Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the following ratios and compare your banks performance with that of Bank of America (shown below) using the Du-Pont Analysis. Explain why your bank

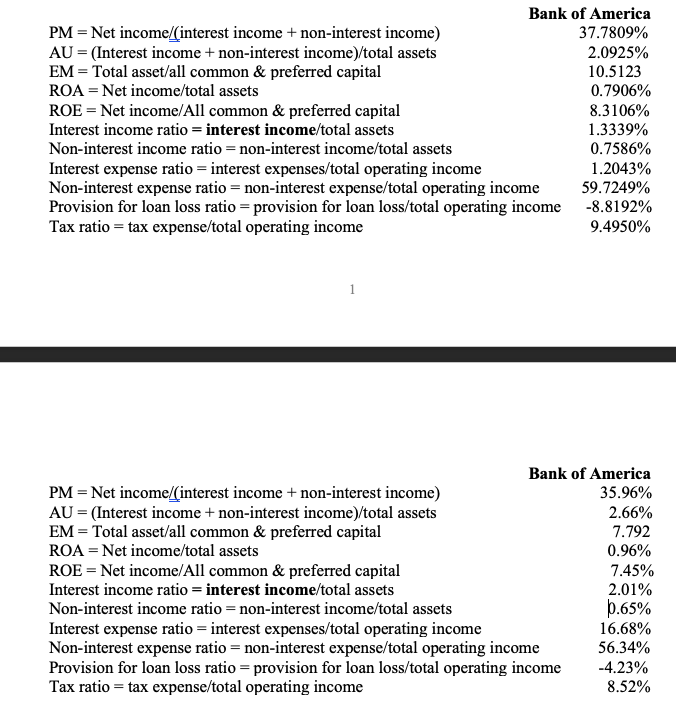

Compute the following ratios and compare your banks performance with that of Bank of America (shown below) using the Du-Pont Analysis. Explain why your bank outperformed or underperformed Bank of America in ROE.

Bank of America PM = Net income/(interest income +non-interest income) 37.7809% AU = (Interest income + non-interest income)/total assets 2.0925% EM = Total asset/all common & preferred capital 10.5123 ROA = Net income/total assets 0.7906% ROE = Net income/All common & preferred capital 8.3106% Interest income ratio = interest income/total assets 1.3339% Non-interest income ratio = non-interest income/total assets 0.7586% Interest expense ratio = interest expenses/total operating income 1.2043% Non-interest expense ratio = non-interest expense/total operating income 59.7249% Provision for loan loss ratio = provision for loan loss/total operating income -8.8192% Tax ratio = tax expense/total operating income 9.4950% 1 Bank of America PM = Net income/(interest income +non-interest income) 35.96% AU = (Interest income + non-interest income)/total assets 2.66% EM = Total asset/all common & preferred capital 7.792 ROA = Net income/total assets 0.96% ROE = Net income/All common & preferred capital 7.45% Interest income ratio = interest income/total assets 2.01% Non-interest income ratio = non-interest income/total assets 0.65% Interest expense ratio = interest expenses/total operating income 16.68% Non-interest expense ratio = non-interest expense/total operating income 56.34% Provision for loan loss ratio = provision for loan loss/total operating income -4.23% Tax ratio = tax expense/total operating income 8.52% Bank of America PM = Net income/(interest income +non-interest income) 37.7809% AU = (Interest income + non-interest income)/total assets 2.0925% EM = Total asset/all common & preferred capital 10.5123 ROA = Net income/total assets 0.7906% ROE = Net income/All common & preferred capital 8.3106% Interest income ratio = interest income/total assets 1.3339% Non-interest income ratio = non-interest income/total assets 0.7586% Interest expense ratio = interest expenses/total operating income 1.2043% Non-interest expense ratio = non-interest expense/total operating income 59.7249% Provision for loan loss ratio = provision for loan loss/total operating income -8.8192% Tax ratio = tax expense/total operating income 9.4950% 1 Bank of America PM = Net income/(interest income +non-interest income) 35.96% AU = (Interest income + non-interest income)/total assets 2.66% EM = Total asset/all common & preferred capital 7.792 ROA = Net income/total assets 0.96% ROE = Net income/All common & preferred capital 7.45% Interest income ratio = interest income/total assets 2.01% Non-interest income ratio = non-interest income/total assets 0.65% Interest expense ratio = interest expenses/total operating income 16.68% Non-interest expense ratio = non-interest expense/total operating income 56.34% Provision for loan loss ratio = provision for loan loss/total operating income -4.23% Tax ratio = tax expense/total operating income 8.52%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started