Answered step by step

Verified Expert Solution

Question

1 Approved Answer

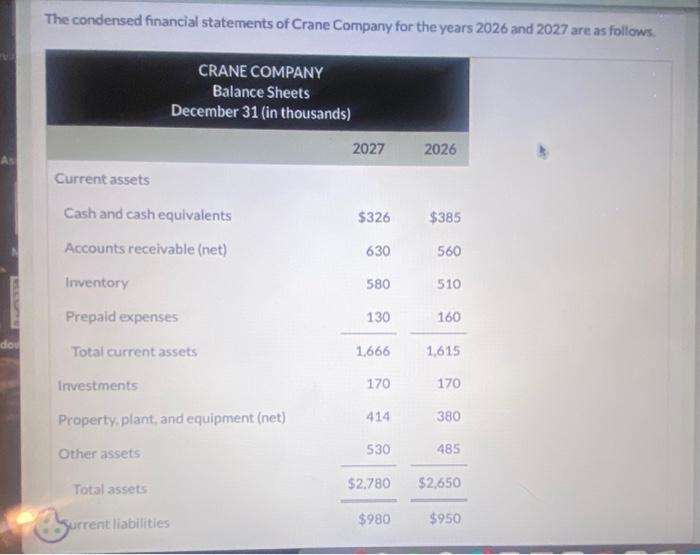

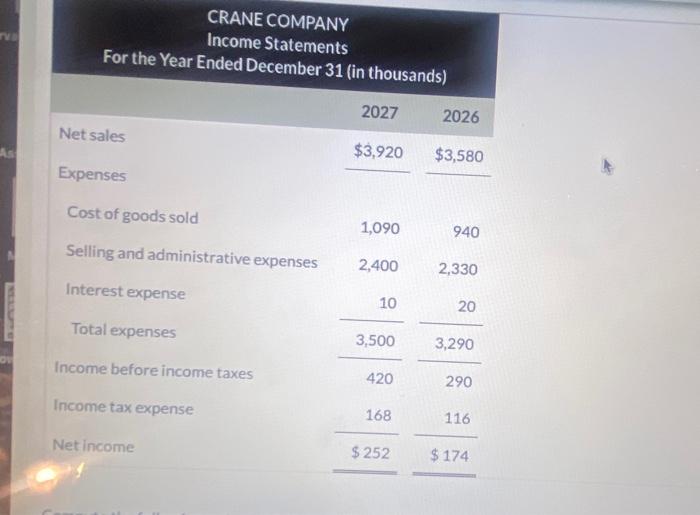

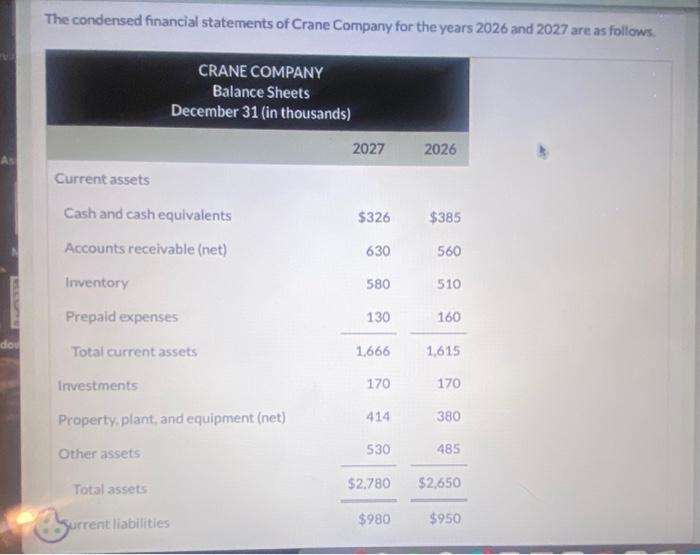

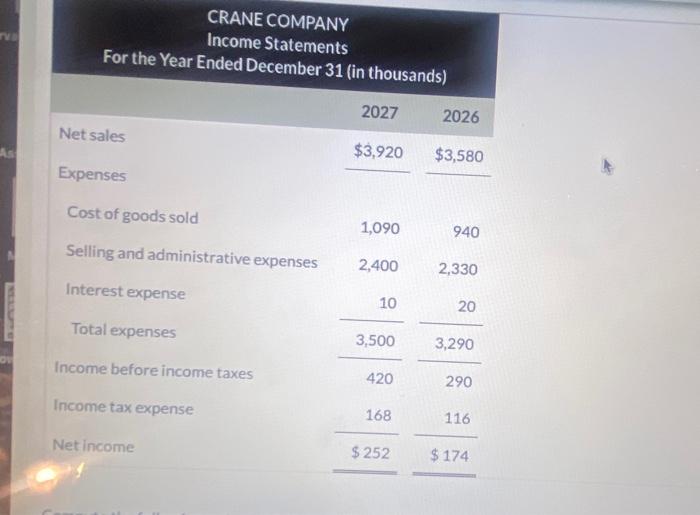

compute the following ratios for 2027 and 2026 The condensed financial statements of Crane Company for the years 2026 and 2027 are as follows. CRANE

