Answered step by step

Verified Expert Solution

Question

1 Approved Answer

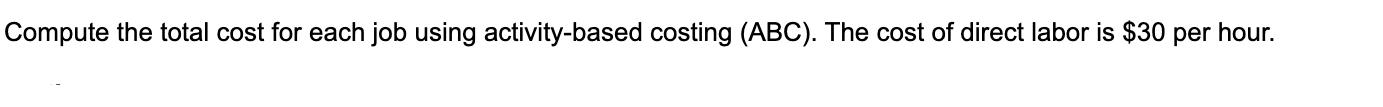

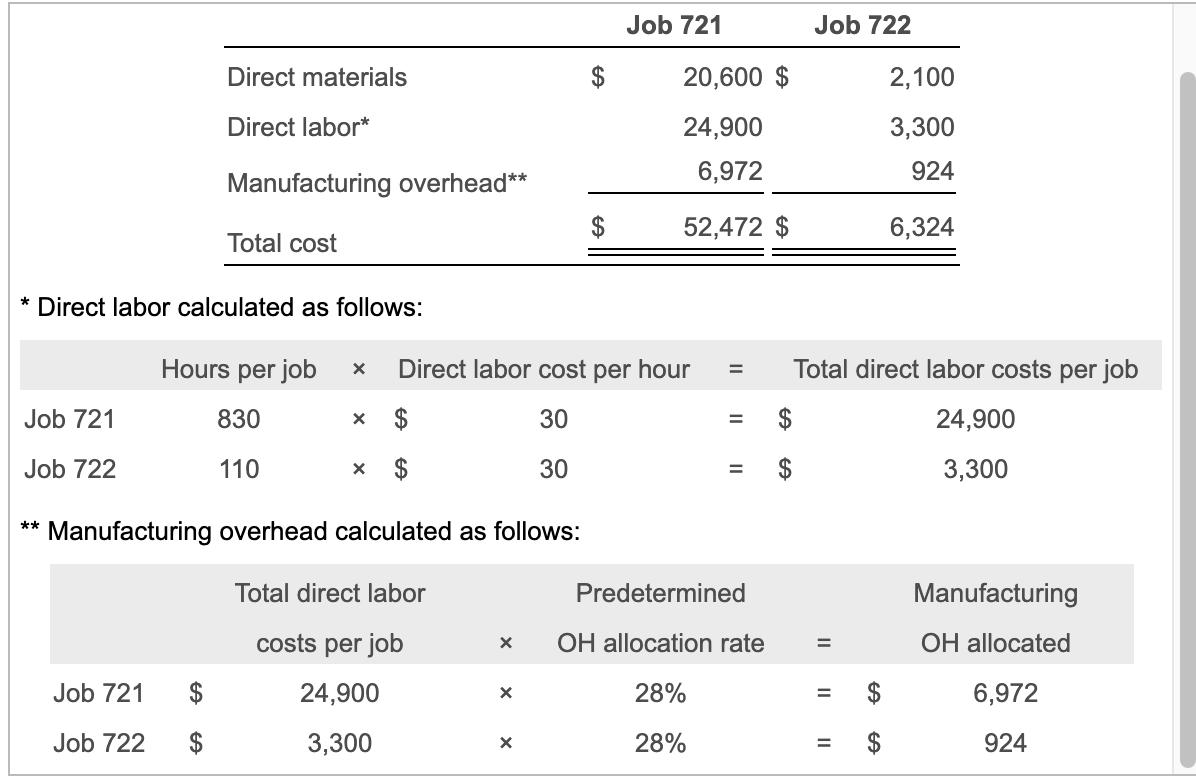

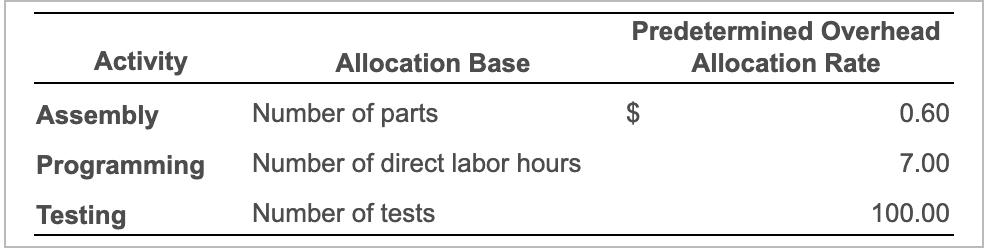

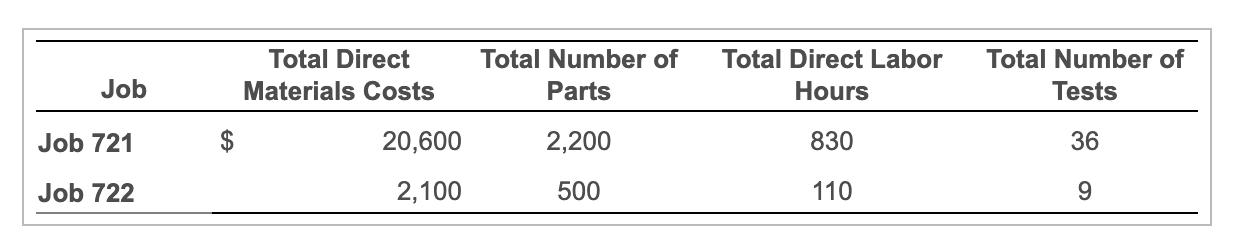

Compute the total cost for each job using activity-based costing (ABC). The cost of direct labor is $30 per hour. Activity-based costing: Direct costs:

![]()

