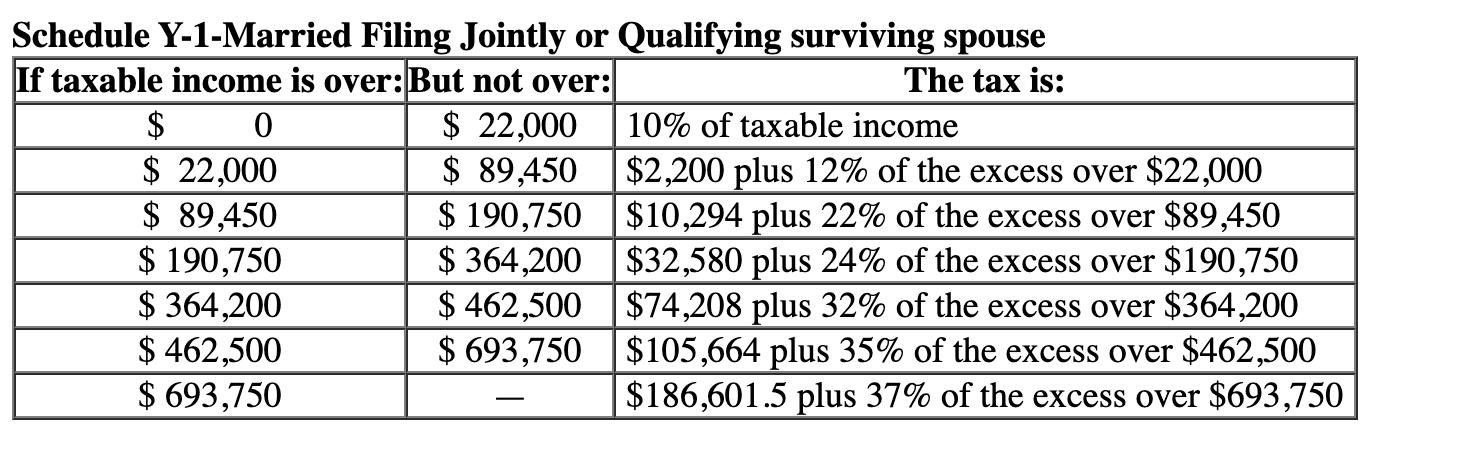

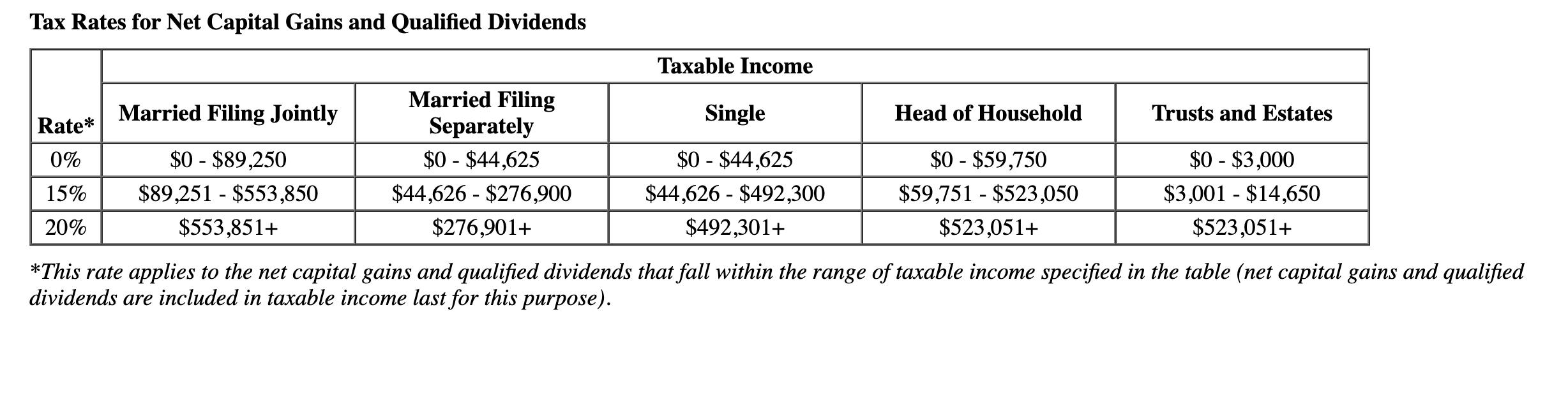

Compute the Howells' tax liability for the year (ignoring the alternative minimum tax and any phase-out provisions) assuming they file a joint return, they have

Compute the Howells' tax liability for the year (ignoring the alternative minimum tax and any phase-out provisions) assuming they file a joint return, they have no dependents, they don't make any special tax elections, and their itemized deductions total $30,000.

