Answered step by step

Verified Expert Solution

Question

1 Approved Answer

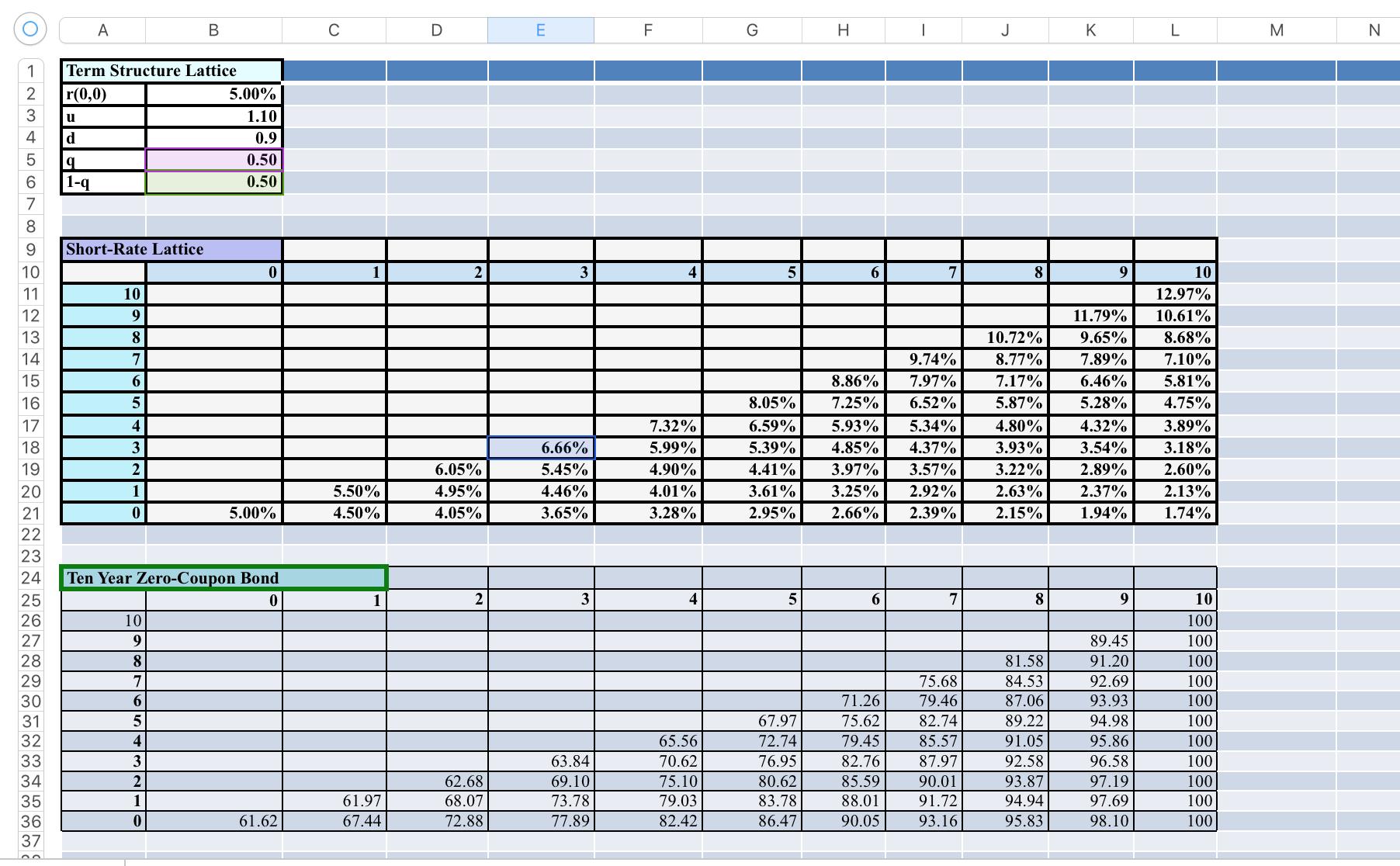

Compute the price of a forward contract on the ZCB above where the forward contract matures at time t = 4 H. K Term Structure

