compute the question

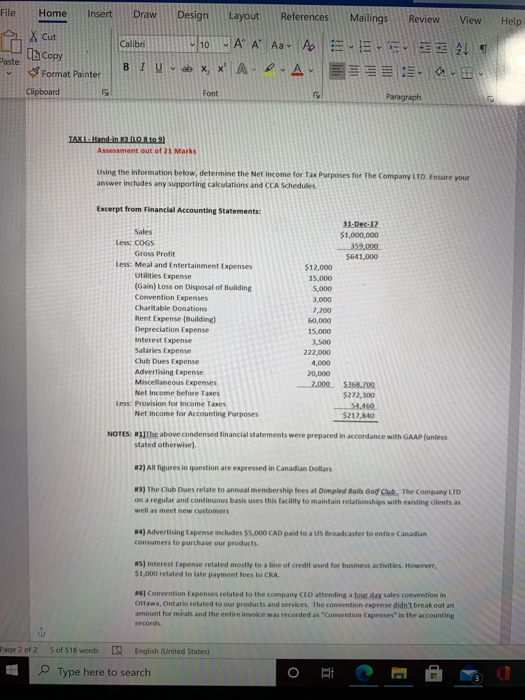

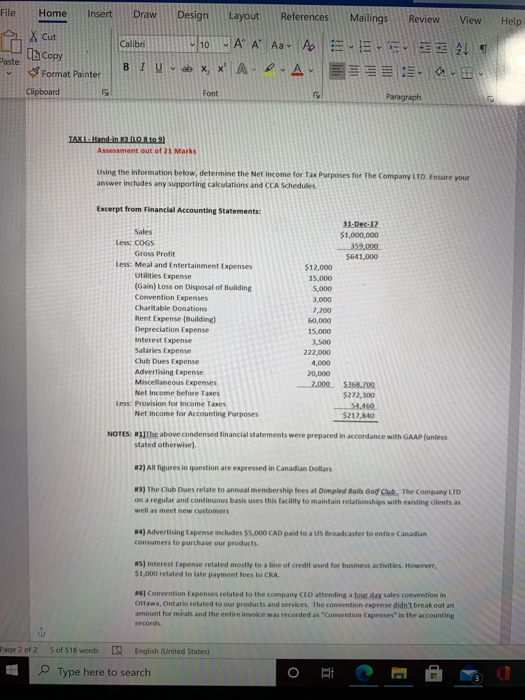

File Home Insert Draw Design Layout References Mailings Review View Help Calibri 10 X Cut Copy Format Painter VA A A A E AL BIUX, ' ADA. Paste Clipboard Font Paragraph TAXILHand in ILO 8 to Assessment out of 21 Marks Using the information below, determine the Net Income for Tax Purposes for The Company LTD. Ensure your answer includes any supporting calculations and CCA Schedules Excerpt from Financial Accounting Statements: 31-Dec-17 $1,000,000 359.000 $641,000 Sales Less: COGS Gross Profit Less Meal and Entertainment Expenses Utilities Expense (Gain) Loss on Disposal of Building Convention Expenses Charitable Donations Rent Expense (Building) Depreciation Expense Interest Expense Salaries Expense Club Dues Expense Advertising Expense Miscellaneous Expenses Net Income before Taxes Less: Provision for Income Taxes Net Income for Accounting Purposes $12,000 15,000 5.000 3,000 7,200 60,000 15,000 3.500 222,000 4,000 20,000 2,000 $363.700 $272,300 54.460 $217,840 NOTES: The above condensed financial statements were prepared in accordance with GAAP (unless stated otherwise) 12) All figures in question are expressed in Canadian Dollars 3) The Club Dues relate to annual membership fees at Dimpled Balls Golf Club, The Company LTD on a regular and continuous basis uses this facility to maintain relationships with existing clients as well as meet new customers 14) Advertising Expense includes $5,000 CAD paid to a US Broadcaster to entice Canadian consumers to purchase our products. as interest Expense related mostly to a line of credit used for business activities. However, $1,000 related to late payment fees to CRA 6) Convention Expenses related to the company CEO attending a four day sales convention in Ottawa, Ontario related to our products and services. The convention expense didn't break out an amount for meals and the entire invoice was recorded as "Convention Expenses in the accounting records Page 2 of 2 5 of 518 words English (United States) Type here to search AaBbccbd AaBbc ist Para... 1 No Spac... 1 Table Pa... Heading 1 Replace Select Dictate Sensitivity Editor Styles Editing Voice Sensitivity Editor #7) Salaries expense includes $ 12,000 in bonuses declared on December 31, 2017 that were paid on: August 2, 2011 #8) Assume The Company LTD wants to claim the maximum CCA Deduction they are entitled to #10) UCC Balances for January 1, 2017 are as follows: Class 1 %) Class 8 (20%) Class 14.1 $160,000 (Consisting of One Building Only) 115,000 8,000 (Balance converted from old CEC Pool) There was only one depreciable asset disposed of during the year (Building). The journal entry was as follows (Class 1): Cash Loss on Disposal of Building Accumulated Dep n - Building Building 175,000 (Net Proceeds on Sale) 5,000 20,000 200,000 (Cost of Building) During the year, the company acquired equipment for $25,000 The Company LTD signed a lease for a building on January 1, 2017. Since the original layout didn't work for our operations, we incurred expenses to remodel the building. The lease details are as follows: $50,000 8 Cost of Renovations: Lease Term: First Renewal Option: Second Renewal Option: 2 The Company LTD, on April 5, 2017, purchased a new luxury vehicle that the CEO will use to impress clients with. The purchase price of the vehicle was 595,000. For simplicity, ignore any excise taxes (GST and PST) for this transaction. #11) The corporation sold inventory on installment in 2017. The sales price was $100,000 and the cost of goods sold was $40,000. The $100,000 accounts receivable will require payments of $50,000 on June, 