Question

Compute the tracking error from the following information: Month 2001 January February March April May June July August September October November December Portfolio As Return

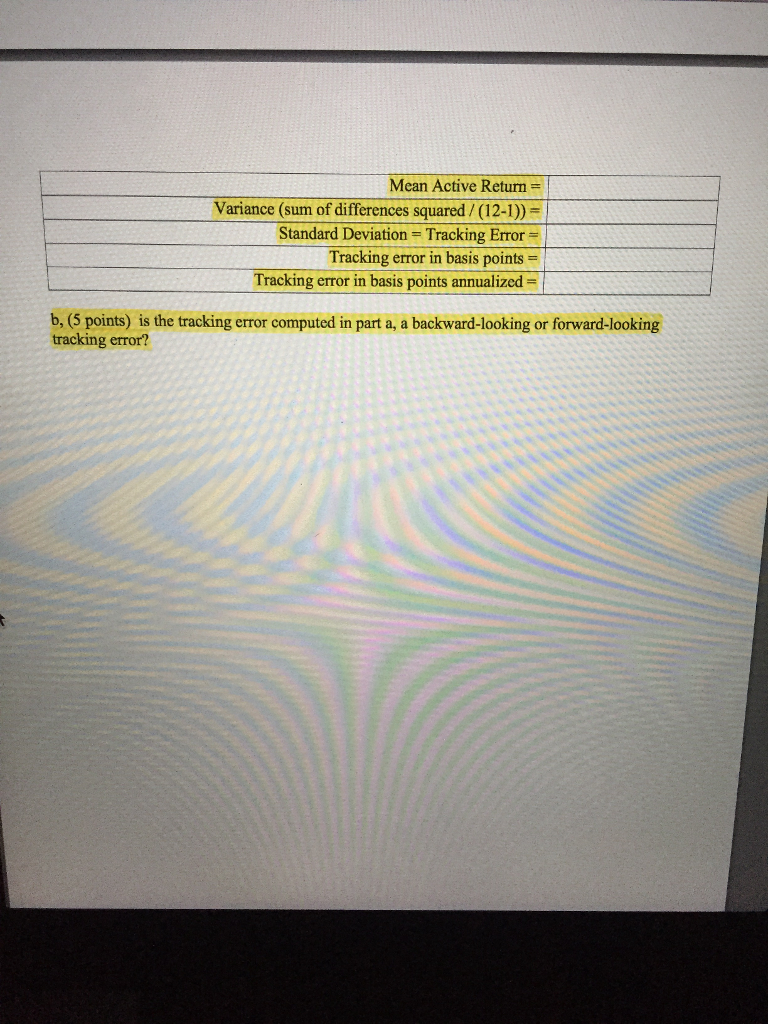

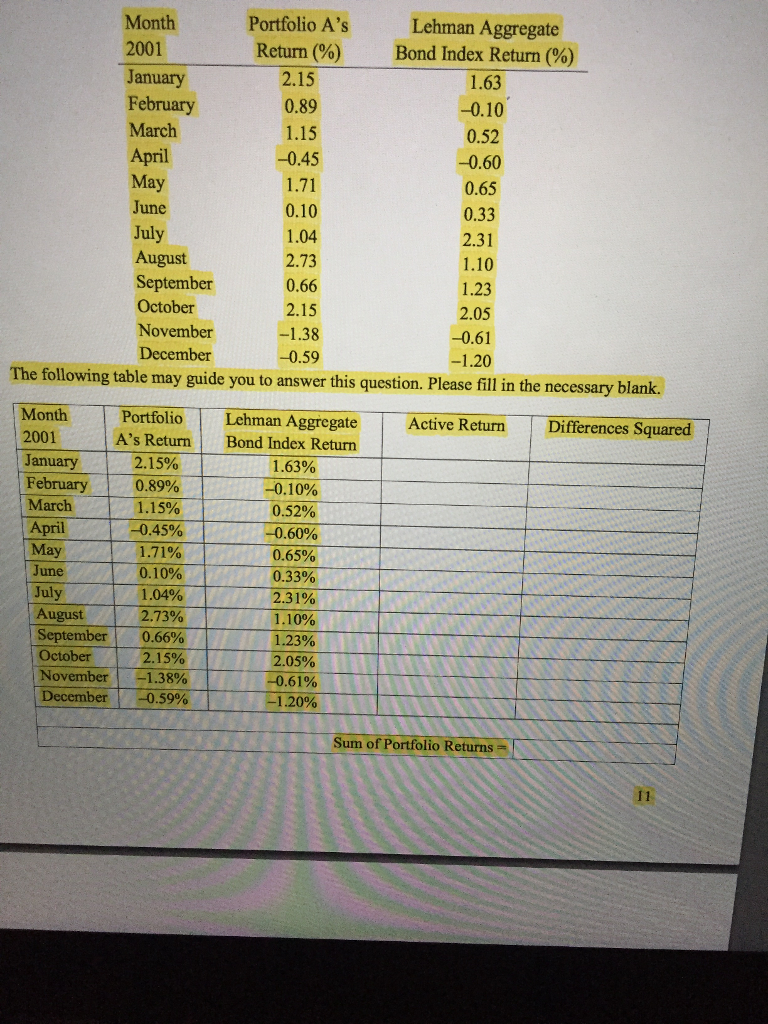

Compute the tracking error from the following information: Month 2001 January February March April May June July August September October November December Portfolio As Return (%) 2.15 0.89 1.15 0.45 1.71 0.10 1.04 2.73 0.66 2.15 1.38 Lehman Aggregate Bond Index Return (%) 1.63 0.10 0.52 0.60 0.65 0.33 2.31 1.10 1.23 2.05 0.61 0.59 The following table may guide you to answer this question. Please fill in the necessary blank. 1.20 Month 2001 Portfolio As Return Lehman Aggregate Bond Index Return Active Return Differences Squared January 2.15% 1.63% February 0.89% 0.10% March 1.15% 0.52% April 0.45% 0.60% May 1.71% 0.65% June 0.10% 0.33% July 1.04% 2.31% August 2.73% 1.10% September 0.66% 1.23% October 2.15% 2.05% November 1.38% 0.61% December 0.59% 1.20% Sum of Portfolio Returns = 11 Mean Active Return = Variance (sum of differences squared / (12-1)) = Standard Deviation = Tracking Error = Tracking error in basis points = Tracking error in basis points annualized = b, (5 points) is the tracking error computed in part a, a backward-looking or forward-looking tracking error?

