Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the profits tax liability payable that Tak Wang Ltd. would be entitled for the year of assessment 2011/12. Tak Wang Ltd. carried on

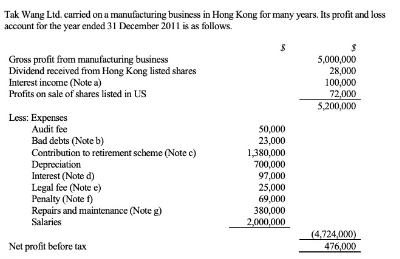

Compute the profits tax liability payable that Tak Wang Ltd. would be entitled for the year of assessment 2011/12. Tak Wang Ltd. carried on a manufacturing business in Hong Kong for many years. Its profit and loss account for the year ended 31 December 2011 is as follows. Gross profit from manufacturing business Dividend received from Hong Kong listed shares Interest income (Note a) Profits on sale of shares listed in US Less: Expenses Audit fee Bad debts (Note b) Contribution to retirement scheme (Note c) Depreciation Interest (Note d) Legal fee (Note e) Penalty (Note f) Repairs and maintenance (Noteg) Salaries Net profit before tax S 50,000 23,000 1,380,000 700,000 97,000 25,000 69,000 380,000 2,000,000 5,000,000 28,000 100,000 72,000 5,200,000 (4,724,000) 476,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The question is incomplete as it does not provide the specific tax rates or rules necessary to compu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started