Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the net present value (NPV) of the project to manufacture and sell the new product. Round off your answer to the nearest dollar and

Compute the net present value (NPV) of the project to manufacture and sell the new product. Round off your answer to the nearest dollar and show all relevant workings.

Comment on whether Messina should proceed with the project.

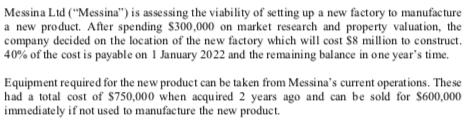

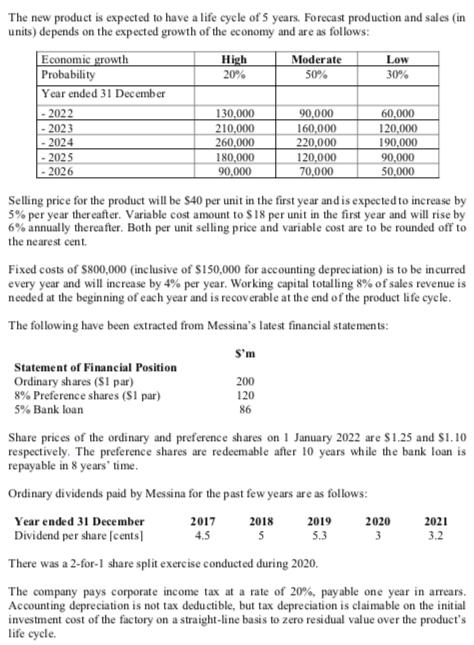

Messina Ltd ("Messina") is assessing the viability of setting up a new factory to manufacture a new product. After spending $300,000 on market research and property valuation, the company decided on the location of the new factory which will cost $8 million to construct. 40% of the cost is payable on 1 January 2022 and the remaining balance in one year's time. Equipment required for the new product can be taken from Messina's current operations. These had a total cost of $750,000 when acquired 2 years ago and can be sold for $600,000 immediately if not used to manufacture the new product.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the net present value NPV of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started