Answered step by step

Verified Expert Solution

Question

1 Approved Answer

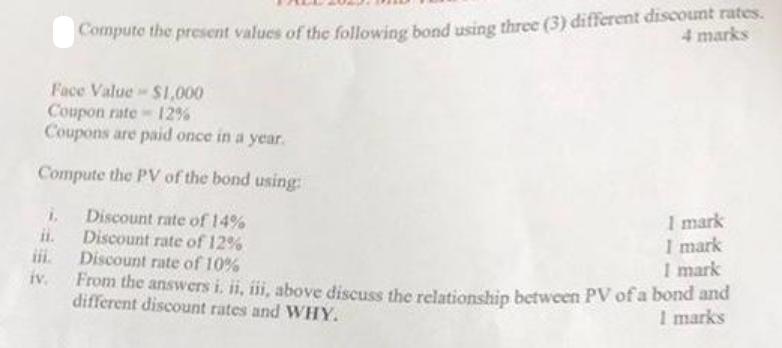

Compute the present values of the following bond using three (3) different discount rates. 4 marks $1,000 Face Value Coupon rate 12% Coupons are

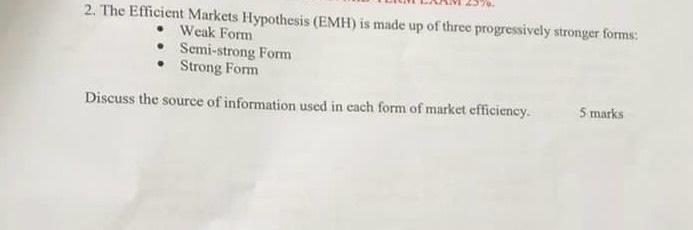

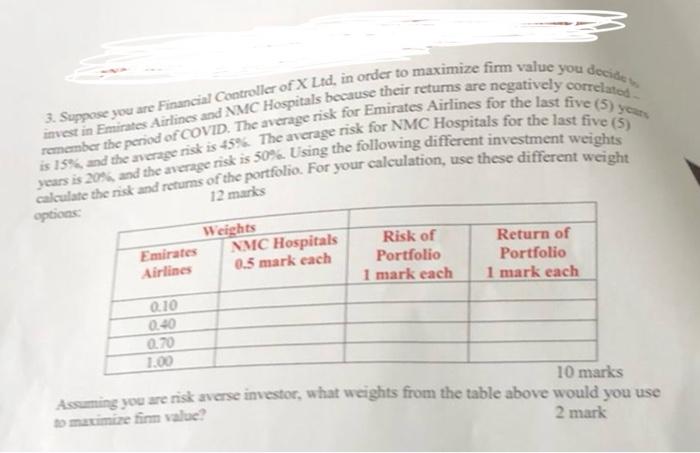

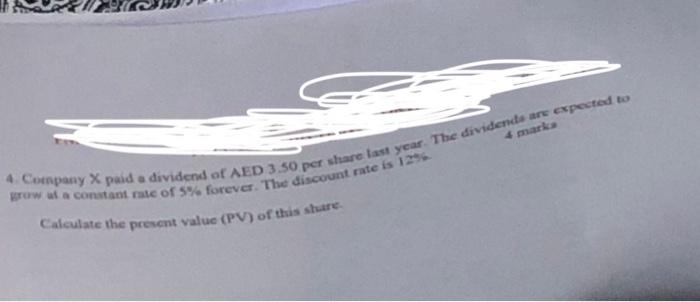

Compute the present values of the following bond using three (3) different discount rates. 4 marks $1,000 Face Value Coupon rate 12% Coupons are paid once in a year. Compute the PV of the bond using: i. Discount rate of 14% Discount rate of 12% Discount rate of 10% 1 mark I mark I mark From the answers i, ii, iii, above discuss the relationship between PV of a bond and different discount rates and WHY. 1 marks 2. The Efficient Markets Hypothesis (EMH) is made up of three progressively stronger forms: Weak Form Semi-strong Form Strong Form Discuss the source of information used in each form of market efficiency. 5 marks 3. Suppose you are Financial Controller of X Ltd, in order to maximize firm value you decide to remember the period of COVID. The average risk for Emirates Airlines for the last five (5) years invest in Emirates Airlines and NMC Hospitals because their returns are negatively correlated is 15%, and the average risk is 45%. The average risk for NMC Hospitals for the last five (5) years is 20%, and the average risk is 50%. Using the following different investment weights calculate the risk and returns of the portfolio. For your calculation, use these different weight options: marks Emirates Airlines 0.10 0.40 0.70 1.00 Weights NMC Hospitals 0.5 mark each Risk of Portfolio Return of Portfolio 1 mark each 1 mark each 10 marks Assuming you are risk averse investor, what weights from the table above would you use to maximize firm value? 2 mark 4. Company X paid a dividend of AED 3.50 per share last year. The dividends are expected to grow at a constant rate of 5% forever. The discount rate is 12% 4 marks Calculate the present value (PV) of this share.

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Computing Present Values of Bond To compute the present values PV of the bond we need to discount the future cash flows coupon payments and face val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started