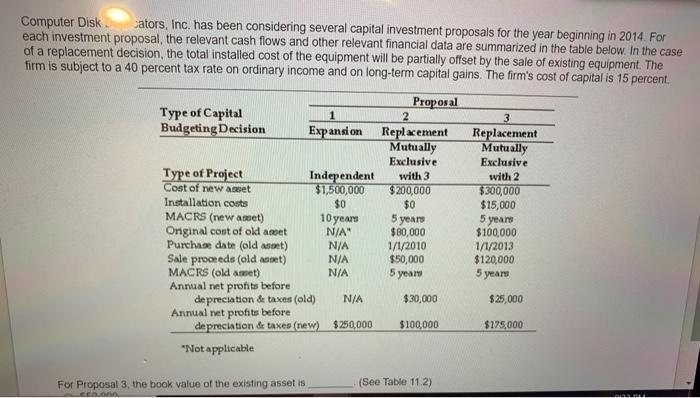

Computer Disk ators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent Proposal Type of Capital 1 2 Budgeting Decision Expansion Replacement Mutually Exclusive Type of Project Independent with 3 Cost of new asset $1,500,000 $200,000 Installation costs $0 $0 MACRS (new asset) 10 years 5 years Onginal cost of old aseet N/A $80,000 Purchase date (old st) N/A 1/1/2010 Sale prooteds (old asset) N/A $50,000 MACRS (old asset) N/A 5 year Annual net profits before depreciation & taxes (old) N/A $30,000 Annual net profits before depreciation de taxes (new) $250,000 $100,000 "Not applicable 3 Replacement Mutually Exclusive with 2 $300,000 $15,000 5 years $100,000 1/1/2013 $120,000 5 years $25,000 $175,000 For Proposal 3, the book value of the existing asset is een. (See Table 11.2) ACELL Computer Disk ators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent Proposal Type of Capital 1 2 Budgeting Decision Expansion Replacement Mutually Exclusive Type of Project Independent with 3 Cost of new asset $1,500,000 $200,000 Installation costs $0 $0 MACRS (new asset) 10 years 5 years Onginal cost of old aseet N/A $80,000 Purchase date (old st) N/A 1/1/2010 Sale prooteds (old asset) N/A $50,000 MACRS (old asset) N/A 5 year Annual net profits before depreciation & taxes (old) N/A $30,000 Annual net profits before depreciation de taxes (new) $250,000 $100,000 "Not applicable 3 Replacement Mutually Exclusive with 2 $300,000 $15,000 5 years $100,000 1/1/2013 $120,000 5 years $25,000 $175,000 For Proposal 3, the book value of the existing asset is een. (See Table 11.2) ACELL