Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the implicit rate. Classify this lease agreement for both the lessor and the lessee. Prepare an amortization table for the lease. Prepare the journal

Compute the implicit rate.

Classify this lease agreement for both the lessor and the lessee.

Prepare an amortization table for the lease.

Prepare the journal entries for the lessor and the lessee during the first year of the contract.

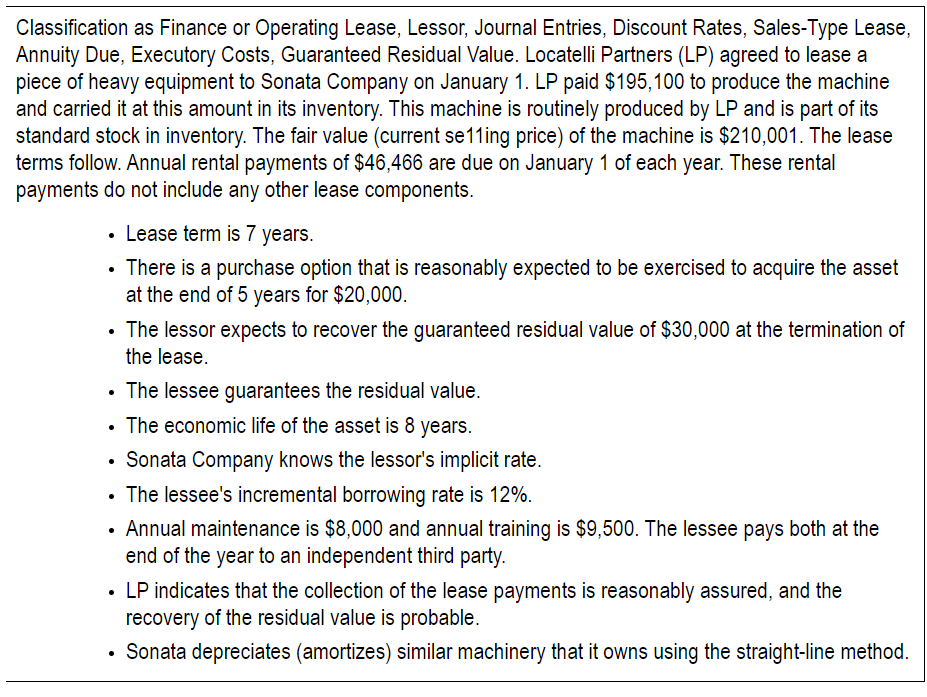

Classification as Finance or Operating Lease, Lessor, Journal Entries, Discount Rates, Sales-Type Lease, Annuity Due, Executory Costs, Guaranteed Residual Value. Locatelli Partners (LP) agreed to lease a piece of heavy equipment to Sonata Company on January 1. LP paid $195,100 to produce the machine and carried it at this amount in its inventory. This machine is routinely produced by LP and is part of its standard stock in inventory. The fair value (current se11ing price) of the machine is $210,001. The lease terms follow. Annual rental payments of $46,466 are due on January 1 of each year. These rental payments do not include any other lease components. - Lease term is 7 years. - There is a purchase option that is reasonably expected to be exercised to acquire the asset at the end of 5 years for $20,000. - The lessor expects to recover the guaranteed residual value of $30,000 at the termination of the lease. - The lessee guarantees the residual value. - The economic life of the asset is 8 years. - Sonata Company knows the lessor's implicit rate. - The lessee's incremental borrowing rate is 12%. - Annual maintenance is $8,000 and annual training is $9,500. The lessee pays both at the end of the year to an independent third party. - LP indicates that the collection of the lease payments is reasonably assured, and the recovery of the residual value is probable. - Sonata depreciates (amortizes) similar machinery that it owns using the straight-line methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started