Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the present value of a revenue stream of 10 payments (starting next period) of 100,000 when the interest rate is 10% and the

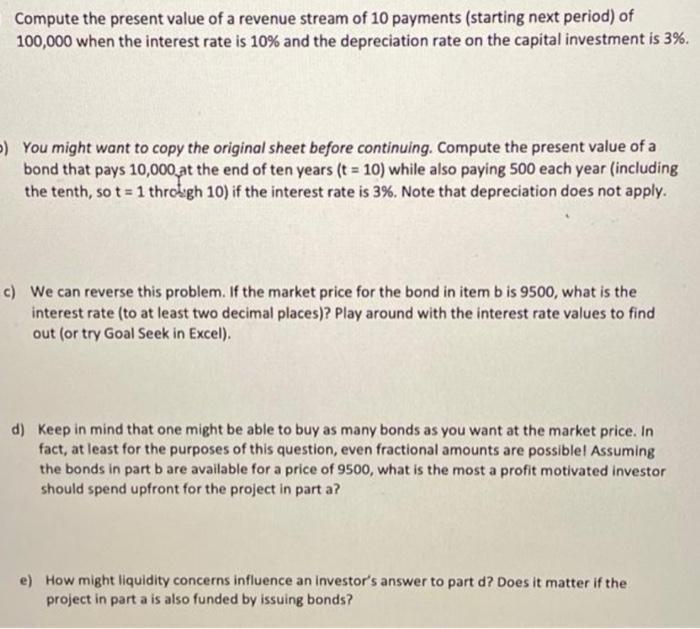

Compute the present value of a revenue stream of 10 payments (starting next period) of 100,000 when the interest rate is 10% and the depreciation rate on the capital investment is 3%. >) You might want to copy the original sheet before continuing. Compute the present value of a bond that pays 10,000 at the end of ten years (t = 10) while also paying 500 each year (including the tenth, so t = 1 through 10) if the interest rate is 3%. Note that depreciation does not apply. c) We can reverse this problem. If the market price for the bond in item b is 9500, what is the interest rate (to at least two decimal places)? Play around with the interest rate values to find out (or try Goal Seek in Excel). d) Keep in mind that one might be able to buy as many bonds as you want at the market price. In fact, at least for the purposes of this question, even fractional amounts are possible! Assuming the bonds in part b are available for a price of 9500, what is the most a profit motivated investor should spend upfront for the project in part a? e) How might liquidity concerns influence an investor's answer to part d? Does it matter if the project in part a is also funded by issuing bonds?

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The present value of a revenue stream of 10 payments starting next period of 100000 when the inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started