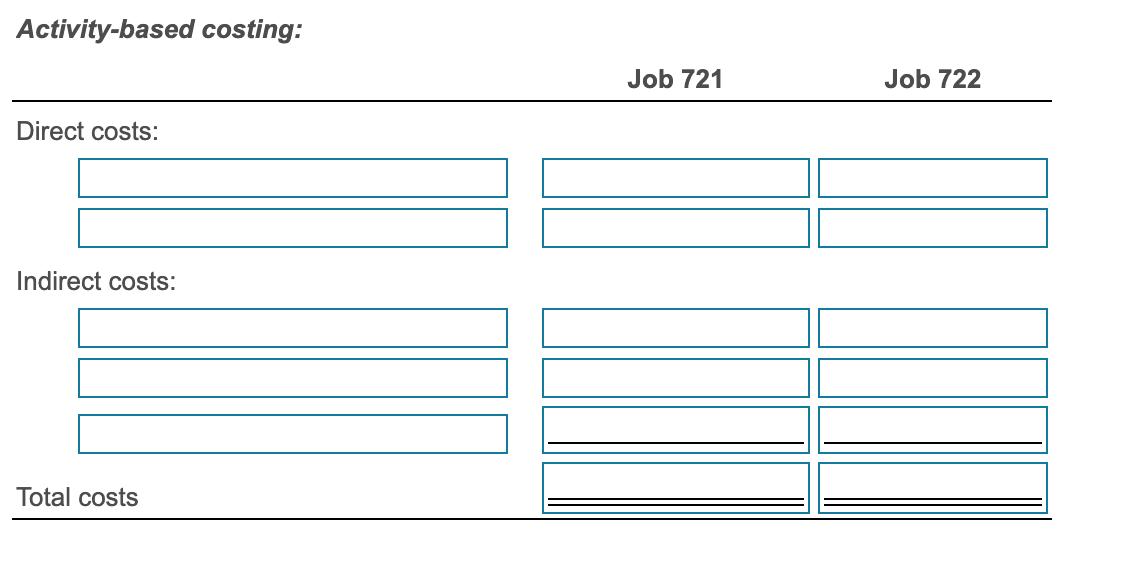

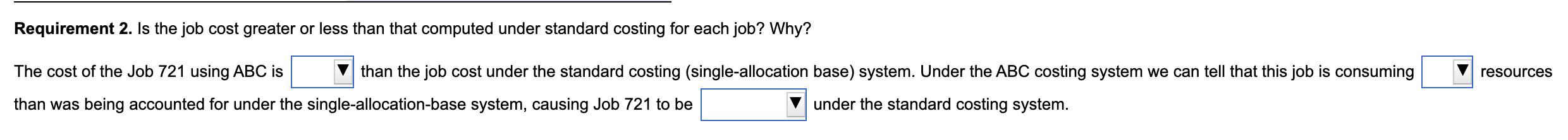

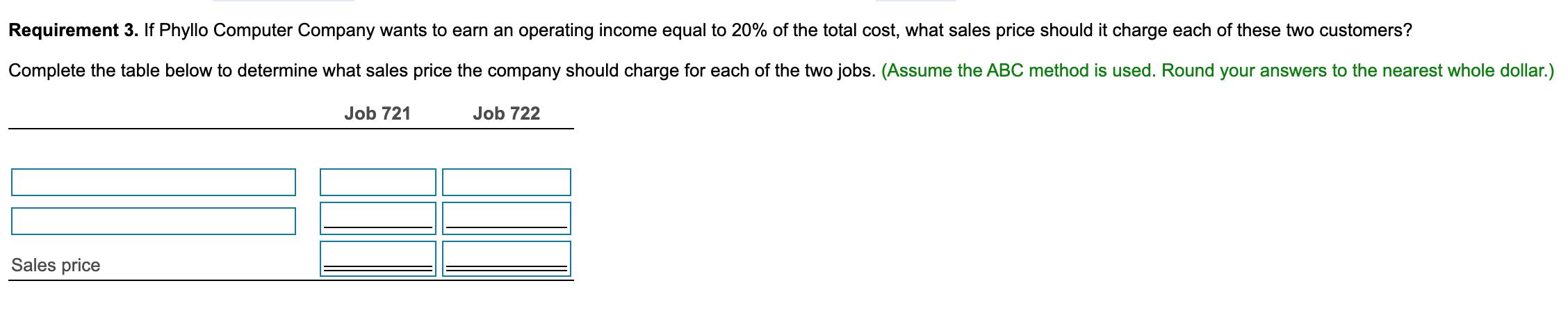

Compute the total cost for each job using activity-based costing (ABC). The cost of direct labor is $30 per hour. Activity-based costing: Direct costs: Indirect costs: Total costs Job 721 Job 722 Requirement 2. Is the job cost greater or less than that computed under standard costing for each job? Why? The cost of the Job 721 using ABC is than was being accounted for under the single-allocation-base system, causing Job 721 to be than the job cost under the standard costing (single-allocation base) system. Under the ABC costing system we can tell that this job is consuming under the standard costing system. resources than the job cost under the standard costing (single-allocation base) system. Under the ABC costing system we can tell that this job is consuming under the standard costing system. The cost of the Job 722 using ABC is than was being accounted for under the single-allocation-base system, causing Job 722 to be resources Under the system, overhead is allocated to the two jobs based solely on a percentage of direct labor costs, using a single predetermined overhead allocation rate. This costing system the way the two jobs actually use the company's resources (activities). takes into account assembling, programming, and testing activities when allocating overhead costs costs are closer to the true costs of completing each job. reflects the way the