Compute the tracking error from the following information: Month 2001 January February March April May June July August September October November December Portfolio As Return (%) 2.15 0.89 1.15 0.45 1.71 0.10 1.04 2.73 0.66 2.15 1.38 Lehman Aggregate Bond Index Return (%) 1.63 0.10 0.52 0.60 0.65 0.33 2.31 1.10 1.23 2.05 0.61 0.59 The following table may guide you to answer this question. Please fill in the necessary blank. 1.20 Month 2001 Portfolio As Return Lehman Aggregate Bond Index Return Active Return Differences Squared January 2.15% 1.63% February 0.89% 0.10% March 1.15% 0.52% April 0.45% 0.60% May 1.71% 0.65% June 0.10% 0.33% July 1.04% 2.31% August 2.73% 1.10% September 0.66% 1.23% October 2.15% 2.05% November 1.38% 0.61% December 0.59% 1.20% Sum of Portfolio Returns = 11 Mean Active Return = Variance (sum of differences squared / (12-1)) = Standard Deviation = Tracking Error = Tracking error in basis points = Tracking error in basis points annualized = b, (5 points) is the tracking error computed in part a, a backward-looking or forward-looking tracking error?

I uploaded the pictures

Mean Active Return Variance (sum of differences squared/ (12-1)) Standard Deviation = Tracking Error Tracking error in basis points = Tracking error in basis points annualized- b, (5 points) is the tracking error computed in part a, a backward-looking or forward-looking tracking errorStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started