Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the Coca-Cola's enterprise value in 2019 using the efficient market approach in Chapter 2, the Coca-Cola's balance sheet in 2019, and the Coca-Cola's

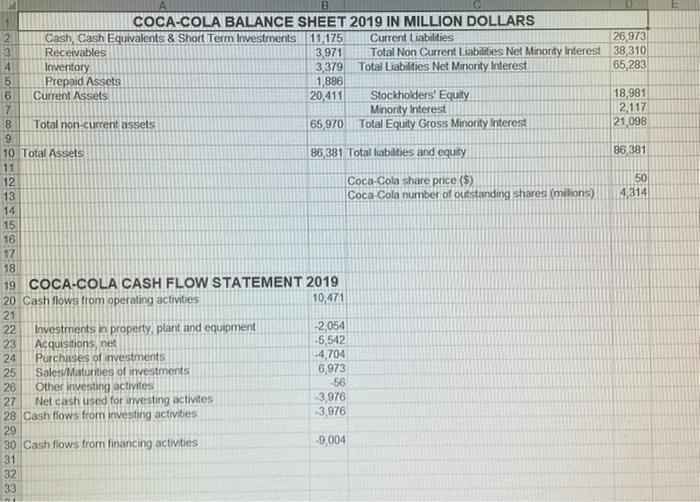

Compute the Coca-Cola's enterprise value in 2019 using the efficient market approach in Chapter 2, the Coca-Cola's balance sheet in 2019, and the Coca-Cola's current share price and number of outstanding shares below the balance sheet. (Submit the number in million dollars. For example, submit 12,345 if the enterprise value is $12,345,000.) B. COCA-COLA BALANCE SHEET 2019 IN MILLION DOLLARS Cash, Cash Equivalents & Short Term Investments 11,175 3,971 3,379 1,886 20,411 26,973 Total Non Current Liabilities Net Minority Interest 38,310 65,283 2 Current Liabilities 13 Receivables Total Liabilities Net Minority Interest Inventory Prepaid Assets Current Assets Stockholders' Equity Minority Interest 65,970 Total Equity Grass Minority Interest 18,981 2,117 21,098 7 8. Total non-current assets 19 10 Total Assets 86,381 Total liabilties and equity 86,381 11 Coca-Cola share price ($) Coca-Cola number of outstanding shares (milions) 50 4,314 12 13 14 15 16 17 18 19 COCA-COLA CASH FLOW STATEMENT 2019 20 Cash flows from operating activities 10,471 21 Investments in property, plant and equipment Acquisitions, net -2,054 -5,542 4,704 6,973 22 23 24 Purchases of investments Sales/Maturities of investments 26 25 56 Other investing activites Net cash used for investing activites 28 Cash flows from investing activities 29 3,976 3,976 27 30 Cash flows from financing activities 9,004 31 32 33

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started