Answered step by step

Verified Expert Solution

Question

1 Approved Answer

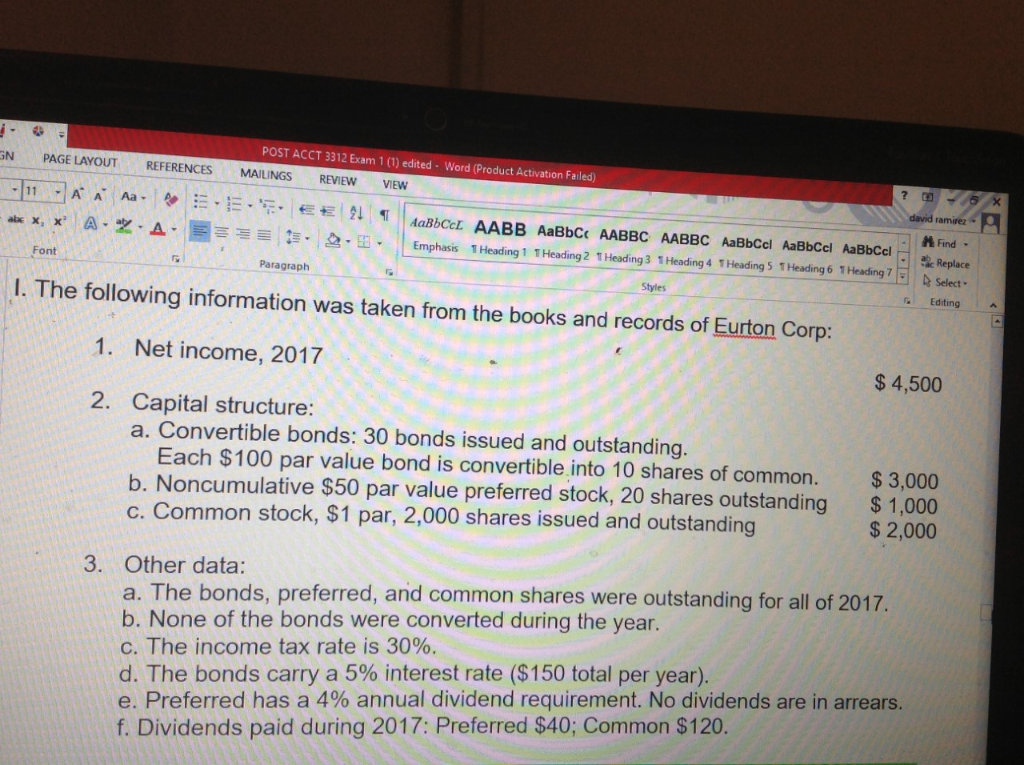

Compute the DILUTED earnings per share(EPS) for 2017. The answer key says the answer is 1.9847 but I don't know how it got that. Can

Compute the DILUTED earnings per share(EPS) for 2017.

The answer key says the answer is 1.9847 but I don't know how it got that. Can someone help me please? show your work! thanks in advance!

GN PAGE LAYOUT REFERENCES -111 A A A E - abx X, X A A E POST ACCT 3312 Exam 1 (U) edited - Word (Product Activation Failed MAILINGS REVIEW VIEW . ? 6 x EE211 AaBbcc AABB AaBbcc AABBC AABBC AaBbCcl AaBbCel AaBbCal david ramirez E . Emphasis T Heading 1 Heading 2 T Heading 3 T Heading 4 T Heading 5 THeading 6 THeading 7 Find - Paragraph - Pac Replace ing? Select Editing Aabe Font 1. The following information was taken from the books and records of Eurton Corp: Styles 1. Net income, 2017 $ 4,500 2. Capital structure: a. Convertible bonds: 30 bonds issued and outstanding. Each $100 par value bond is convertible into 10 shares of common. b. Noncumulative $50 par value preferred stock, 20 shares outstanding c. Common stock, $1 par, 2,000 shares issued and outstanding $3,000 $1,000 $ 2,000 ck, $1 par, Zalue preferred into 10 sham 3. Other data: a. The bonds, preferred, and common shares were outstanding for all of 2017. b. None of the bonds were converted during the year. c. The income tax rate is 30%. d. The bonds carry a 5% interest rate ($150 total per year). e. Preferred has a 4% annual dividend requirement. No dividends are in arrears. f. Dividends paid during 2017: Preferred $40; Common $120Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started