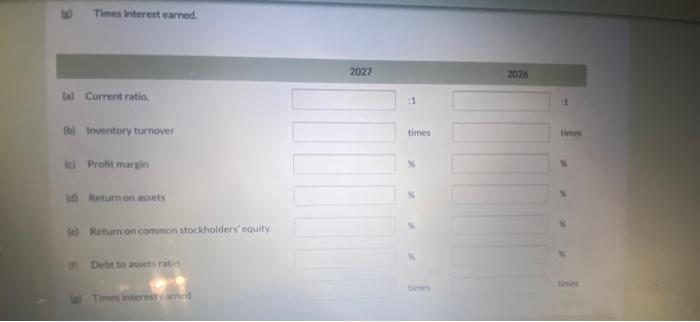

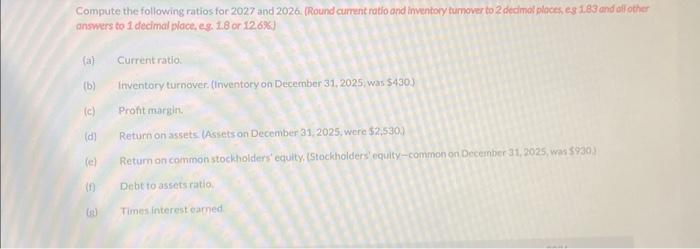

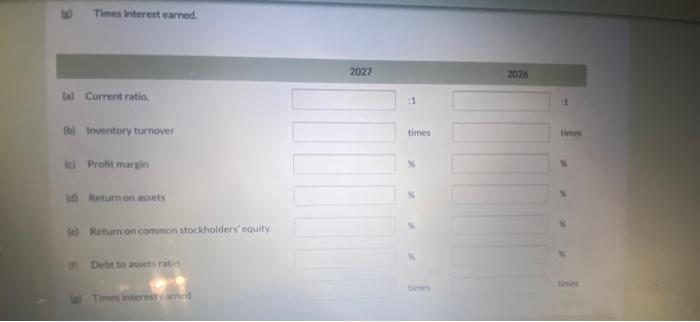

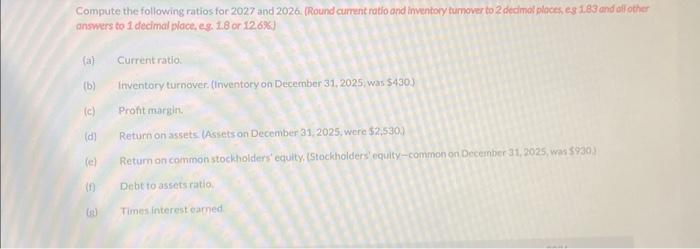

compute the following ratios for 2027 and 2026

The condensed financial statements of Crane Company for the years 2026 and 2027 are as follows. CRANE COMPANY Income Statements For the Year Ended December 31 (in thousands) Compute the following ratios for 2027 and 2026 . Round current natlo and inventory turnover to 2 decimol places, es 1.83 and ofl other answers to 1 decimal place, eg. 1.8 or 126%. (a) Currentratio. (b) Inventory turnover. (Inventory on December 31, 2025, was \$430) (c) Profit margin. (d) Return on assets. (Assets on December 31, 2025, were \$2,530) (e) Retum on coimmon stockhoiders' equity, (Stockholders' equity-common on December 31, 2025, was 5930) (f) Debt to assetsratio. (8) Times interest gamed. w) Tines interest earned. (b) Inventory tumover tc. Prohtmargin (6) Returnon assets (e) Retum on commen stockholders' equity in Debt to muets ratio 2027 2026 times x X thene The condensed financial statements of Crane Company for the years 2026 and 2027 are as follows. CRANE COMPANY Income Statements For the Year Ended December 31 (in thousands) Compute the following ratios for 2027 and 2026 . Round current natlo and inventory turnover to 2 decimol places, es 1.83 and ofl other answers to 1 decimal place, eg. 1.8 or 126%. (a) Currentratio. (b) Inventory turnover. (Inventory on December 31, 2025, was \$430) (c) Profit margin. (d) Return on assets. (Assets on December 31, 2025, were \$2,530) (e) Retum on coimmon stockhoiders' equity, (Stockholders' equity-common on December 31, 2025, was 5930) (f) Debt to assetsratio. (8) Times interest gamed. w) Tines interest earned. (b) Inventory tumover tc. Prohtmargin (6) Returnon assets (e) Retum on commen stockholders' equity in Debt to muets ratio 2027 2026 times x X thene

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started