![[The following information applies to the questions displayed below.] During 2023, your clients, Mr. and Mrs.](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/01/6597fe36ec650_1704459829575.jpg)

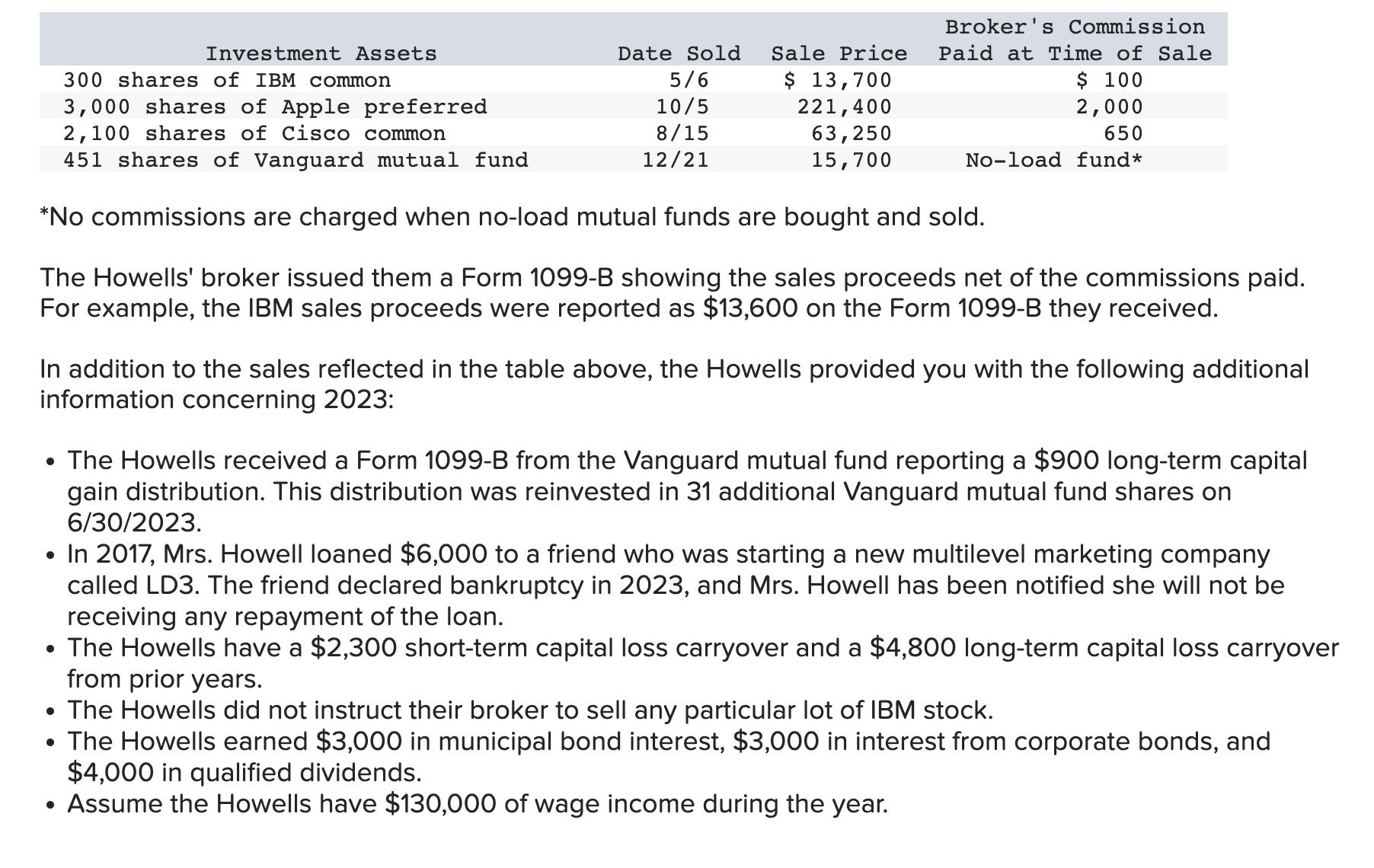

[The following information applies to the questions displayed below.] During 2023, your clients, Mr. and Mrs. Howell, owned the following investment assets: Date Acquired Purchase Price 11/22/2020 $ 10,350 4/3/2021 43,250 12/12/2021 147,000 Investment Assets 300 shares of IBM common (NYSE: IBM) 200 shares of IBM common (NYSE: IBM) 3,000 shares of Apple preferred (NASDAQ: AAPL) 2,100 shares of Cisco common (NASDAQ: CSCO) 420 shares of Vanguard mutual fund *No commissions are charged when no-load mutual funds are bought and sold. Because of the downturn in the stock market, Mr. and Mrs. Howell decided to sell most of their stocks and the mutual fund in 2023 and to reinvest in municipal bonds. The following investment assets were sold in 2023: 8/14/2022 3/2/2023 Broker's Commission Paid at Time of 52,500 14,700 Purchase $ 100 300 1,300 550 No-load fund* [The following information applies to the questions displayed below.] During 2023, your clients, Mr. and Mrs. Howell, owned the following investment assets: Date Acquired Purchase Price 11/22/2020 $ 10,350 4/3/2021 43,250 12/12/2021 147,000 Investment Assets 300 shares of IBM common (NYSE: IBM) 200 shares of IBM common (NYSE: IBM) 3,000 shares of Apple preferred (NASDAQ: AAPL) 2,100 shares of Cisco common (NASDAQ: CSCO) 420 shares of Vanguard mutual fund *No commissions are charged when no-load mutual funds are bought and sold. Because of the downturn in the stock market, Mr. and Mrs. Howell decided to sell most of their stocks and the mutual fund in 2023 and to reinvest in municipal bonds. The following investment assets were sold in 2023: 8/14/2022 3/2/2023 Broker's Commission Paid at Time of 52,500 14,700 Purchase $ 100 300 1,300 550 No-load fund*

Step by Step Solution

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the Howells tax liability for the year we need to consider their income deductions capital gains and the applicable tax rates Lets go through the information provided step by ste...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started