Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the Unearned Interest Income on the date of sale. Prepare the amortization table. Prepare the Journal entry on the 1st, 2nd, and last year.

Compute the Unearned Interest Income on the date of sale.

Prepare the amortization table.

Prepare the Journal entry on the 1st, 2nd, and last year.

Compute the Carrying amount of the note on the 2nd year.

Compute the Interest Income on the 2nd year.

Compute the Unearned Interest Income on the 3rd year.

Prepare the amortization table.

Prepare the Journal entry on the 1st, 2nd, and last year.

Compute the Carrying amount of the note on the 2nd year.

Compute the Interest Income on the 2nd year.

Compute the Unearned Interest Income on the 3rd year.

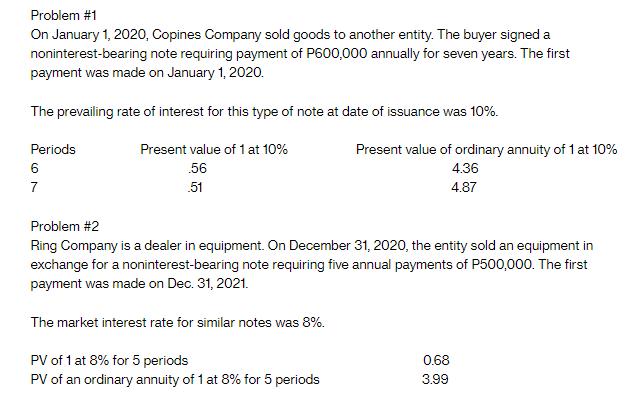

Problem #1 On January 1, 2020, Copines Company sold goods to another entity. The buyer signed a noninterest-bearing note requiring payment of P600,000 annually for seven years. The first payment was made on January 1, 2020. The prevailing rate of interest for this type of note at date of issuance was 10%. Present value of 1 at 10% 56 51 Periods 6 7 Problem #2 Ring Company is a dealer in equipment. On December 31, 2020, the entity sold an equipment in exchange for a noninterest-bearing note requiring five annual payments of P500,000. The first payment was made on Dec. 31, 2021. The market interest rate for similar notes was 8%. Present value of ordinary annuity of 1 at 10% 4.36 4.87 PV of 1 at 8% for 5 periods PV of an ordinary annuity of 1 at 8% for 5 periods 0.68 3.99

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Problem 1 To compute the unearned interest income on the date of sale we need to determine the present value of the note and subtract it from the tota...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started