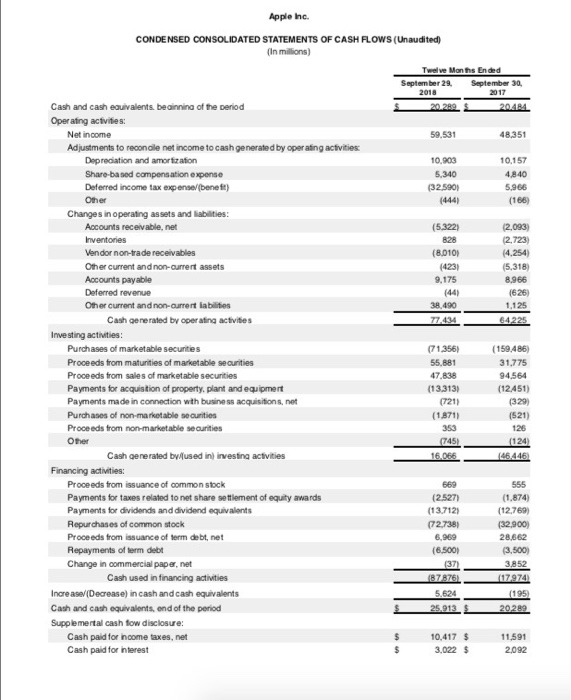

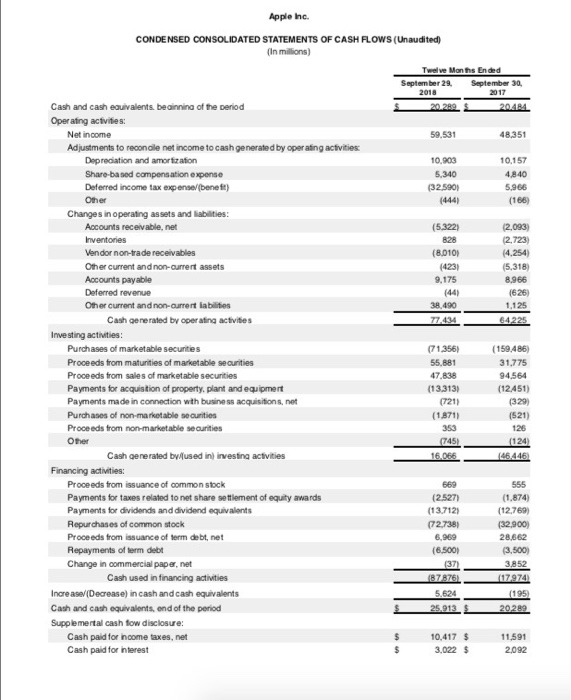

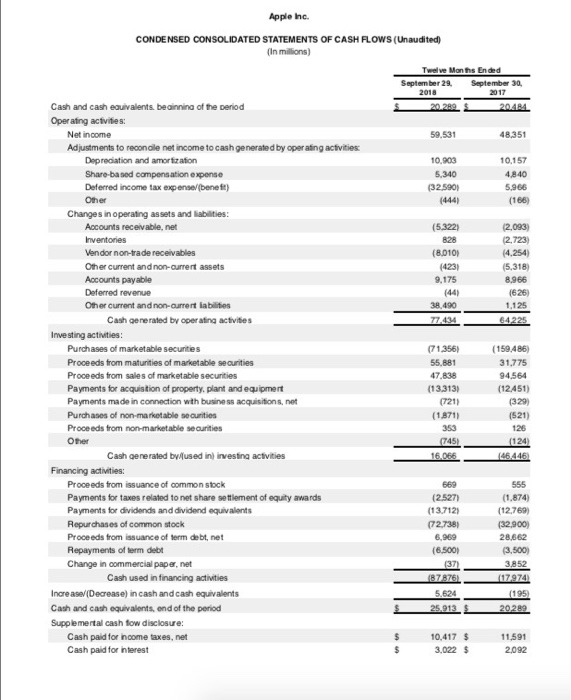

compute the operating cash flow margin (OCFM) then compare and contrast your results with the industry standard.

Apple Inc. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (In millions) Twelve Months Ended September 29, September 30, 2018 2017 20.289 2 0484 59,531 48,351 10.903 5,340 (32.5901 (444) 10.157 4,840 5,966 (166) (5.3221 828 (8.10) (423) 9,175 (44) 38.490 77434 (2,093) (2,723 (4.254 5,318 8,966 (626) 1,125 64225 Cash and cash equivalents. beoinning of the period Operating activities: Net income Adjustments to reconcile net income to cash generated by operating activities Depreciation and amortization Share-based compensation expense Deferred income tax expense/benet) Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current abilities Cash generated by operating activities Investing activities: Purchases of marketable securities Proceeds from matunities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Purchases of non-marketable securities Proceeds from non-marketable securities Other Cash generated by used in investing activities Financing activities: Proceeds from issuance of common stock Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock Proceeds from issuance of term debt, net Repayments of term debt Change in commercial paper, net Cash used in financing activities Increase/(Decrease) in cash and cash equivalents Cash and cash equivalents, end of the period Supplemental cash fow disclosure: Cash paid for income taxes, net Cash paid for interest (71,356) 55,881 47.838 (13.313) (721) (1.871) (159,486 31,775 94.564 (12451) (329) (521) 126 (124) 146.446 353 745) 16.066 555 669 (2.527) (13.712) (72.7381 6.969 (6.500) (37) B7876) (1.874) (12,769) (32.900) 28.662 (3,500) 3,852 (17.974 (195) 20289 25.913 10,417 $ 3,022 $ 11,591 2,092 $ Apple Inc. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (In millions) Twelve Months Ended September 29, September 30, 2018 2017 20.289 2 0484 59,531 48,351 10.903 5,340 (32.5901 (444) 10.157 4,840 5,966 (166) (5.3221 828 (8.10) (423) 9,175 (44) 38.490 77434 (2,093) (2,723 (4.254 5,318 8,966 (626) 1,125 64225 Cash and cash equivalents. beoinning of the period Operating activities: Net income Adjustments to reconcile net income to cash generated by operating activities Depreciation and amortization Share-based compensation expense Deferred income tax expense/benet) Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current abilities Cash generated by operating activities Investing activities: Purchases of marketable securities Proceeds from matunities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Purchases of non-marketable securities Proceeds from non-marketable securities Other Cash generated by used in investing activities Financing activities: Proceeds from issuance of common stock Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock Proceeds from issuance of term debt, net Repayments of term debt Change in commercial paper, net Cash used in financing activities Increase/(Decrease) in cash and cash equivalents Cash and cash equivalents, end of the period Supplemental cash fow disclosure: Cash paid for income taxes, net Cash paid for interest (71,356) 55,881 47.838 (13.313) (721) (1.871) (159,486 31,775 94.564 (12451) (329) (521) 126 (124) 146.446 353 745) 16.066 555 669 (2.527) (13.712) (72.7381 6.969 (6.500) (37) B7876) (1.874) (12,769) (32.900) 28.662 (3,500) 3,852 (17.974 (195) 20289 25.913 10,417 $ 3,022 $ 11,591 2,092 $