Compute the price of a forward contract on the ZCB above

where the forward contract matures at time t = 4

H. K Term Structure Lattice r(0,0) 5.00% u 1.10 4 0.9 0.50 b1 1-q 0.50 Short-Rate Lattice 10 2 3 6 10 11 10 12.97% 12 11.79% 10.61% 13 10.72% 9.65% 8.68% 14 74% 8.77% 7.89% 7.10% 15 6. 8.86% 7.97% 7.17% 6.46% 5.81% 16 8.05% 7.25% 6.52% 5.87% 5.28% 4.75% 17 7.32% 6.59% 5.93% 5.34% 4.80% 4.32% 3.89% 18 3 6.66% 5.99% 5.39% 4.85% 4.37% 3.93% 3.54% 3.18% 19 6.05% 5.45% 4.90% 4.41% 3.97% 3.57% 3.22% 2.89% 2.60% 5.50% 4.95% 4.46% 4.01% 3.61% 3.25% 2.92% 2.63% 2.37% 2.13% 21 5.00% 4.50% 4.05% 3.65% 3.28% 2.95% 2.66% 2.39% 2.15% 1.94% 1.74% 22 23 24 Ten Year Zero-Coupon Bond 25 3 10 26 10 100 27 89.45 100 28 81.58 91.20 100 29 75.68 84.53 92.69 100 30 71.26 79.46 87.06 93.93 100 75.62 31 32 67.97 82.74 89.22 94.98 100 4 65.56 72.74 79.45 85.57 91.05 95.86 100 33 63.84 70.62 76.95 82.76 87.97 92.58 96.58 100 34 62.68 69.10 75.10 80.62 85.59 90.01 93.87 97.19 100 35 61.97 68.07 73.78 79.03 83.78 88.01 91.72 94.94 97.69 100 67.44 77.89 82.42 93.16 36 37 61.62 72.88 86.47 90.05 95.83 98.10 100 B. H. K Term Structure Lattice r(0,0) 5.00% u 1.10 4 0.9 0.50 b1 1-q 0.50 Short-Rate Lattice 10 2 3 6 10 11 10 12.97% 12 11.79% 10.61% 13 10.72% 9.65% 8.68% 14 74% 8.77% 7.89% 7.10% 15 6. 8.86% 7.97% 7.17% 6.46% 5.81% 16 8.05% 7.25% 6.52% 5.87% 5.28% 4.75% 17 7.32% 6.59% 5.93% 5.34% 4.80% 4.32% 3.89% 18 3 6.66% 5.99% 5.39% 4.85% 4.37% 3.93% 3.54% 3.18% 19 6.05% 5.45% 4.90% 4.41% 3.97% 3.57% 3.22% 2.89% 2.60% 5.50% 4.95% 4.46% 4.01% 3.61% 3.25% 2.92% 2.63% 2.37% 2.13% 21 5.00% 4.50% 4.05% 3.65% 3.28% 2.95% 2.66% 2.39% 2.15% 1.94% 1.74% 22 23 24 Ten Year Zero-Coupon Bond 25 3 10 26 10 100 27 89.45 100 28 81.58 91.20 100 29 75.68 84.53 92.69 100 30 71.26 79.46 87.06 93.93 100 75.62 31 32 67.97 82.74 89.22 94.98 100 4 65.56 72.74 79.45 85.57 91.05 95.86 100 33 63.84 70.62 76.95 82.76 87.97 92.58 96.58 100 34 62.68 69.10 75.10 80.62 85.59 90.01 93.87 97.19 100 35 61.97 68.07 73.78 79.03 83.78 88.01 91.72 94.94 97.69 100 67.44 77.89 82.42 93.16 36 37 61.62 72.88 86.47 90.05 95.83 98.10 100 B.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started