Answered step by step

Verified Expert Solution

Question

1 Approved Answer

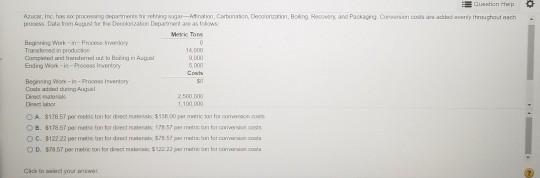

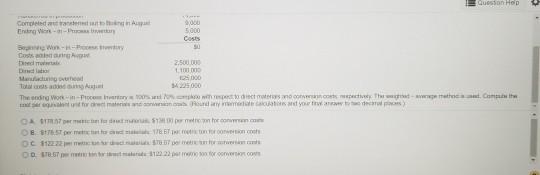

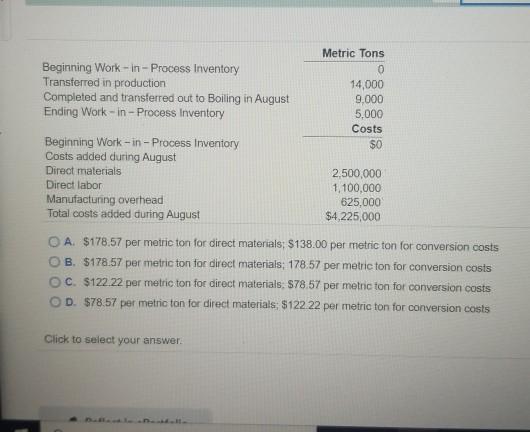

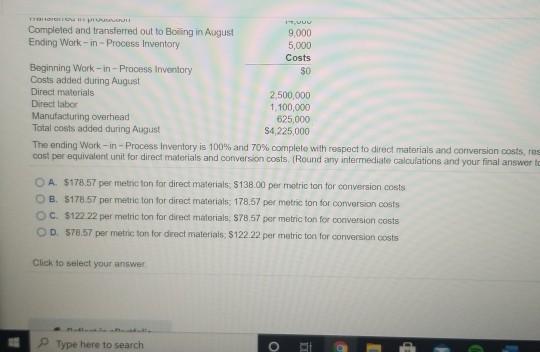

Compute the cost per equivalent unit for direct materials and conversion costs. The weighted average method is used. Conversion costs are added evenly throughout each

Compute the cost per equivalent unit for direct materials and conversion costs. The weighted average method is used. Conversion costs are added evenly throughout each process.

- tion Aug-inom Cartoon hoon Hand Paytren om Me To Tannrode Edgos LE Costa Bergs-Posten Cath 11 A 1785 pomoc Os 51185 GCB22 Ciao Guesson Hop Corona 2000 Engin 5.000 Costs We 50 Costs 2.500 1. ng 000 TA 225000 Theodor- com.htm mind you to Om Score DE ST permettono ODT110222 RON Metric Tons Beginning Work-in - Process Inventory 0 Transferred in production 14,000 Completed and transferred out to Boiling in August 9,000 Ending Work-in - Process Inventory 5.000 Costs Beginning Work-in - Process Inventory $0 Costs added during August Direct materials 2,500,000 Direct labor 1,100,000 Manufacturing overhead 625,000 Total costs acided during August $4,225,000 O A $178.57 per metric ton for direct materials: $138.00 per metric ton for conversion costs OB. $178.57 per metric ton for direct materials: 178.57 per metric ton for conversion costs C. $122.22 per metric ton for direct materials $78.57 per metric ton for conversion costs D. $78.57 per metric ton for direct materials: $122 22 per metric ton for conversion costs Click to select your answer. 30 ORIUL UUU Completed and transferred out to Boning in August 9,000 Ending Work-in - Process Inventory 5,000 Costs Beginning Work-in - Process Inventory Costs added during August Direct materials 2.500.000 Direct labor 1 100,000 Manufacturing overhead 625,000 Total costs added during August S4, 225,000 The ending Work-in - Process Inventory is 100% and 70% complete with respect to direct materials and conversion costs, res cost per equivalent unit for direct materials and conversion costs. (Round any intermediate calculations and your final answer to OA. $178.57 per metric ton for direct materials: $138.00 per metric ton for conversion costs OB. 5178.57 per metric ton for direct materials: 178.57 per metric ton for conversion costs OC 5122 22 per metric ton for direct materials. S78,57 per metric ton for conversion costs OD 578.57 per metric ton for direct materials: 5122 22 per matric ton for conversion costs Click to select your answer Type here to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started