2018 and $50,000 on June, 2019 I D. Focus 19 11:22 PM File Home Insert Draw Design Layout References Mailings Review View Help Calibri 10 X Cut Copy Format Painter VA A A A E AL BIUX, ' ADA. Paste Clipboard Font Paragraph TAXILHand in ILO 8 to Assessment out of 21 Marks Using the information below, determine the Net Income for Tax Purposes for The Company LTD. Ensure your answer includes any supporting calculations and CCA Schedules Excerpt from Financial Accounting Statements: 31-Dec-17 $1,000,000 359.000 $641,000 Sales Less: COGS Gross Profit Less Meal and Entertainment Expenses Utilities Expense (Gain) Loss on Disposal of Building Convention Expenses Charitable Donations Rent Expense (Building) Depreciation Expense Interest Expense Salaries Expense Club Dues Expense Advertising Expense Miscellaneous Expenses Net Income before Taxes Less: Provision for Income Taxes Net Income for Accounting Purposes $12,000 15,000 5.000 3,000 7,200 60,000 15,000 3.500 222,000 4,000 20,000 2,000 $363.700 $272,300 54.460 $217,840 NOTES: The above condensed financial statements were prepared in accordance with GAAP (unless stated otherwise) 12) All figures in question are expressed in Canadian Dollars 3) The Club Dues relate to annual membership fees at Dimpled Balls Golf Club, The Company LTD on a regular and continuous basis uses this facility to maintain relationships with existing clients as well as meet new customers 14) Advertising Expense includes $5,000 CAD paid to a US Broadcaster to entice Canadian consumers to purchase our products. as interest Expense related mostly to a line of credit used for business activities. However, $1,000 related to late payment fees to CRA 6) Convention Expenses related to the company CEO attending a four day sales convention in Ottawa, Ontario related to our products and services. The convention expense didn't break out an amount for meals and the entire invoice was recorded as "Convention Expenses in the accounting records Page 2 of 2 5 of 518 words English (United States) Type here to search AaBbccbd AaBbc ist Para... 1 No Spac... 1 Table Pa... Heading 1 Replace Select Dictate Sensitivity Editor Styles Editing Voice Sensitivity Editor #7) Salaries expense includes $ 12,000 in bonuses declared on December 31, 2017 that were paid on: August 2, 2011 #8) Assume The Company LTD wants to claim the maximum CCA Deduction they are entitled to #10) UCC Balances for January 1, 2017 are as follows: Class 1 %) Class 8 (20%) Class 14.1 $160,000 (Consisting of One Building Only) 115,000 8,000 (Balance converted from old CEC Pool) There was only one depreciable asset disposed of during the year (Building). The journal entry was as follows (Class 1): Cash Loss on Disposal of Building Accumulated Dep n - Building Building 175,000 (Net Proceeds on Sale) 5,000 20,000 200,000 (Cost of Building) During the year, the company acquired equipment for $25,000 The Company LTD signed a lease for a building on January 1, 2017. Since the original layout didn't work for our operations, we incurred expenses to remodel the building. The lease details are as follows: $50,000 8 Cost of Renovations: Lease Term: First Renewal Option: Second Renewal Option: 2 The Company LTD, on April 5, 2017, purchased a new luxury vehicle that the CEO will use to impress clients with. The purchase price of the vehicle was 595,000. For simplicity, ignore any excise taxes (GST and PST) for this transaction. #11) The corporation sold inventory on installment in 2017. The sales price was $100,000 and the cost of goods sold was $40,000. The $100,000 accounts receivable will require payments of $50,000 on June, 2018 and $50,000 on June, 2019 I D. Focus 19 11:22 PM