compute the following ratio analysis for two year (most recent 2018 and 2017)s. Round amounts to the percentages to the nearest one-tenth of a percent. Provide analysis detailed formula and calculation you used to derive to your number for each of the ratio and what the ratio is telling you about companys performance

Debt-to-equity ratio Profit margin ratio Return on total assets Return on common stockholders equity (assume preferred dividends are zero)

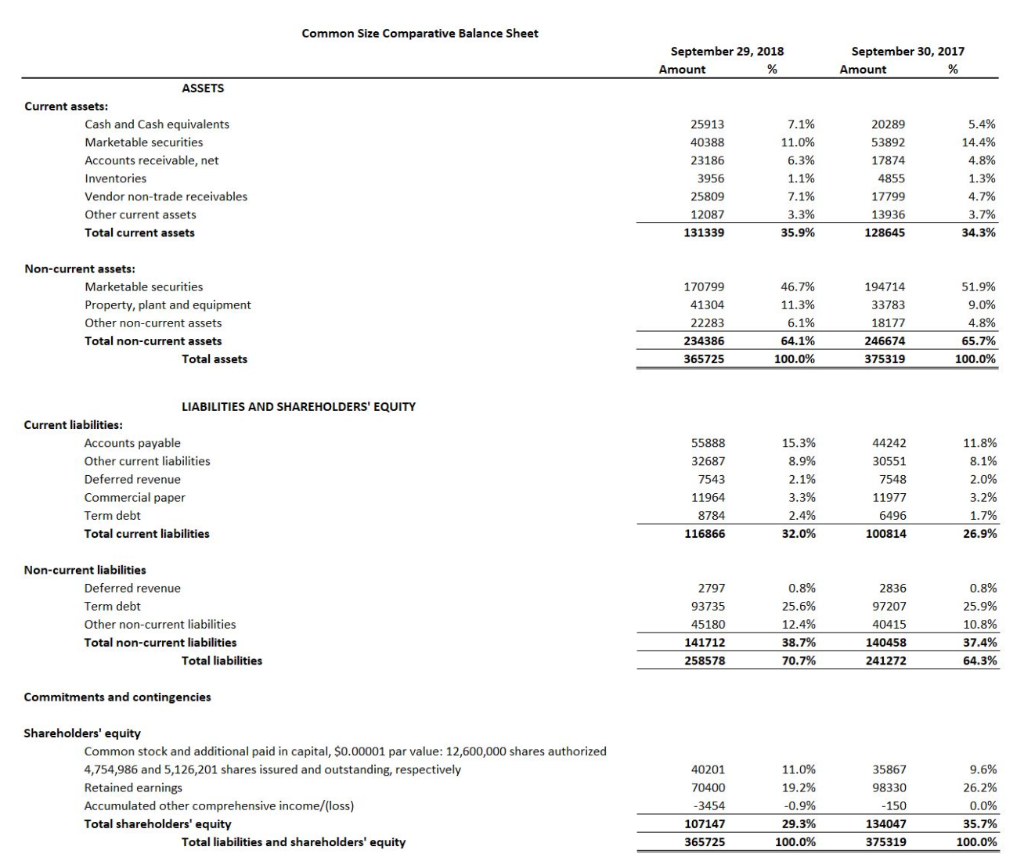

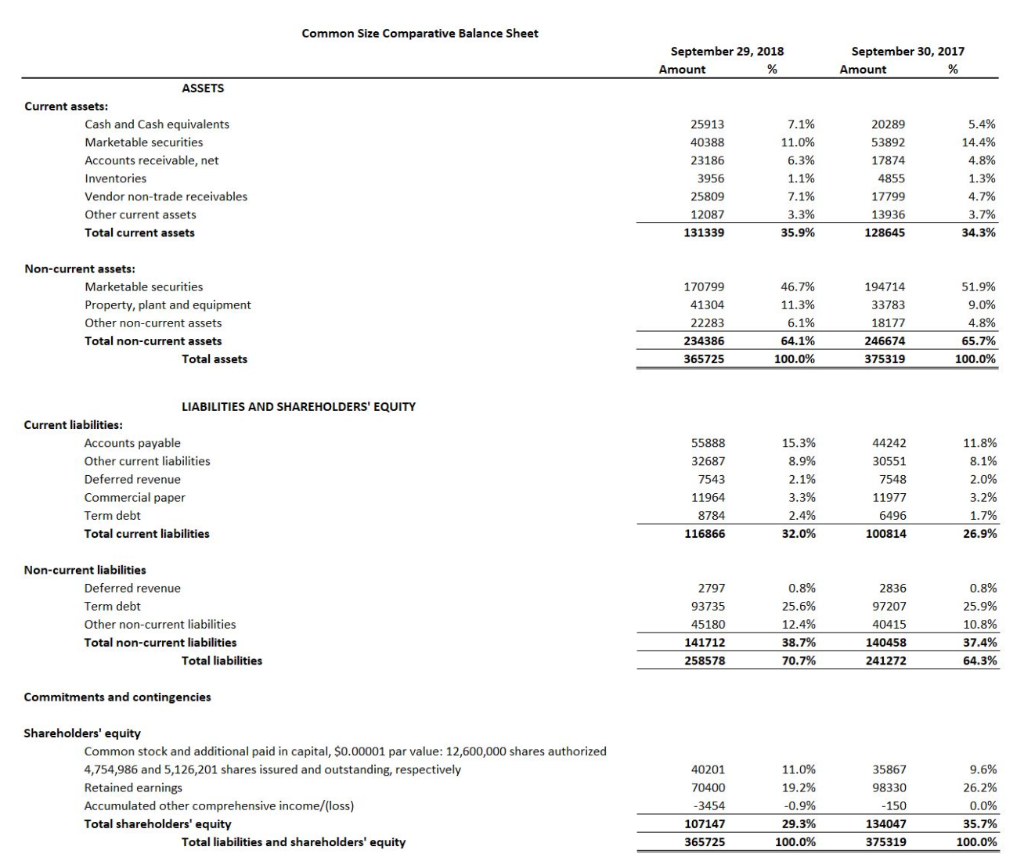

Common Size Comparative Balance Sheet September 29, 2018 Amount % September 30, 2017 Amount % ASSETS Current assets: Cash and Cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 25913 40388 23186 3956 25809 12087 131339 7.1% 11.0% 6.3% 1.1% 7.1% 3.3% 35.9% 20289 53892 17874 4855 17799 13936 128645 5.4% 14.4% 4.8% 1.3% 4.7% 3.7% 34.3% Non-current assets: Marketable securities Property, plant and equipment Other non-current assets Total non-current assets Total assets 170799 41304 22283 234386 365725 46.7% 11.3% 6.1% 64.1% 100.0% 194714 33783 18177 246674 375319 51.9% 9.0% 4.8% 65.7% 100.0% LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 55888 32687 7543 11964 8784 116866 15.3% 8.9% 2.1% 3.3% 2.4% 32.0% 44242 30551 7548 11977 6496 100814 11.8% 8.1% 2.0% 3.2% 1.7% 26.9% Non-current liabilities Deferred revenue Term debt Other non-current liabilities Total non-current liabilities Total liabilities 2797 93735 45180 141712 258578 0.8% 25.6% 12.4% 38.7% 70.7% 2836 97207 40415 140458 241272 0.8% 25.9% 10.8% 37.4% 64.3% Commitments and contingencies Shareholders' equity Common stock and additional paid in