Answered step by step

Verified Expert Solution

Question

1 Approved Answer

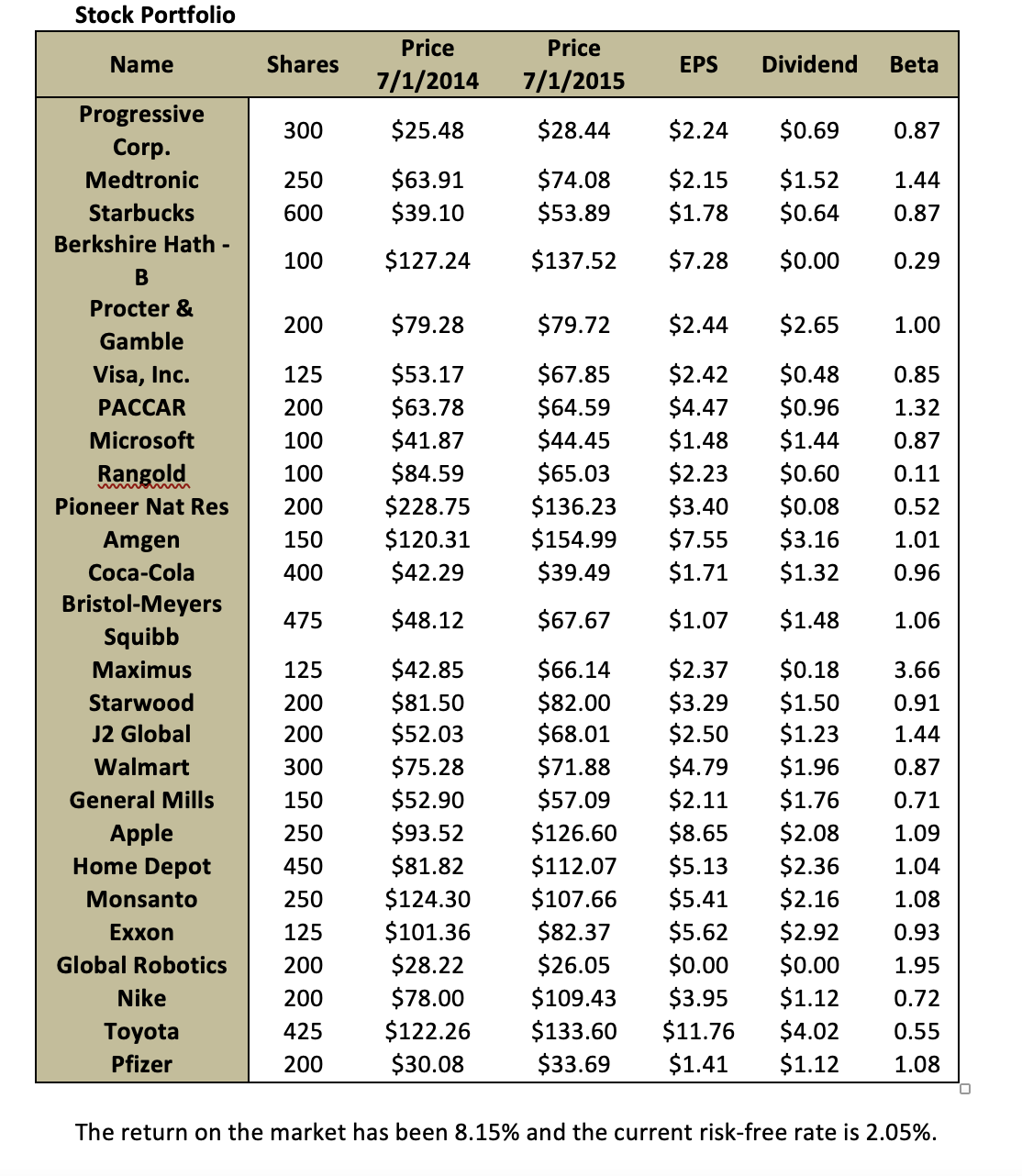

Compute the portfolio return, the portfolio beta and the expected return of the portfolio based on the CAPM model.Did the portfolio over or under perform?

Compute the portfolio return, the portfolio beta and the expected return of the portfolio based on the CAPM model.Did the portfolio over or under perform?

Stock Portfolio Name Shares Price 7/1/2014 Price EPS Dividend Beta 7/1/2015 Progressive 300 $25.48 $28.44 $2.24 $0.69 0.87 Corp. Medtronic 250 $63.91 $74.08 $2.15 $1.52 1.44 Starbucks 600 $39.10 $53.89 $1.78 $0.64 0.87 Berkshire Hath - 100 $127.24 $137.52 $7.28 $0.00 0.29 B Procter & 200 $79.28 $79.72 $2.44 $2.65 1.00 Gamble Visa, Inc. 125 $53.17 $67.85 $2.42 $0.48 0.85 PACCAR 200 $63.78 $64.59 $4.47 $0.96 1.32 Microsoft 100 $41.87 $44.45 $1.48 $1.44 0.87 Rangold 100 $84.59 $65.03 $2.23 $0.60 0.11 Pioneer Nat Res 200 $228.75 $136.23 $3.40 $0.08 0.52 Amgen 150 $120.31 $154.99 $7.55 $3.16 1.01 Coca-Cola 400 $42.29 $39.49 $1.71 $1.32 0.96 Bristol-Meyers 475 $48.12 $67.67 $1.07 $1.48 1.06 Squibb Maximus 125 $42.85 $66.14 $2.37 $0.18 3.66 Starwood 200 $81.50 $82.00 $3.29 $1.50 0.91 J2 Global 200 $52.03 $68.01 $2.50 $1.23 1.44 Walmart 300 $75.28 $71.88 $4.79 $1.96 0.87 General Mills 150 $52.90 $57.09 $2.11 $1.76 0.71 Apple 250 $93.52 $126.60 $8.65 $2.08 1.09 Home Depot 450 $81.82 $112.07 $5.13 $2.36 1.04 Monsanto 250 $124.30 $107.66 $5.41 $2.16 1.08 Exxon 125 $101.36 $82.37 $5.62 $2.92 0.93 Global Robotics 200 $28.22 $26.05 $0.00 $0.00 1.95 Nike 200 $78.00 $109.43 $3.95 $1.12 0.72 Toyota 425 $122.26 $133.60 $11.76 $4.02 0.55 Pfizer 200 $30.08 $33.69 $1.41 $1.12 1.08 The return on the market has been 8.15% and the current risk-free rate is 2.05%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the portfolio return portfolio beta and expected return of the portfolio based on the CAPM model well use the following formulas Portfoli...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started