Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the Economic Value Added (EVA) Explain the potential problems associated with EVA VC Limited Summary income statements for the year: Revenue Pre-tax accounting

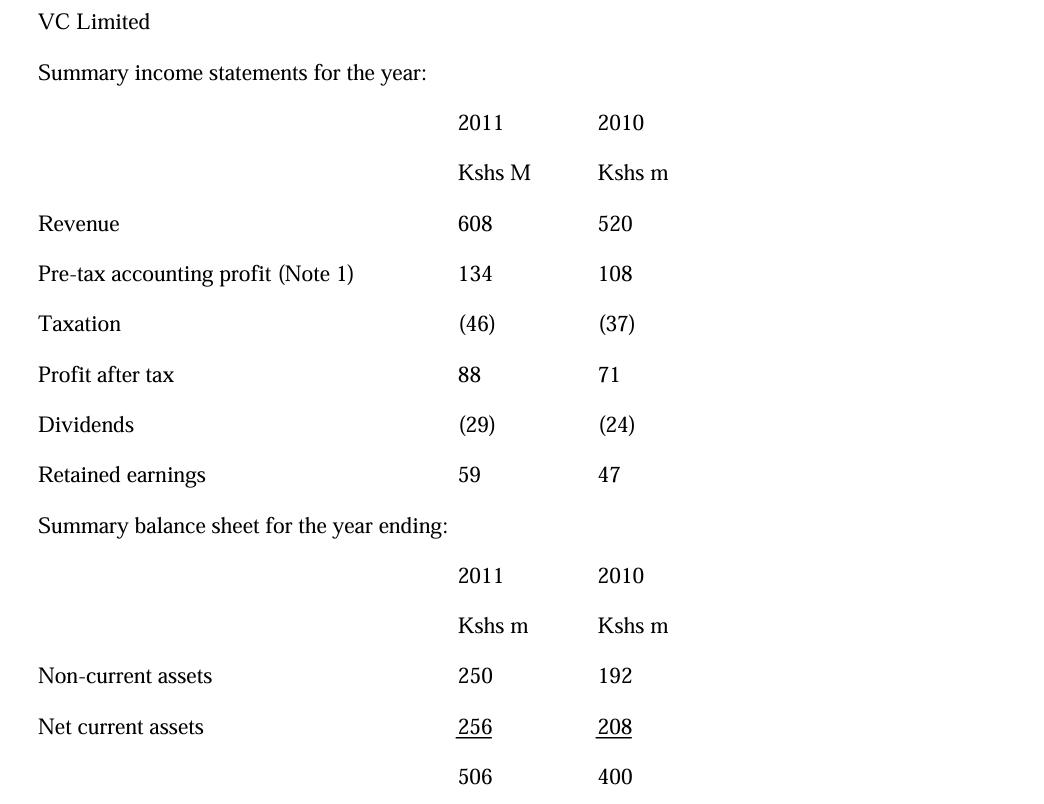

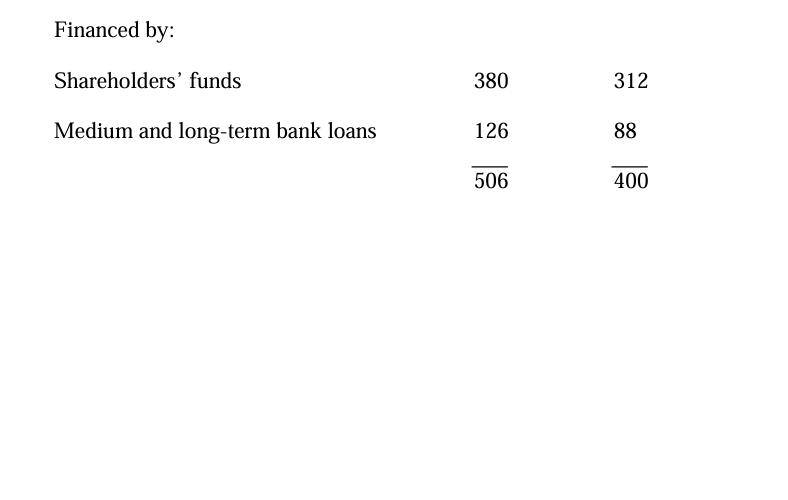

Compute the Economic Value Added (EVA) Explain the potential problems associated with EVA VC Limited Summary income statements for the year: Revenue Pre-tax accounting profit (Note 1) Taxation Profit after tax Dividends Retained earnings Summary balance sheet for the year ending: Non-current assets Net current assets 2011 Kshs M 608 134 (46) 88 (29) 59 2011 Kshs m 250 256 506 2010 Kshs m 520 108 (37) 71 (24) 47 2010 Kshs m 192 208 400 Financed by: Shareholders' funds Medium and long-term bank loans 380 126 506 312 88 400 Note 1: After deduction of the economic depreciation of the company's non-current assets. This is also the depreciation used for tax purposes. Other information is as follows: 1. Capital employed at the end of 2009 amounted to Kshs 350M. 2. VC Ltd had non-capitalized leases valued at Kshs 16M in each of the years 2009 to 2011. The leases are not subject to amortization. 3. VC Ltd's pre-tax cost of debt was estimated to be 9% in 2009 and 10% in 2010. 4. VC Ltd's cost of equity was estimated to be 15% in 2009 and 17% in 2010. 5. The target capital structure is 70% equity, 30% debt. 6. The rate of taxation is 30% in both 2009 and 2010 7. Economic depreciation amounted to Kshs 64M in 2009 and Kshs 72M in 2010. These amounts were equal to the depreciation used for tax purposes and depreciation charged in the income statements. 8. Interest payable amounted to Kshs 6M in 2009 and Kshs 8M in 2010. 9. Other non-cash expenses amounted to Kshs 20M per year in both 2009 and 2010.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the Economic Value Added EVA we need to follow several steps Step 1 Determine the Net Operating Profit After Taxes NOPAT NOPAT is calculated by taking the operating profit and subtracting t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started