capital, $0.00001 par value: 12,600,000 shares authorized 4,754,986 and 5,126,201 shares issured and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 40201 70400 -3454 107147 365725 11.0% 19.2% -0.9% 29.3% 100.0% 35867 98330 - 150 134047 375319 9.6% 26.2% 0.0% 35.7% 100.0% Common Size Comparative Balance Sheet September 29, 2018 Amount % September 30, 2017 Amount % ASSETS Current assets: Cash and Cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 25913 40388 23186 3956 25809 12087 131339 7.1% 11.0% 6.3% 1.1% 7.1% 3.3% 35.9% 20289 53892 17874 4855 17799 13936 128645 5.4% 14.4% 4.8% 1.3% 4.7% 3.7% 34.3% Non-current assets: Marketable securities Property, plant and equipment Other non-current assets Total non-current assets Total assets 170799 41304 22283 234386 365725 46.7% 11.3% 6.1% 64.1% 100.0% 194714 33783 18177 246674 375319 51.9% 9.0% 4.8% 65.7% 100.0% LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 55888 32687 7543 11964 8784 116866 15.3% 8.9% 2.1% 3.3% 2.4% 32.0% 44242 30551 7548 11977 6496 100814 11.8% 8.1% 2.0% 3.2% 1.7% 26.9% Non-current liabilities Deferred revenue Term debt Other non-current liabilities Total non-current liabilities Total liabilities 2797 93735 45180 141712 258578 0.8% 25.6% 12.4% 38.7% 70.7% 2836 97207 40415 140458 241272 0.8% 25.9% 10.8% 37.4% 64.3% Commitments and contingencies Shareholders' equity Common stock and additional paid in capital, $0.00001 par value: 12,600,000 shares authorized 4,754,986 and 5,126,201 shares issured and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 40201 70400 -3454 107147 365725 11.0% 19.2% -0.9% 29.3% 100.0% 35867 98330 - 150 134047 375319 9.6% 26.2% 0.0% 35.7% 100.0%