Answered step by step

Verified Expert Solution

Question

1 Approved Answer

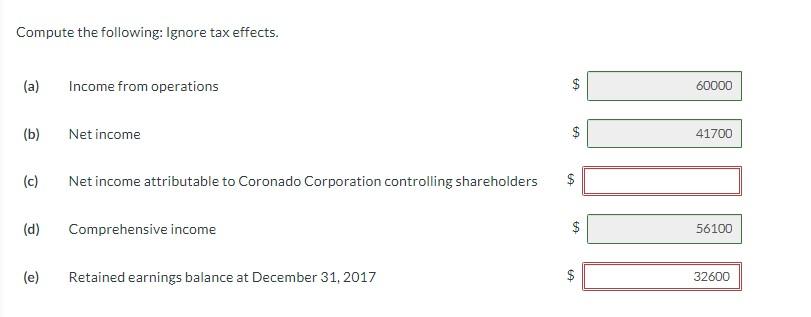

Compute the following: Ignore tax effects. (a) Income from operations 60000 (b) Net income 41700 (c) Net income attributable to Coronado Corporation controlling shareholders

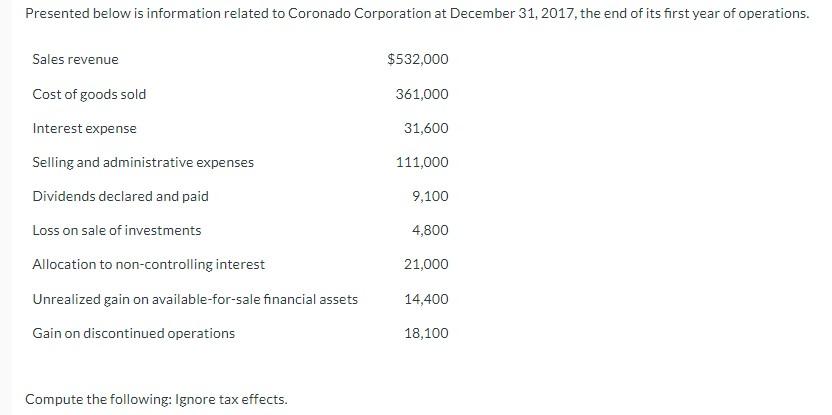

Compute the following: Ignore tax effects. (a) Income from operations 60000 (b) Net income 41700 (c) Net income attributable to Coronado Corporation controlling shareholders $ (d) Comprehensive income 56100 (e) Retained earnings balance at December 31, 2017 32600 %24 %24 %24 %24 %24 Presented below is information related to Coronado Corporation at December 31, 2017, the end of its first year of operations. Sales revenue $532,000 Cost of goods sold 361,000 Interest expense 31,600 Selling and administrative expenses 111,000 Dividends declared and paid 9,100 Loss on sale of investments 4,800 Allocation to non-controlling interest 21,000 Unrealized gain on available-for-sale financial assets 14,400 Gain on discontinued operations 18,100 Compute the following: Ignore tax effects.

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Parts Particulars 2 Sales Revenue 532000 Less Cost of Good...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started