Question

computer facilities over a one-year period to aid in customer billing and perhaps inventory control. Project C entails the evaluation of a customer billing system

computer facilities over a one-year period to aid in customer billing and perhaps inventory control. Project C entails the evaluation of a customer billing system proposed by Advanced Computer Corporation. Under this system, all the bookkeeping and billing presently being done by HPMC's accounting department would now be done by Advanced. In addition to saving bookkeeping costs, Advanced would provide a more efficient billing system and do a credit analysis of delinquent customers, which could be used in the future for in-depth credit analysis. Project D is proposed by International Computer Corporation and includes a billing system similar to that offered by Advanced, as well as an inventory control system that will keep track of all raw materials and parts in stock and reorder when necessary, thereby reducing the likelihood of material stockouts, which has become more and more frequent over the past there years. (The cash flows for projects C and D and given in Exhibit 2.)

The third decision that faces the financial directors of HPMC involves a newly developed and patented process for molding hard plastic. HPMC can either manufacture and market the equipment necessary to mold such plastics or it can sell the patent rights to Polyplastics, Inc., the world's largest producer of plastics products. (The cash flows for projects E and F are shown in Exhibit 3.) At present, the process has not been fully tested, and if HPMC is going to market it itself, it will be necessary to complete this testing and begin production of plant facilities immediately. On the other hand, the selling of these patent rights to Polyplastics would involve only minor testing and refinements, which could be completed within the year. Thus, a decision between the two courses of action is necessary immediately.

The final set of projects up for consideration concerns the replacement of some of the machinery. HPMC can go into one of two directions: project G suggests the purchase and installation of moderately priced and extremely efficient equipment with an expected life of 5 years; while project H advocates the purchase of a similarly priced, although less efficient, machine with a life expectancy of 10 years. (The cash flows for these alternatives are shown in Exhibit 4.)

As the meeting opened, debate immediately centered on the most appropriate method for evaluating all projects. Harding suggested that since the projects to be considered were mutually exclusive, perhaps their usual capital budgeting criterion of net present value was inappropriate. He felt that, in examining these projects, they should be more concerned with some measure of relative profitability. Both Jorgensen and Woelk agreed with Harding's point of view, with Jorgensen advocating a profitability index approach and Woelk preferring to use the internal rate of return. Jorgensen argued that the use of profitability index would provide a benefit-cost ratio, directly implying relative profitability, so that they would merely need to rank the projects and select those with the highest profitability index. Woelk suggested that the calculation of an internal rate of return would also give a measure of profitability and perhaps be somewhat easier to interpret. To settle the issue, Harding suggested that they calculate all three measures, as they would undoubtedly yield the same ranking.

From here the discussion turned to an appropriate approach to the problem of differing lives among mutually exclusive projects E and F, and G and H. Woelk argued that there really was no problem here, since all cash flows from these projects could be determined, any of the discounted cash flow methods of capital budgeting would work well. Jorgensen argued that this was true, but felt that some compensation should be made for the fact that the projects being considered did not have equal lives.

QUESTIONS

1. Was Harding correct in stating that the NPV, PI, and IRR necessarily will yield the same ranking order? Under what situations might the NPV, PI, and IRR methods provide different rankings? Why is this possible?

2. What are the NPV, PI, and IRR for projects A and B? What has caused the ranking conflicts? Should project A or B be chosen? Calculate Modified IRR assuming 10% reinvestment rate. Does Modified IRR support NPV or IRR? Why?

3. Now assume that projects A and B are independent, however you cannot start both projects immediately. One of the projects must be delayed and it must start only in year 2 (the initial outlay will occur in year 2) and will go until year 5. In this case, which project should be delayed, A or B?

4. What are the NPV, PI, and IRR for projects C and D? Should project C or D be chosen? Does your answer change if these projects are considered under a capital constraint? Calculate Modified IRR. Does it support NPV or IRR? Why? Now calculate Incremental IRR. Does it support NPV or IRR? Why?

5. What are the NPV, PI, and IRR for projects E and F? Are these projects comparable even though they have unequal lives? Why? Which project should be chosen? Assume that these projects are not considered under a capital constraint.

6. What are the NPV, PI, and IRR for projects G and H? Are these projects comparable even though they have unequal lives? Why? Which project should be chosen? Assume that these projects are not considered under a capital constraint.

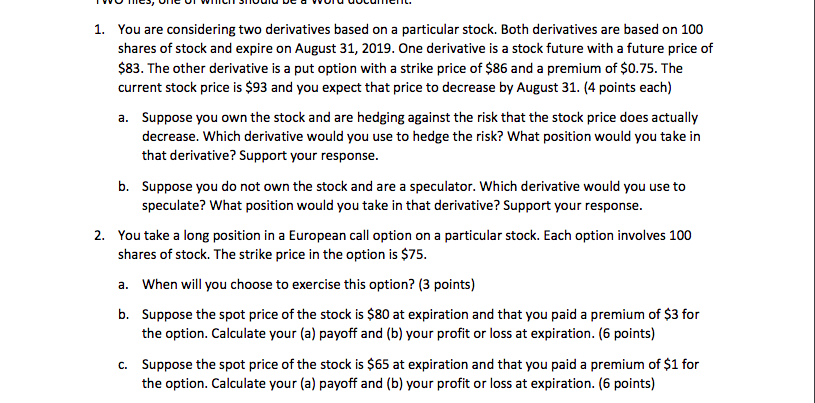

1. You are considering two derivatives based on a particular stock. Both derivatives are based on 100 shares of stock and expire on August 31, 2019. One derivative is a stock future with a future price of $83. The other derivative is a put option with a strike price of $86 and a premium of $0.75. The current stock price is $93 and you expect that price to decrease by August 31. (4 points each) a. Suppose you own the stock and are hedging against the risk that the stock price does actually decrease. Which derivative would you use to hedge the risk? What position would you take in that derivative? Support your response. b. Suppose you do not own the stock and are a speculator. Which derivative would you use to speculate? What position would you take in that derivative? Support your response. 2. You take a long position in a European call option on a particular stock. Each option involves 100 shares of stock. The strike price in the option is $75. a. When will you choose to exercise this option? (3 points) b. Suppose the spot price of the stock is $80 at expiration and that you paid a premium of $3 for the option. Calculate your (a) payoff and (b) your profit or loss at expiration. (6 points) c. Suppose the spot price of the stock is $65 at expiration and that you paid a premium of $1 for the option. Calculate your (a) payoff and (b) your profit or loss at expiration. (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Harding is incorrect in his statement that NPV PI and IRR will necessarily yield the same ranking order This is because each method uses a different basis for comparison NPV compares projects based on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started