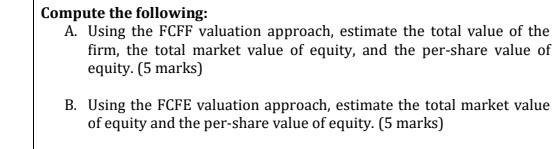

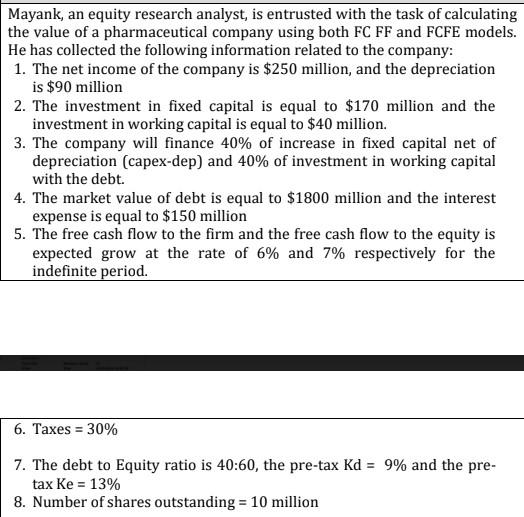

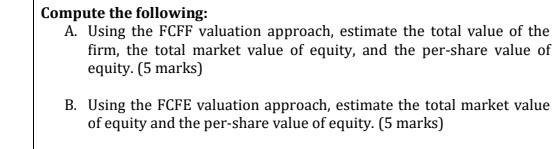

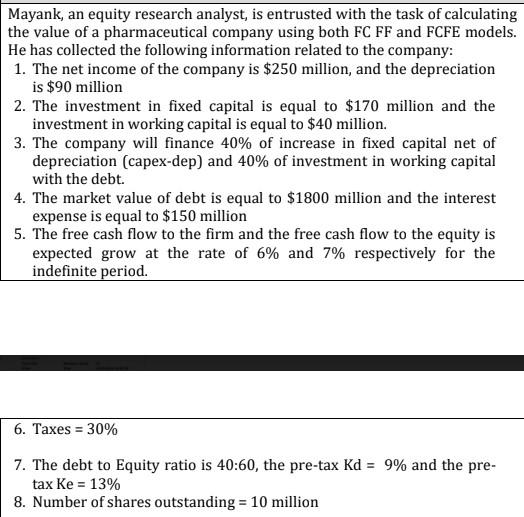

Compute the following: A. Using the FCFF valuation approach, estimate the total value of the firm, the total market value of equity, and the per-share value of equity. (5 marks) B. Using the FCFE valuation approach, estimate the total market value of equity and the per-share value of equity. (5 marks) Mayank, an equity research analyst, is entrusted with the task of calculating the value of a pharmaceutical company using both FC FF and FCFE models. He has collected the following information related to the company: 1. The net income of the company is $250 million, and the depreciation is $90 million 2. The investment in fixed capital is equal to $170 million and the investment in working capital is equal to $40 million. 3. The company will finance 40% of increase in fixed capital net of depreciation (capex-dep) and 40% of investment in working capital with the debt. 4. The market value of debt is equal to $1800 million and the interest expense is equal to $150 million 5. The free cash flow to the firm and the free cash flow to the equity is expected grow at the rate of 6% and 7% respectively for the indefinite period. 6. Taxes = 30% 7. The debt to Equity ratio is 40:60, the pre-tax Kd = 9% and the pre- tax Ke = 13% 8. Number of shares outstanding = 10 million Compute the following: A. Using the FCFF valuation approach, estimate the total value of the firm, the total market value of equity, and the per-share value of equity. (5 marks) B. Using the FCFE valuation approach, estimate the total market value of equity and the per-share value of equity. (5 marks) Mayank, an equity research analyst, is entrusted with the task of calculating the value of a pharmaceutical company using both FC FF and FCFE models. He has collected the following information related to the company: 1. The net income of the company is $250 million, and the depreciation is $90 million 2. The investment in fixed capital is equal to $170 million and the investment in working capital is equal to $40 million. 3. The company will finance 40% of increase in fixed capital net of depreciation (capex-dep) and 40% of investment in working capital with the debt. 4. The market value of debt is equal to $1800 million and the interest expense is equal to $150 million 5. The free cash flow to the firm and the free cash flow to the equity is expected grow at the rate of 6% and 7% respectively for the indefinite period. 6. Taxes = 30% 7. The debt to Equity ratio is 40:60, the pre-tax Kd = 9% and the pre- tax Ke = 13% 8. Number of shares outstanding = 10 million