Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the total income subject to regular tax if the taxpayer is a resident citizen. 52. Compute the total income subject to regular tax

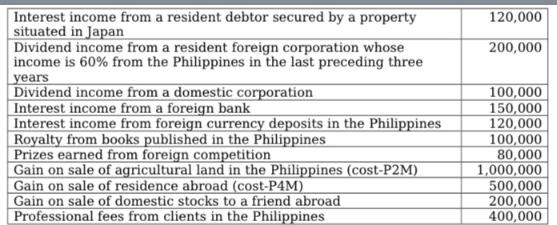

Compute the total income subject to regular tax if the taxpayer is a resident citizen. 52. Compute the total income subject to regular tax if the taxpayer is a non-resident citizen. 53. Compute the final tax on passive income if the taxpayer is a resident citizen. Interest income from a resident debtor secured by a property situated in Japan Dividend income from a resident foreign corporation whose income is 60% from the Philippines in the last preceding three years Dividend income from a domestic corporation Interest income from a foreign bank Interest income from foreign currency deposits in the Philippines Royalty from books published in the Philippines Prizes earned from foreign competition Gain on sale of agricultural land in the Philippines (cost-P2M) Gain on sale of residence abroad (cost-P4M) Gain on sale of domestic stocks to a friend abroad Professional fees from clients in the Philippines 120,000 200,000 100,000 150,000 120,000 100,000 80,000 1,000,000 500,000 200,000 400,000

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Lets begin with the calculations 1 Compute the total income subject to regular tax if the taxpayer is a resident citizen Interest income from a reside...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started