Question

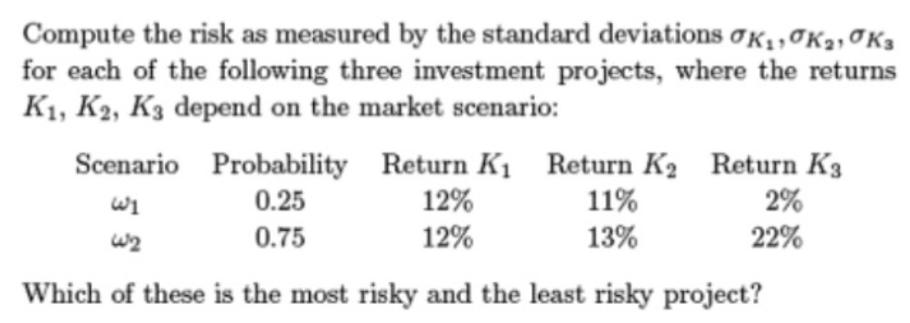

Compute the risk as measured by the standard deviations K, K, K3 for each of the following three investment projects, where the returns K,

Compute the risk as measured by the standard deviations K, K, K3 for each of the following three investment projects, where the returns K, K2, K3 depend on the market scenario: Scenario Probability 0.25 0.75 Return K 12% 12% Return K Return K3 2% 11% 13% 22% Which of these is the most risky and the least risky project?

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To compute the standard deviations sigma for each investment project we need to calculate the varian...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

6th edition

1305637100, 978-1305637108

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App