisition effects 116 Changes in deferred income taxes 117 Other operating activities 118 Net cash provided by operating activities 119 120 Cash Flows from Investing Activities 121 Capital expenditures, net of non-cash capital expenditures 122 Payments for business acquired, net 123 Proceeds from sales of property and equipment 124 Other investing activities 125 Net cash used in investing activities 126 Cash Flows from Financing Activities 127 Repayment of short-term debt, net 128 Proceeds from long-term debt, net of discounts 129 Repayment of long-term debt 130 Repurchases of common stock 131 Proceeds from sales of common stock 132 Cash dividends 133 Other financing activities 134 Net cash used in financing activities 135 Change in cash and cash euivalent 136 Effect of exchange rate changes on cash and cash equivalents 137 Cash and cash equivalents at beginning of period 138 Cash amd cash equivalents at end of period $ 2,442.00 $ 1,897.00 s 21.00 5 374.00 $ 33.00 $ 47.00 S 14.00 $ 4.00 $ 2,416.00 $ 228.00 + 5 220.00 $ 850.00 $ 3,466.00 $ 2,991.00 S 1,209.00 $ 543.00 $ 9,963.00 S 8,000.00 $ 236.00 $ 255.00 $4,704.00 $ 4,212.00 -S 26.00 $ 211.00 $ 12.420.00 $ 8,870.00 $ 1.798.00 5 933.00 -S 19.00 S 124.00 S 3,595.00 $. 2.538.00 $ 1.778.00 5 3.595.00 29-Jul-18 30-Jul-17 $ 2,513.00 $ 2,404.00 $ 547.00 $ 532.00 $ 86.00 $ 84.00 $ 391.00 $ 319.00 $ 1,586.00 $ 1,687.00 32.00 $ 250.00 2,488.00 $ 2,532.00 $ 236.00 $ 208.00 $ 554.00 $ 547.00 $ 5.00 $ 9.00 $ 91.00 $ 61.00 $ 4,575.00 $ 3,981.00 141 2019 Q1 142 Cash flow from operating activities 143 Net eamings 144 Reconciliation of net earnings to net cash provided by operating activities 145 Depreciation and amortization 146 Stock-based compensation expense 147 Changes in receivables, net 148 Changes in merchandise inventories 149 Changes in other current assets 150 Changes in accounts payable and accrued expenses 151 Changes in deferred revenue 152 changes in income taxes payable 153 Changes in deferred income taxes 154 Other operating activities 155 Net cash provided by operating activities 156 Cash Flows from Investing Activities 157 Capital expenditures, net of non-cash capital expenditures 158 Proceeds from sales of property and equipment 159 Other investing activities 160 Net cash used in investing activities 161 Cash Flows from Financing Activities 162 Repayment of short-term debt, net 163 Proceeds from long-term debt, net of discounts 164 Repurchases of common stock 165 Proceeds from sales of common stock 166 Cash dividends 167 Other financing activities 168 Net cash used in financing activities 169 Change in cash and cash euivalent 170 Effect of exchange rate changes on cash and cash equivalents 171 Cash and cash equivalents at beginning of period 172 Cash amd cash equivalents at end of period 173 556.00 8.00 linis 681.00 $ 6.00 $ 13.00 $ 688.00 $ 548.00 uus S 967.00 $ 1.209.00 $ 15.00 $ 10.00 S 1,368.00 $ 1,121.00 34.00 5 14.00 $ 1,499.00 $ 1,189.00 $ 40.00 5 115.00 $ 3.775.00$ 3,400.00 S 112.00 S 33.00 8.00 $ 29.00 $1,278,00 5 3.595.00 $ 1.8B2.00 S 3,599.00 leslas is liste 4-Aug-19 29-Jul-18 $ 5,992.00 S 5,910.00 onunun 1:107 $ 1,062.00 $ 139.00 $ 144.00 $ 338.00 $ 192.00 $ 810.00 $ 1,355.00 244.00 $ 468.00 $ 2,051.00 $ 2,617.00 452.00 $ 287.00 $ 11.00 S 21.00 $ 58.00-S 120.00 $ 79.00 $ 1.00 $ 8,497.00 $ 7,907.00 + 5 2019 Q2 6 Cash flow from operating activities 7 Net earnings 8 Reconciliation of net earnings to net cash provided by operating activities 9 Depreciation and amortization 0 Stock-based compensation expense 1 Changes in receivables, net 2 Changes in merchandise inventories 33 Changes in other current assets 34 Changes in accounts payable and accrued expenses 35 Changes in deferred revenue 36 changes in income taxes payable 37 Changes in deferred income taxes 38 Other operating activities 39 Net cash provided by operating activities 30 Cash Flows from Investing Activities 21 Capital expenditures, net of non-cash capital expenditures 92 Proceeds from sales of property and equipment 33 Other investing activities 