Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the IRR of the Chosen machinery using the IRR function and assess whether this is a good purchase? show working A semiconductor manufacturing company

Compute the IRR of the Chosen machinery using the IRR function and assess whether this is a good purchase? show working

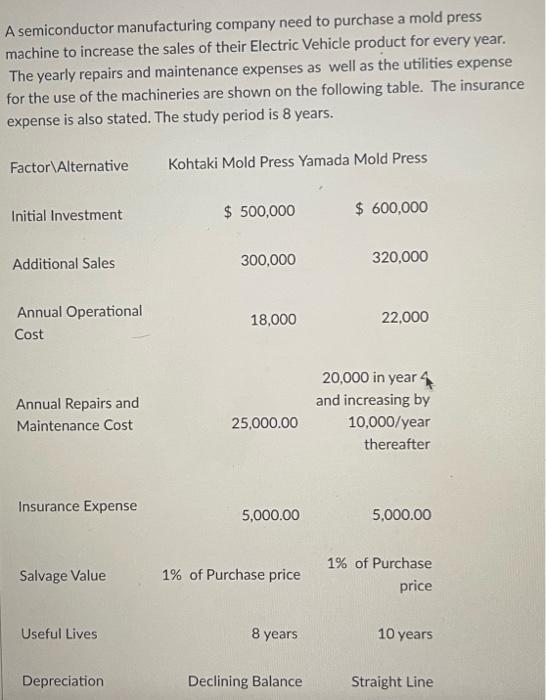

Compute the IRR of the Chosen machinery using the IRR function and assess whether this is a good purchase? show working A semiconductor manufacturing company need to purchase a mold press machine to increase the sales of their Electric Vehicle product for every year. The yearly repairs and maintenance expenses as well as the utilities expense for the use of the machineries are shown on the following table. The insurance expense is also stated. The study period is 8 years. Factor Alternative Initial Investment Additional Sales Annual Operational Cost Annual Repairs and Maintenance Cost Insurance Expense Salvage Value Useful Lives Depreciation Kohtaki Mold Press Yamada Mold Press $ 500,000 300,000 18,000 25,000.00 5,000.00 1% of Purchase price 8 years Declining Balance $ 600,000 320,000 22,000 20,000 in year 4 and increasing by 10,000/year thereafter 5,000.00 1% of Purchase price 10 years Straight Line

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To compute the Internal Rate of Return IRR for each of the two machinery alternatives and assess whether its a good purchase we can follow these steps Lets start with the Kohtaki Mold Press Initial In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started