Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the total depreciation allowances in respect of plant and machinery of Mr Cheung's business for the year of assessment 2010/11. Mr Cheung has

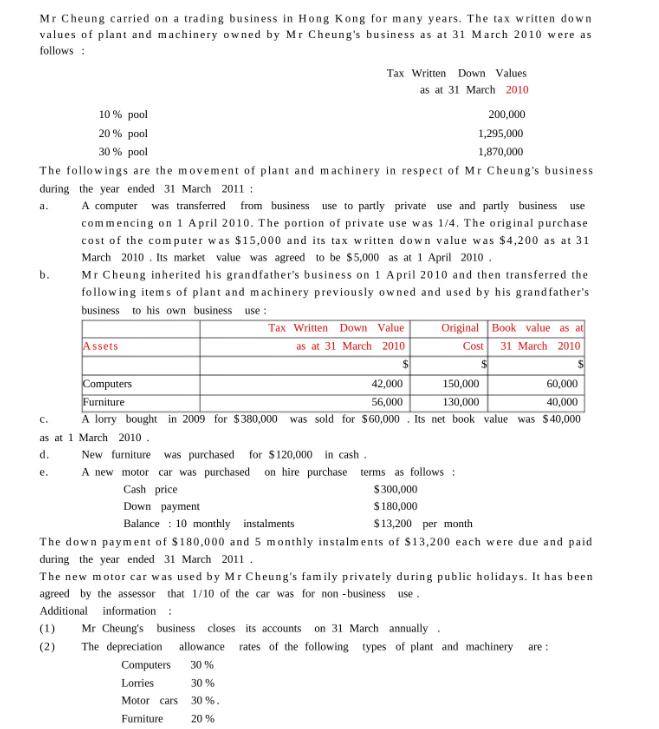

Compute the total depreciation allowances in respect of plant and machinery of Mr Cheung's business for the year of assessment 2010/11. Mr Cheung has not applied for application of s. 16G Mr Cheung carried on a trading business in Hong Kong for many years. The tax written down values of plant and machinery owned by Mr Cheung's business as at 31 March 2010 were as follows: 10% pool 20% pool 30% pool The followings are the movement of plant and machinery in respect of Mr Cheung's business during the year ended 31 March 2011 : a. A computer was transferred. from business use to partly private use and partly business use commencing on 1 April 2010. The portion of private use was 1/4. The original purchase cost of the computer was $15,000 and its tax written down value was $4,200 as at 31 March 2010. Its market value was agreed to be $5,000 as at 1 April 2010. Mr Cheung inherited his grandfather's business on 1 April 2010 and then transferred the following items of plant and machinery previously owned and used by his grandfather's business to his own business use : b. Assets Tax Written Down Values as at 31 March 2010 Tax Written Down Value as at 31 March 2010 $ 200,000 1,295,000 1,870,000 Lorries Motor cars 30%. Furniture 20 % Original Book value as at Cost 31 March 2010 $ S Computers 42,000 56,000 150,000 130,000 60,000 40,000 Furniture C. A lorry bought in 2009 for $380,000 was sold for $60,000. Its net book value was $40,000 as at 1 March 2010. d. New furniture was purchased for $120,000 in cash. e. A new motor car was purchased on hire purchase terms as follows: Cash price $300,000 Down payment $180,000 Balance 10 monthly instalments $13,200 per month The down payment of $180,000 and 5 monthly instalments of $13,200 each were due and paid during the year ended 31 March 2011. The new motor car was used by Mr Cheung's family privately during public holidays. It has been agreed by the assessor that 1/10 of the car was for non-business use. Additional information : (1) Mr Cheung's business closes its accounts on 31 March annually (2) The depreciation allowance rates of the following types of plant and machinery are: Computers 30% 30 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started