Answered step by step

Verified Expert Solution

Question

1 Approved Answer

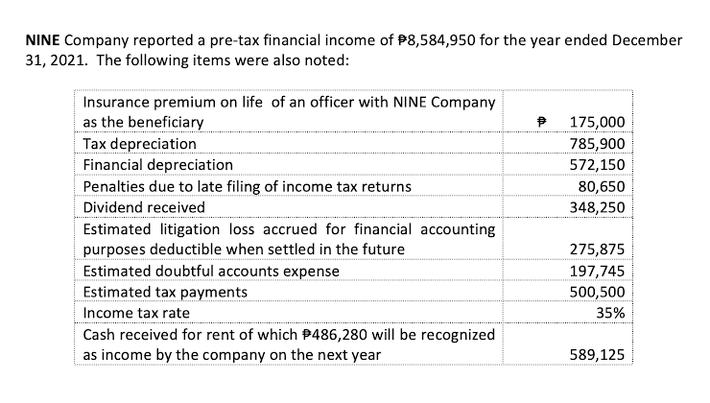

Compute the taxable income Compute for the deferred tax asset. Compute for the net income after tax (round off to the nearest whole number) NINE

Compute the taxable income

Compute for the deferred tax asset.

Compute for the net income after tax (round off to the nearest whole number)

NINE Company reported a pre-tax financial income of $8,584,950 for the year ended December 31, 2021. The following items were also noted: Insurance premium on life of an officer with NINE Company as the beneficiary Tax depreciation Financial depreciation Penalties due to late filing of income tax returns Dividend received Estimated litigation loss accrued for financial accounting purposes deductible when settled in the future Estimated doubtful accounts expense Estimated tax payments Income tax rate Cash received for rent of which #486,280 will be recognized as income by the company on the next year 175,000 785,900 572,150 80,650 348,250 275,875 197,745 500,500 35% 589,125

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

7 Computation of Taxable Income Pre tax Financial Income as given in the problem 8584950 Add Disallo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started