Answered step by step

Verified Expert Solution

Question

1 Approved Answer

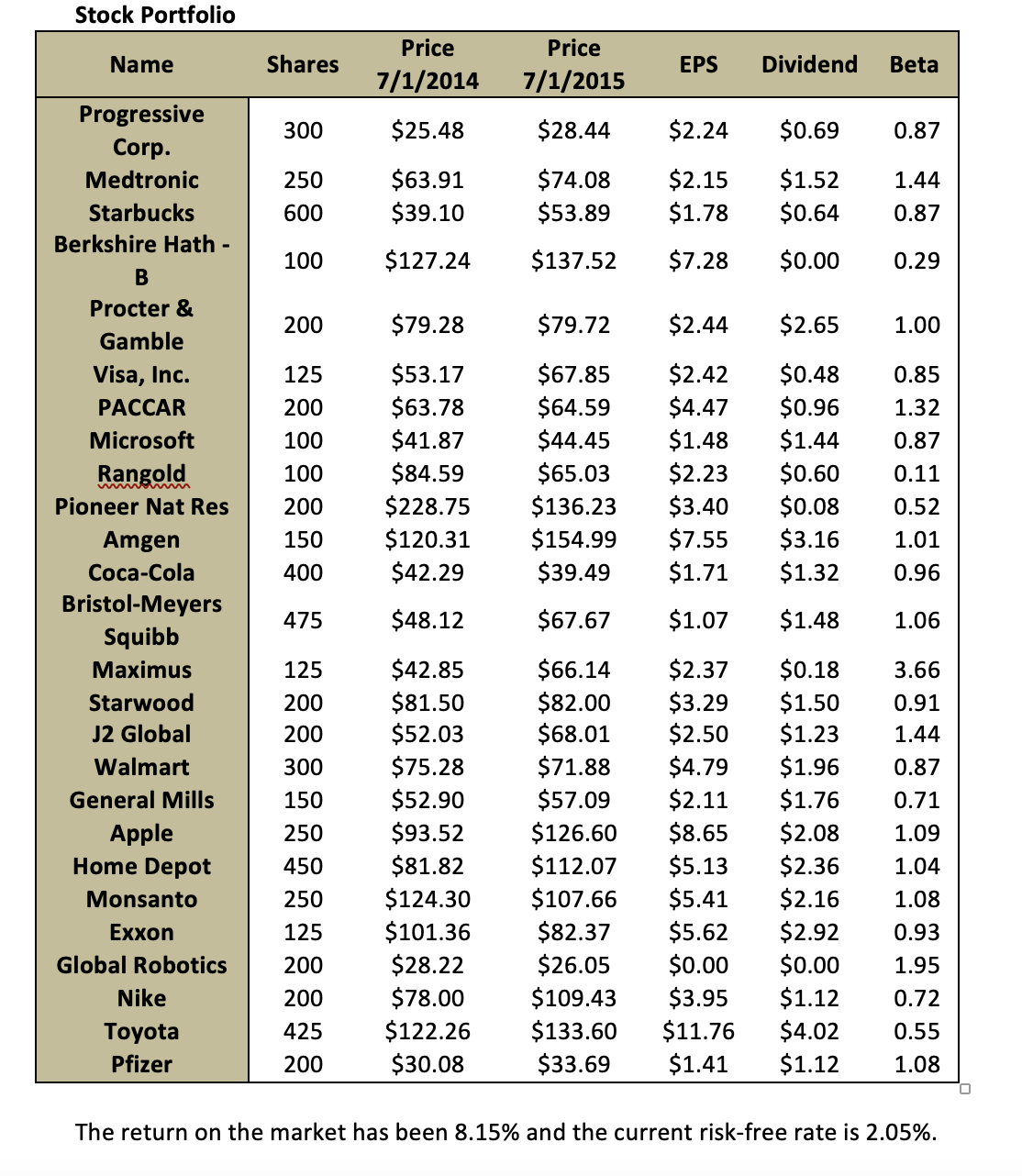

Compute the expectation of each stock's performance based on the CAPM model. Show whether each stock under- or over-performed. Below is the stock portfolio. Stock

Compute the expectation of each stock's performance based on the CAPM model. Show whether each stock under- or over-performed. Below is the stock portfolio.

Stock Portfolio Name Shares Price 7/1/2014 Price EPS Dividend Beta 7/1/2015 Progressive 300 $25.48 $28.44 $2.24 $0.69 0.87 Corp. Medtronic 250 $63.91 $74.08 $2.15 $1.52 1.44 Starbucks 600 $39.10 $53.89 $1.78 $0.64 0.87 Berkshire Hath - 100 $127.24 $137.52 $7.28 $0.00 0.29 B Procter & 200 $79.28 $79.72 $2.44 $2.65 1.00 Gamble Visa, Inc. 125 $53.17 $67.85 $2.42 $0.48 0.85 PACCAR 200 $63.78 $64.59 $4.47 $0.96 1.32 Microsoft 100 $41.87 $44.45 $1.48 $1.44 0.87 Rangold 100 $84.59 $65.03 $2.23 $0.60 0.11 Pioneer Nat Res 200 $228.75 $136.23 $3.40 $0.08 0.52 Amgen 150 $120.31 $154.99 $7.55 $3.16 1.01 Coca-Cola 400 $42.29 $39.49 $1.71 $1.32 0.96 Bristol-Meyers 475 $48.12 $67.67 $1.07 $1.48 1.06 Squibb Maximus 125 $42.85 $66.14 $2.37 $0.18 3.66 Starwood 200 $81.50 $82.00 $3.29 $1.50 0.91 J2 Global 200 $52.03 $68.01 $2.50 $1.23 1.44 Walmart 300 $75.28 $71.88 $4.79 $1.96 0.87 General Mills 150 $52.90 $57.09 $2.11 $1.76 0.71 Apple 250 $93.52 $126.60 $8.65 $2.08 1.09 Home Depot 450 $81.82 $112.07 $5.13 $2.36 1.04 Monsanto 250 $124.30 $107.66 $5.41 $2.16 1.08 Exxon 125 $101.36 $82.37 $5.62 $2.92 0.93 Global Robotics 200 $28.22 $26.05 $0.00 $0.00 1.95 Nike 200 $78.00 $109.43 $3.95 $1.12 0.72 Toyota 425 $122.26 $133.60 $11.76 $4.02 0.55 Pfizer 200 $30.08 $33.69 $1.41 $1.12 1.08 The return on the market has been 8.15% and the current risk-free rate is 2.05%.

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To compute the expected performance of each stock based on the Capital Asset Pricing Model CAPM well ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started