94 Net cash used in investing activities 95 Cash Flows from Financing Activities 96 Repayment of short-term debt, net 97 Proceeds from long term debt, net of discounts 98 Repayment of long-term debt 99 Repurchases of common stock 00 Proceeds from sales of common stock 201 Cash dividens 302 Other finacial activities 203 Net cash used in financial activities 204 Change in cash and cash equivalents 205 Effect of exchange rate changes on cash and cash equivalents 206 Cash and cash equivalents at beginning of period 207 Cash and cash equivalents at end of period 208 209 $ 1,246.00 $ 1.091.00 $ 11.00 $ 16.00 $ 14.00 $ $ 1,249.00 $ 1.075.00 $ 1,339.00 $ 1,559.00 S 1,404.00 S $ 1,030.00 S 28.00 S 2,619.00$ 3,121.00 S 157.00 $ 125.00 $ 2.991.00 $ 2,373.00 $ 70.005 142.00 S 6,488.00$ 6,814.00 S 760.00 s 18.00 s 9.00 $ 123.00 S 1.778.00 $ 3,595.00 5 2.547.00 $ 3,490.00 3-Nov-19 28-Oct-18 $ 8,761.00 $8,777.00 $ 1,701.00 $ 1,603.00 $ 197.00 $ 204.00 $ 298.00 $ 196.00 $ 1,788.00 $ 2,041.00 -$ 152.00 5 480.00 $ 1,616.00 $ 2,134.00 $ 340.00 $ 156.00 $ 116.00 5 61.00 $ 107.00 $ 64.00 S 64.00 118.00 $ 10,664.00 $10,036.00 209 210 211 2019 Q3 212 Cash flow from operating activities 213 Net earnings 214 Reconciliation of net earnings to net cash provided by operating activities 215 Depreciation and amortization 216 Stock-based compensation expense 217 Changes in receivables, net 218 Changes in merchandise inventories 219 Changes in other current assets 220 Changes in accounts payable and accrued expenses 221 Changes in deferred revenue 222 changes in income taxes payable 223 Changes in deferred income taxes 224 Other operating activities 225 Net cash provided by operating activities 226 Cash Flows from Investing Activities 2 Capital expenditures, net of non-cash capital expenditures 228 Proceeds from sales of property and equipment 229 Other investing activities 230 Net cash used in investing activities 231 Cash Flows from Financing Activities 232 Repayment of short-term debt, net 233 Proceeds from long-term debt, net of discounts 234 Repayment of long-term debt 235 Repurchases of common stock 236 Proceeds from sales of common stock 237 Cash dividens 238 Other finacial activities 239 Net cash used in financial activities 240 Change in cash and cash equivalents 241 Effect of exchange rate changes on cash and cash equivalents 242 Cash and cash equivalents at beginning of period 243 Cash and cash equivalents at end of period $ 1,891.00 $ 1.711.00 $ 21.00 S 21.00 $ 10.00 $ 3.00 $ 1,850.00 $ 1,693.00 4 $ 544.00 $ 161.00 $1,404.00 $ $ 1,046,00 $ 1.192.00 $ 3,909.00 $ 5,518.00 S 185.00 $ 140.00 $ 4,477.00$ 3,548.00 5 9.00 $ 99.00 S 8,478.00 $10,180.00 S 306.00 5 1,837.00 $ 109.00 $ 6.00 $ 1.778.00 $ 3,595.00 5 2,193.00 $ 1.764,00 3-Nov-19 28-Oct-18 $ 11,242.00 $11,121.00 $ 2,296.00 $ 2,152.00 S 251.00 $ 282.00 $ $ 247.00 -S 452.00 $ 687.00 S 202.00 S 26.00 $ 184.00 $ 103.00 $ 13,723.00 $13,038.00 6 2019 Q4 7 Cash flow from operating activities 3 Net earnings 9 Reconciliation of net earnings to net cash provided by operating activities 0 Depreciation and amortization Stock-based compensation expense 2 Impairment loss 3 changes in working capital 4 Changes in deferred income taxes 5 Other operating activities 16 Net cash provided by operating activities 7 Cash Flows from Investing Activities 8 Capital expenditures, net of non-cash capital expenditures 9 Payments for business acquired, net Proceeds from sales of property and equipment 1 Other investing activities z Net cash used in investing activities 3 Cash Flows from Financing Activities 4 Repayment of short-term debt, net 5 Proceeds from long-term debt, net of discounts 6 Repayment of long-term debt 7 Repurchases of common stock 8 Proceeds from sales of common stock 9 Cash dividens Other finacial activities 1 Net cash used in financial activities 2 Change in cash and cash equivalents 3 Effect of exchange rate changes on cash and cash equivalents 4 Cash and cash equivalents at beginning of period 5 Cash and cash equivalents at end of period $ 2,678.00-2,442.00 $ $ 21.00 S 37.00 $ 33.00 S 12.00 S 14.00 S 2,653.00 $ 2,416.00 S 365.00 S 220.00 S 3,420.00 S 3,466.00 S 1.670.00 $ 1.209.00 -$ 6,965.00 $ 9,963.00 $ 280.00 $ 236.00 $ 5,958.00 $ 4,704.00 $ 176.00 $ 26.00 $ 10,834.00 $12.420.00 $ 236.00 1,798.00 S 119.00 $ 19.00 S 1,778.00 S 3,595.00 $ 213.00 $ 1.778.00 6 3-May-20 5-May-19 $ 2,245.00 $ 2,513.00 5 607.00 $ 547.00 $ 88.00 S 86.00 -S 534.00 5 39100 -S 633.00 $ 1.586.00 $ 52.00 $ 32.00 $ 3.274.00 $ 2,626.00 5 71.00 S 236,00 S 594,00 $ S54.00 $ 58.00 $ 5.00 s 31.00 $ 91.00 $ 5,737.00 $ 4,713.00 & 78 2020 21 79 Cash flow from operating activities 80 Net earnings 81 Reconciliation of net earnings to net cash provided by operating activities 82 Depreciation and amortization 83 Stock-based compensation expense 84 Changes in receivables, net 85 Changes in merchandise Inventories 86 Changes in other current assets 87 Changes in accounts payable and accrued expenses 88 Changes in deferred revenue 89 changes in income taxes payable 90 Changes in deferred income taxes 91 Other operating activities 92 Net cash provided by operating activities 93 Cash Flows from Investing Activities 94 Capital expenditures, net of non-cash capital expenditures 95 Proceeds from sales of property and equipment 96 Other investing activities 97 Net cash used in Investing activities 98 Cash Flows from Financing Activities 99 Repayment of short-term debt, net 00 Proceeds from long-term debt, net of discounts 01 Repayment of long-term debt 02 Repurchases of common stock 03 Proceeds from sales of common stock 04 Cash dividens 05 Other finacial activities 06 Net cash used in financial activities 07 Change in cash and cash equivalents OB Effect of exchange rate changes on cash and cash equivalents 09 Cash and cash equivalents at beginning of period 10 Cash and cash equivalents at end of period $ $ $ $ 586.00 5 8.00 $ $ 578.00 $ 681.00 6,00 13.00 588.00 s 974.00 $ 967.00 $ 4.960.00 $ $ 27.00 5 15.00 5 791.00 $ 1.368.00 115.00 5 34.00 S1,611.00 $ 1,499.00 $ 125.00 $ 98.00 $1,450.00 $ 3.913.00 $ 6.609.00 $ 112.00 5 46.00 8.00 S2,233.00 5 1.77.00 5.696.00 1.832.00 12 2-Aug-20 4-Aug-19 $ 6,577.00 $ 5,992.00 $ 1,222.00 $ 1,107.00 $ 155,00 $ 139.00 5 477.00 338.00 $ 920.005 310.00 $ 126.00 244.00 $ 5.673.00 $ 2,097.00 $ 197.00 $ 452.00 $ 447.00 $ 11.00 $ 13.00 $ 58.00 $ 28.00 $ 79.00 $14,829,005,543.00 + 313 202002 314 Cash flow from operating activities 315 Net earnings 316 Reconciliation of net earnings to net cash provided by operating activities 317 Depreciation and amortization 318 Stock-based compensation expense 319 Changes in receivables, net 320 Changes in merchandise inventories 321 Changes in other current assets 322 Changes in accounts payable and accrued expenses 323 Changes in deferred revenue 324 changes in income taxes payable 325 Changes in deferred Income taxes 326 Other operating activities 327 Net cash provided by operating activities 328 Cash Flows from investing Activities 329 Capital expenditures, net of non cash capital expenditures 330 Proceeds from sales of property and equipment 331 Other investing activities 332 Net cash used in investing activities 333 Cash Flows from Finandng Activities 334 Repayment of short-term debit, net 335 Proceeds from long-term debt.net of discounts 336 Repayment of long-term debt 337 Repurchases of common stock 338 Proceeds from sales of common stock 359 Cash divide 340 Other facilities 341 Net cash used in financial activities 342 Change in cash and cash equivalents 343 ffect of exchange rate changes on cash and cash equivalents 344 Cash and cash equivalents at beginning of period 345 Cash and cash equivalents at end of period 346 347 348 51,032.00 5 1,246.00 5 12.00 $ 11.00 $ 14.00 $1,020.00 1.249.00 $ 974.00 -5 1,339.00 $4.960.00 1,404.00 $ 100.00 $ 1.030.00 5 791.00 52.619.00 S 164.00 $157.00 5 3,223,00 $ 2.991.00 $ 127.00 $ 116.00 51,797.00 56,534.00 $12,012.00$ 760.00 5 6.00 $ 9.00 52.133.005 177.00 5 14 139.00 $ 2.547.00 b) Net capital spending (NCS) schedule should compute NCS

