Answered step by step

Verified Expert Solution

Question

1 Approved Answer

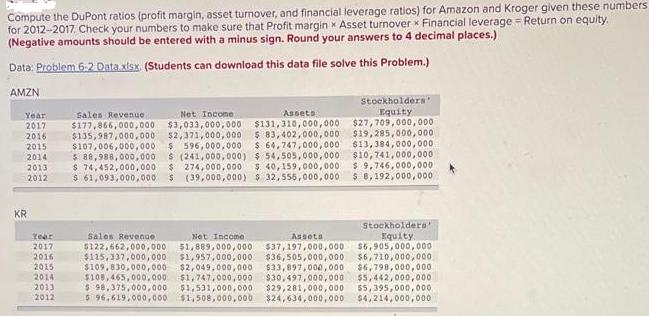

Compute the DuPont ratios (profit margin, asset turnover, and financial leverage ratios) for Amazon and Kroger given these numbers for 2012-2017. Check your numbers

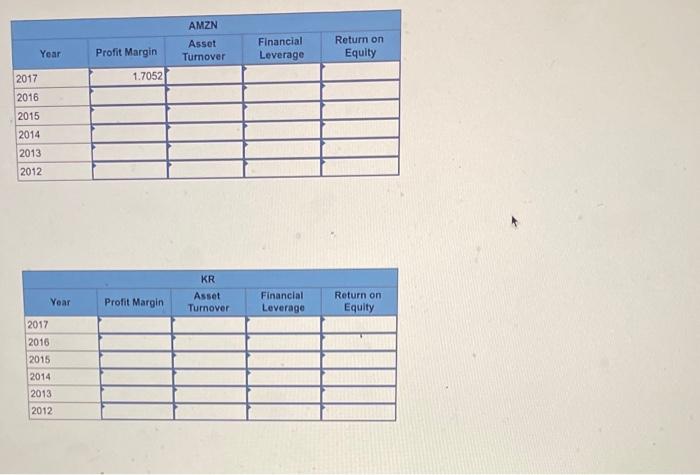

Compute the DuPont ratios (profit margin, asset turnover, and financial leverage ratios) for Amazon and Kroger given these numbers for 2012-2017. Check your numbers to make sure that Profit marginx Asset turnover Financial leverage = Return on equity. (Negative amounts should be entered with a minus sign. Round your answers to 4 decimal places.) Data: Problem 6-2 Data xlsx (Students can download this data file solve this Problem.) AMZN Year 2017 2016 2015 2014 2013 2012 KR Year 2017 2016 2015 2014 2013 2012 Stockholders' Equity $27,709,000,000 $19,285,000,000 $ 64,747,000,000 $13,384,000,000 $10,741,000,000 $ 9,746,000,000 $ 8,192,000,000 Sales Revenue. Net Income Assets $177,866,000,000 $3,033,000,000 $131,310,000,000 $135,987,000,000 $2,371,000,000 $ 83,402,000,000 $107,006,000,000. $ 596,000,000 $ 88,988,000,000 $ 74,452,000,000 $ 61,093,000,000 $ (241,000,000) $54,505,000,000 $274,000,000 $ 40,159,000,000 $ (39,000,000) $32,555,000,000 Stockholders' Sales Revenue Net Income Assets Equity $6,905,000,000 $6,710,000,000 $122,662,000,000 51,889,000,000 $37,197,000,000 $115,337,000,000 $1,957,000,000 $36,505,000,000 $109,830,000,000 $2,049,000,000 $33,897,000,000 $6,798,000,000 $108,465,000,000 $1,747,000,000 $30,497,000,000 $5,442,000,000 $ 98,375,000,000 $1,531,000,000 $29,281,000,000 55,395,000,000 $ 96,619,000,000 $1,508,000,000 $24,634,000,000 $4,214,000,000 Year 2017 2016 2015 2014 2013 2012 Year 2017 2016 2015 2014 2013 2012 Profit Margin 1.7052 Profit Margin AMZN Asset Turnover KR Asset Turnover. Financial Leverage Financial Leverage Return on Equity Return on 1 Equity

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

ANS Profit margin net in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started