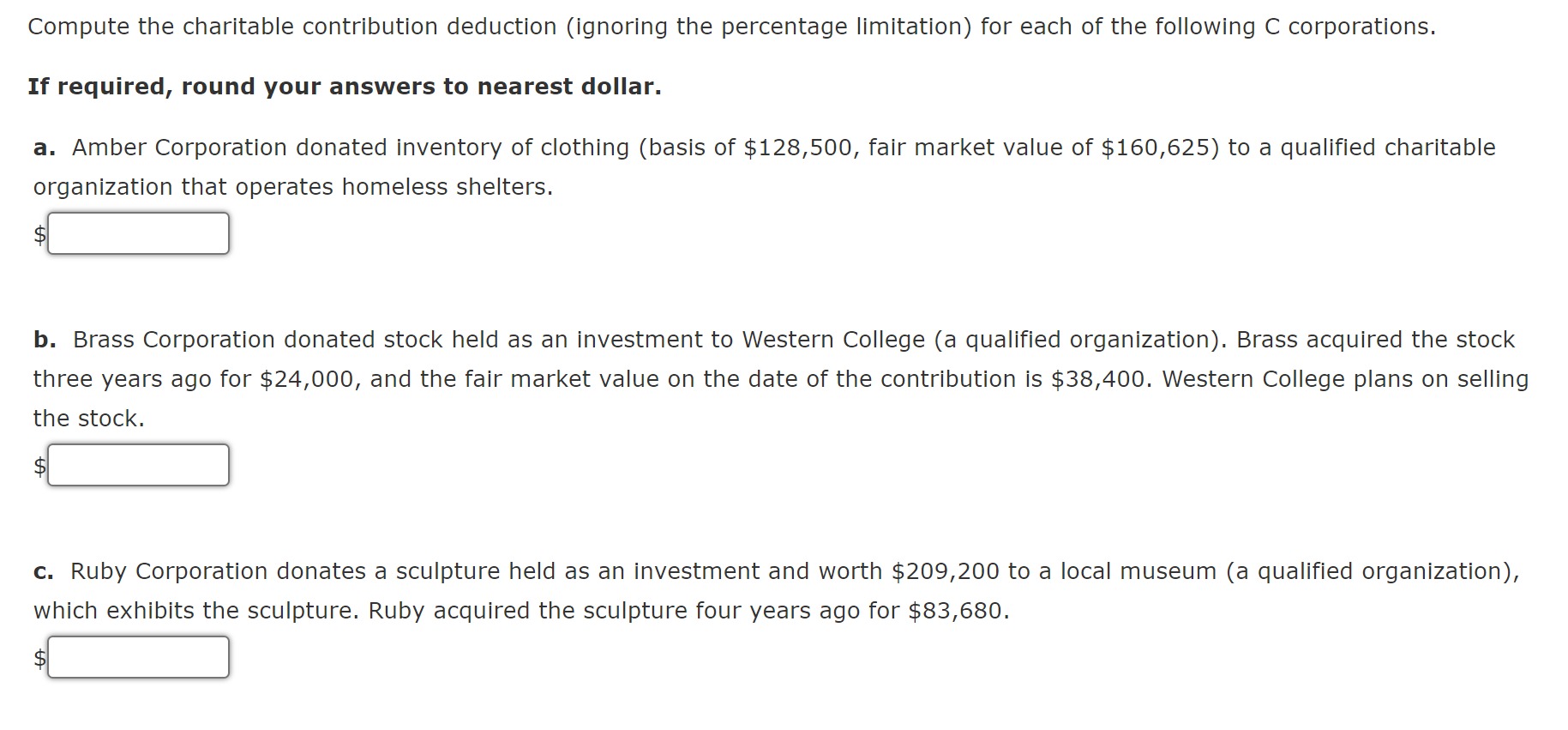

Question: Compute the charitable contribution deduction (ignoring the percentage limitation) for each of the following C corporations. If required, round your answers to nearest dollar. a.

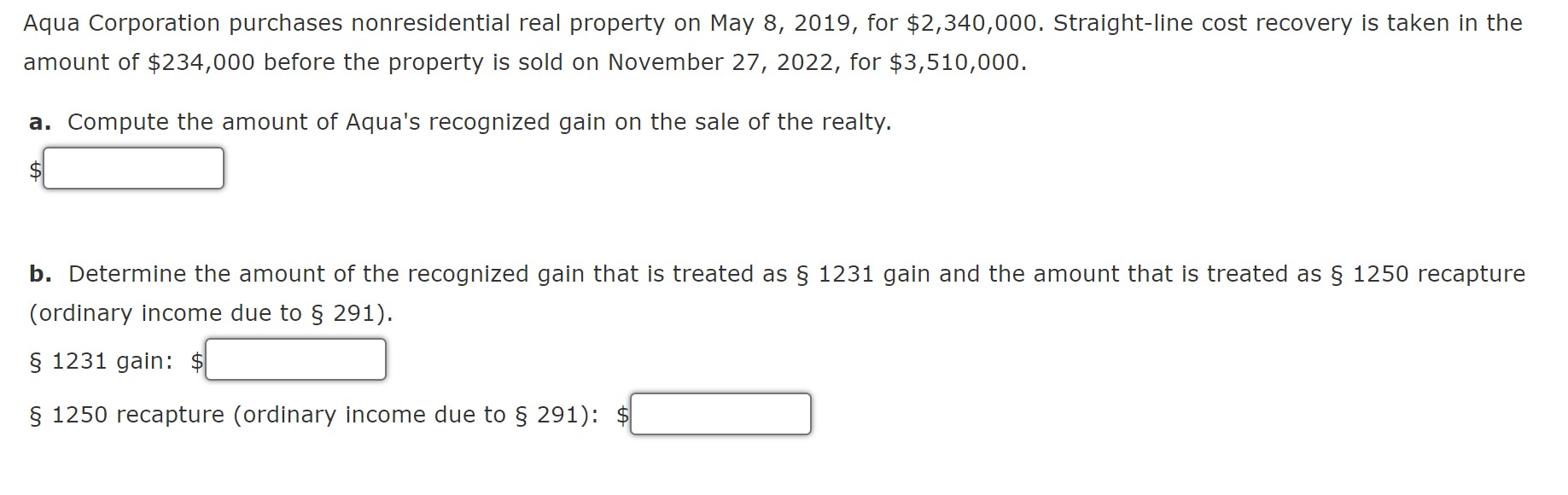

Compute the charitable contribution deduction (ignoring the percentage limitation) for each of the following C corporations. If required, round your answers to nearest dollar. a. Amber Corporation donated inventory of clothing (basis of $128,500, fair market value of $160,625 ) to a qualified charitable organization that operates homeless shelters. $ b. Brass Corporation donated stock held as an investment to Western College (a qualified organization). Brass acquired the stock three years ago for $24,000, and the fair market value on the date of the contribution is $38,400. Western College plans on selling the stock. $ c. Ruby Corporation donates a sculpture held as an investment and worth $209,200 to a local museum (a qualified organization), which exhibits the sculpture. Ruby acquired the sculpture four years ago for $83,680. $ Aqua Corporation purchases nonresidential real property on May 8,2019 , for $2,340,000. Straight-line cost recovery is taken in the amount of $234,000 before the property is sold on November 27,2022 , for $3,510,000. a. Compute the amount of Aqua's recognized gain on the sale of the realty. b. Determine the amount of the recognized gain that is treated as 1231 gain and the amount that is treated as 1250 recapture (ordinary income due to 291). 1231 gain: 1250 recapture (ordinary income due to 291): \$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts