Answered step by step

Verified Expert Solution

Question

1 Approved Answer

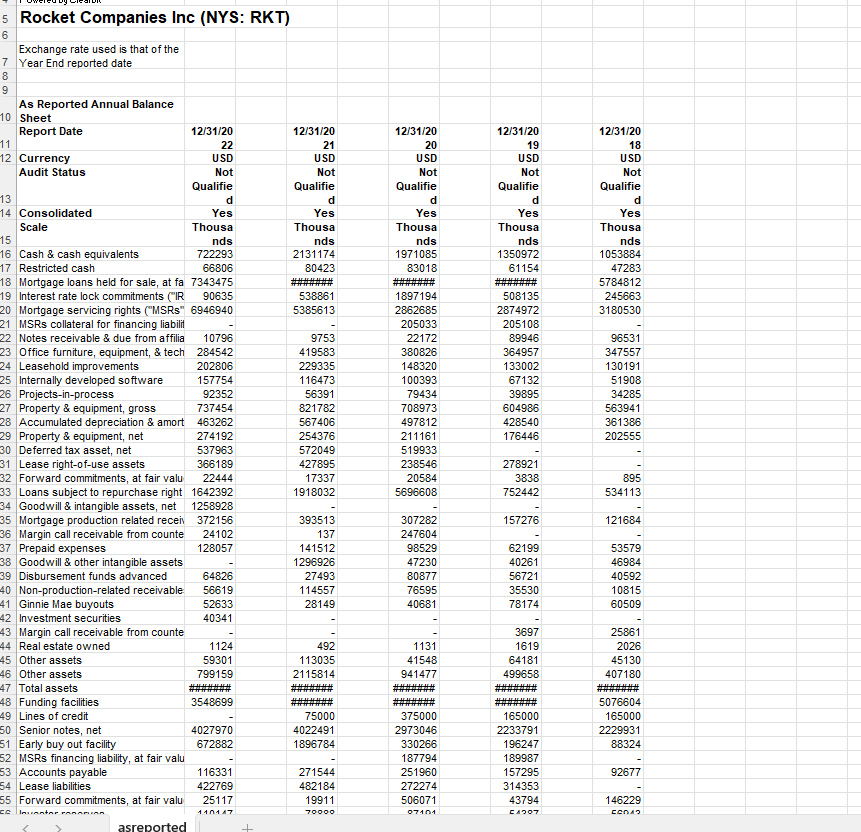

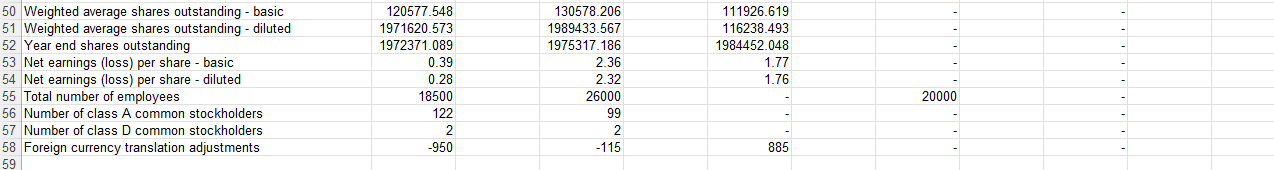

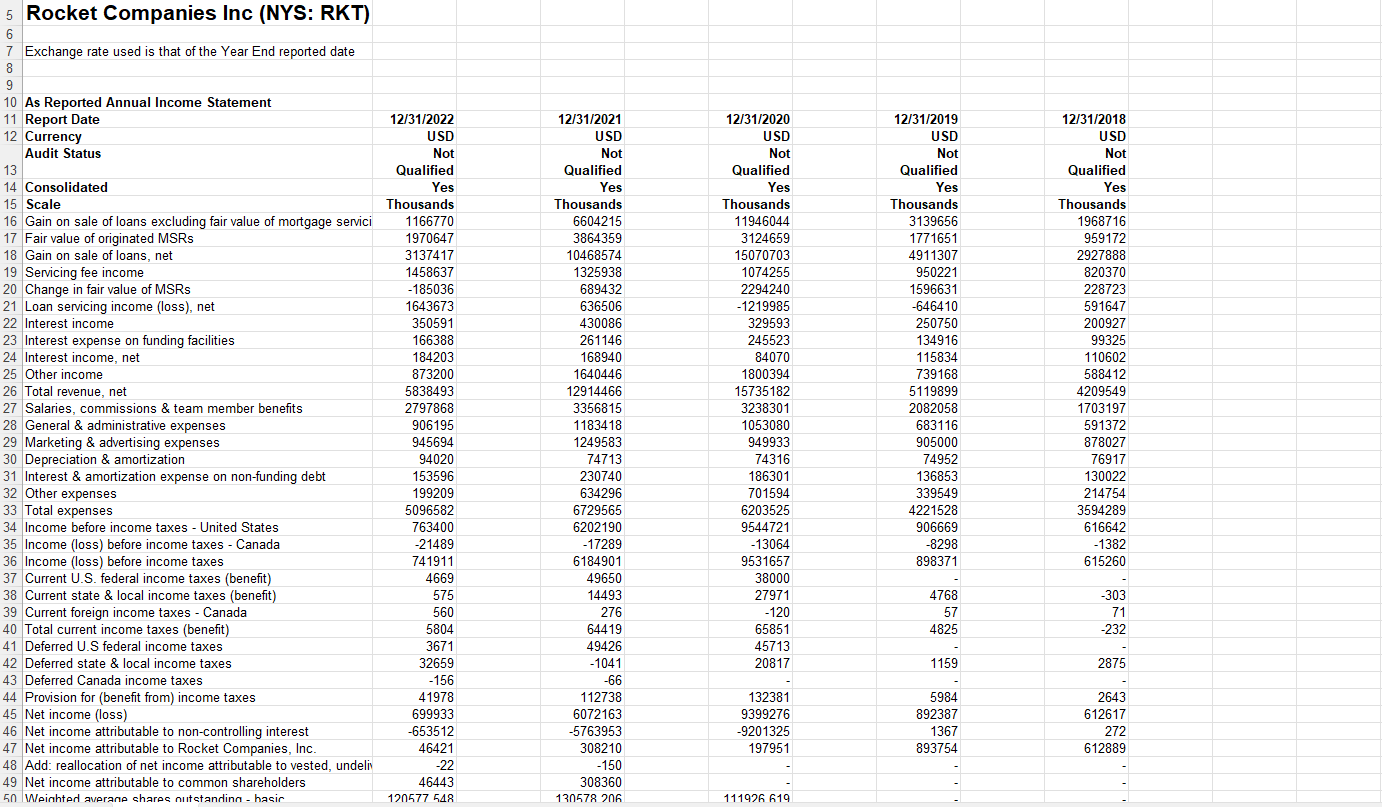

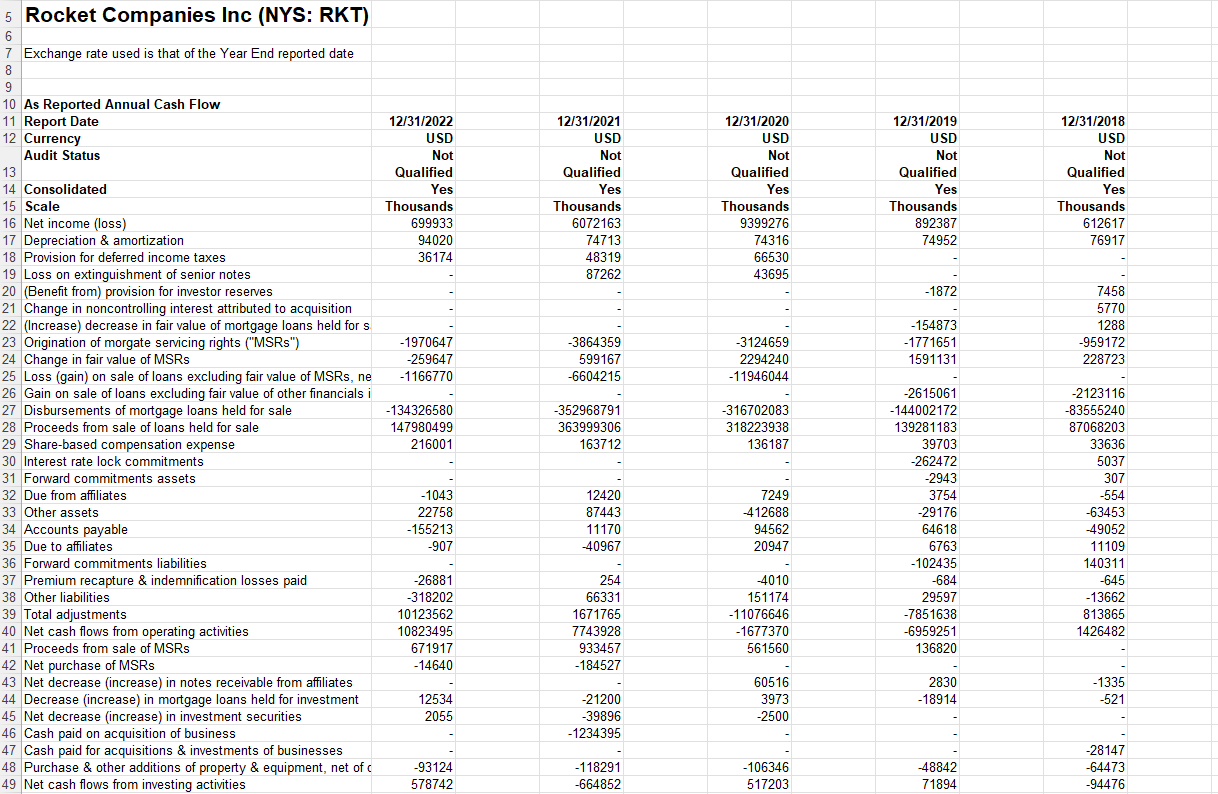

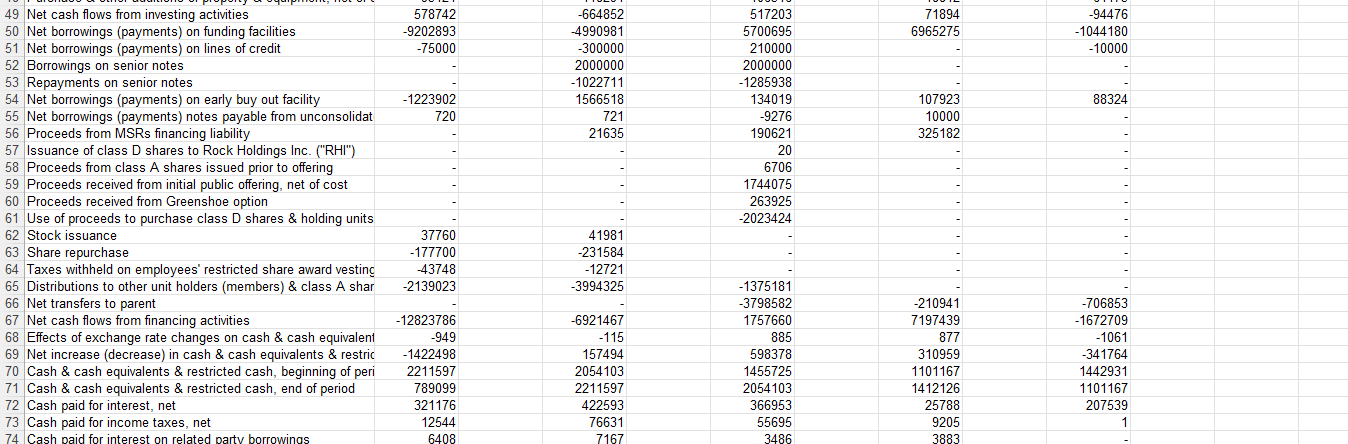

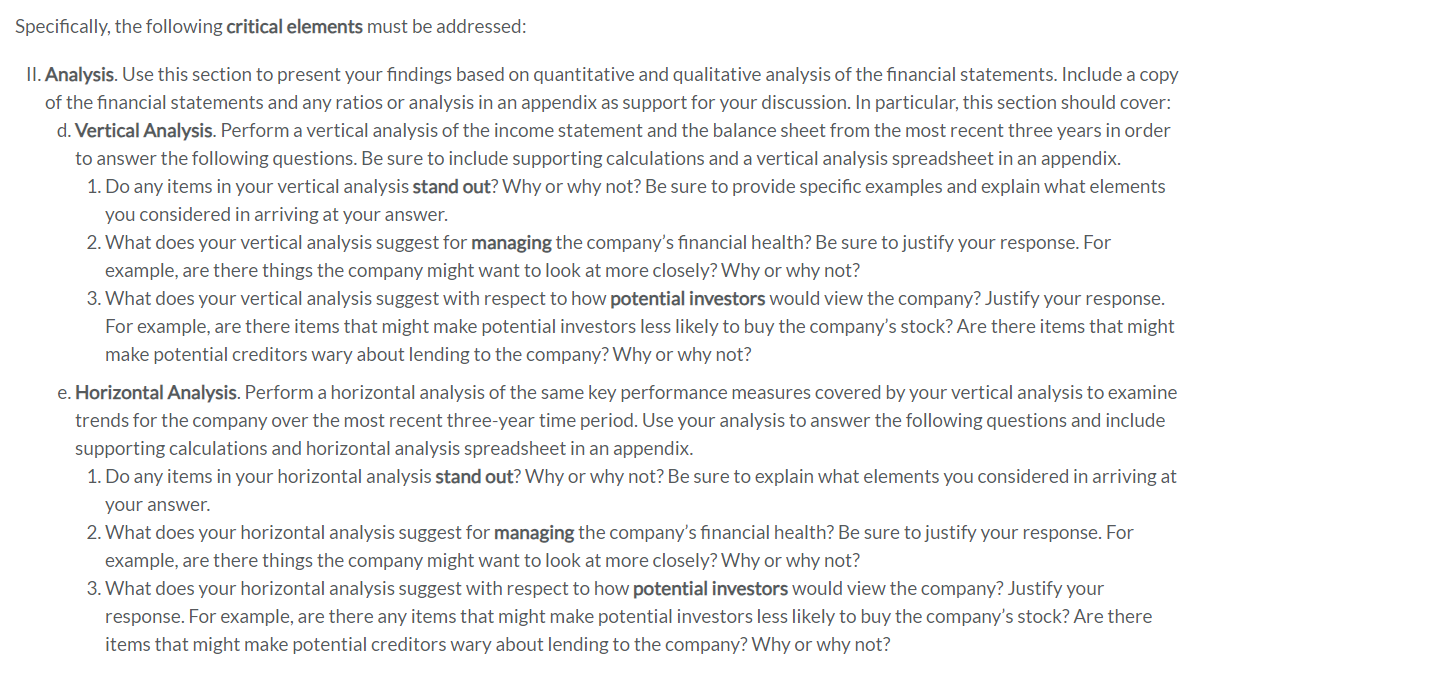

compute three years of vertical and horizontal analyses of the approved company Rocket Companies INC (nys: RKT) In the vertical analysis, will measure performance against

compute three years of vertical and horizontal analyses of the approved company Rocket Companies INC (nys: RKT)

In the vertical analysis, will measure performance against one variable: revenue in the income statement and assets in the balance sheet from the most recent three years. The horizontal analysis measures trends over the most recent three years and is a strong gauge of growth and consistence.

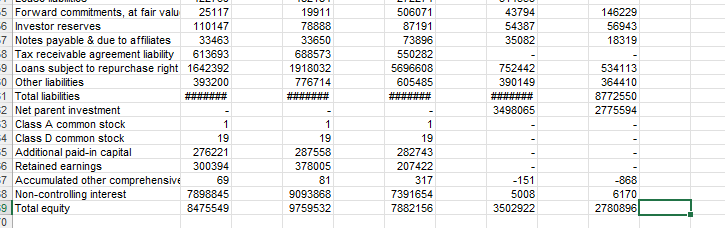

5 Forward commitments, at fair valu 25117 19911 506071 43794 146229 6 Investor reserves 110147 78888 87191 54387 56943 7 Notes payable & due to affiliates 8 Tax receivable agreement liability 9 Loans subject to repurchase right 0 Other liabilities 1 Total liabilities 2 Net parent investment 3 Class A common stock 33463 33650 73896 35082 18319 613693 688573 550282 1642392 1918032 5696608 752442 534113 393200 776714 605485 390149 364410 wwwwwww ####### 8772550 - 3498065 2775594 1 1 1 4 Class D common stock 19 19 5 Additional paid-in capital 276221 287558 6 Retained earnings 300394 378005 19 282743 207422 7 Accumulated other comprehensive 69 81 8 Non-controlling interest 7898845 9093868 317 7391654 9 Total equity 8475549 9759532 7882156 0 -151 5008 -868 6170 3502922 2780896

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To conduct the vertical and horizontal analyses for Rocket Companies Inc NYSE RKT we will examine the income statement and balance sheet for the most recent three years 2020 2021 and 2022 Vertical Ana...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started