jobs actually use the company's resources, to the two jobs. Because Requirement 3. If Phyllo Computer Company wants to earn an operating income equal to 20% of the total cost, what sales price should it charge each of these two customers? Complete the table below to determine what sales price the company should charge for each of the two jobs. (Assume the ABC method is used. Round your answers to the nearest whole dollar.) Job 721 Sales price Job 722 Job 721 Job 722 Direct materials Direct labor* * Direct labor calculated as follows: Manufacturing overhead** Total cost Job 721 Job 722 Hours per job 830 110 ** Manufacturing overhead calculated as follows: Total direct labor costs per job 24,900 3,300 X X 69 X Direct labor cost per hour X $ 30 X $ 30 X $ Job 721 20,600 $ 24,900 6,972 52,472 $ = = = Predetermined OH allocation rate 28% 28% Job 722 Total direct labor costs per job 24,900 3,300 = II = 2,100 3,300 924 6,324 CA Manufacturing OH allocated 6,972 924 Activity Assembly Programming Testing Allocation Base Number of parts Number of direct labor hours Number of tests Predetermined Overhead Allocation Rate 0.60 7.00 100.00 Job Job 721 Job 722 GA Total Direct Materials Costs 20,600 2,100 Total Number of Total Direct Labor Parts Hours 2,200 830 500 110 Total Number of Tests 36 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 computation of Total cost for each Job using Activity Based Costing Job 721 Job 722 Direct ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started