c) change in net working capital (NWC) should compute change in NWC

d) Conpute CFFA from OCF, NCS, and changes in NWC schedule

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

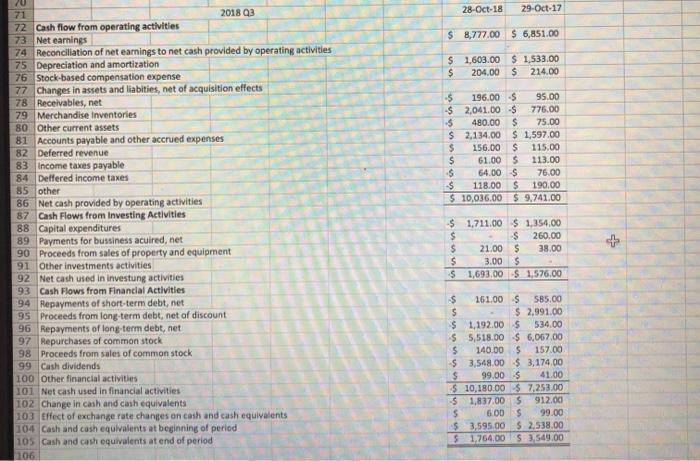

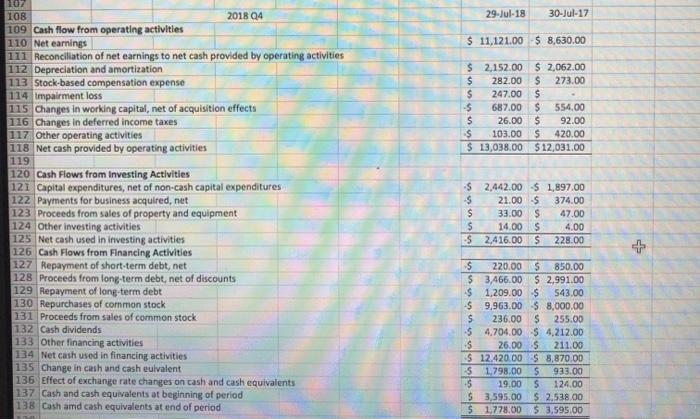

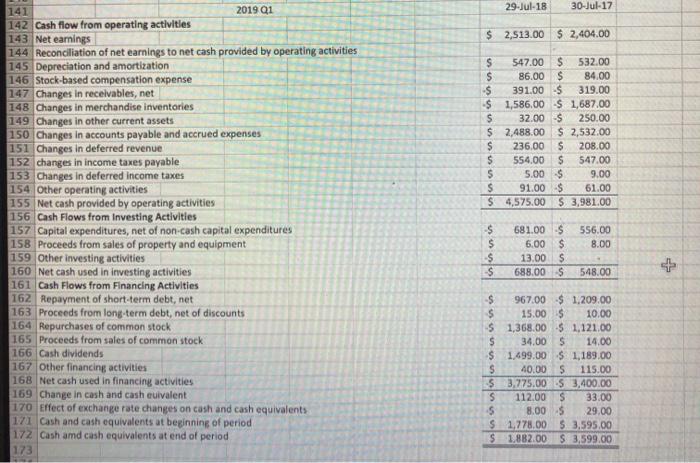

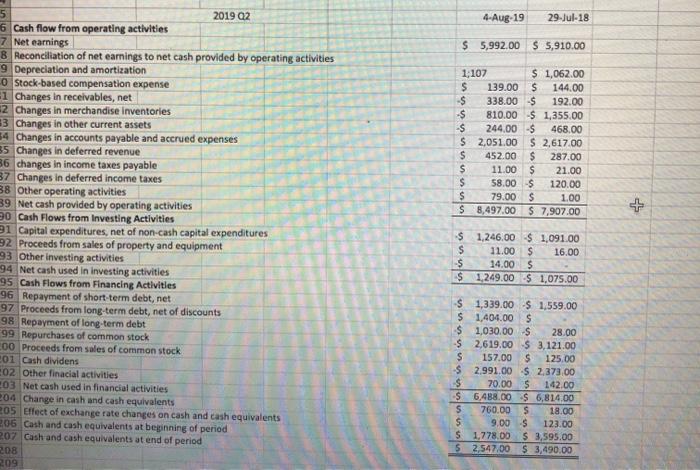

Get Started