Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Computer Tech Limited was started in early 2023 and continued to operate until early 2026, when it was wound up due to disputes between the

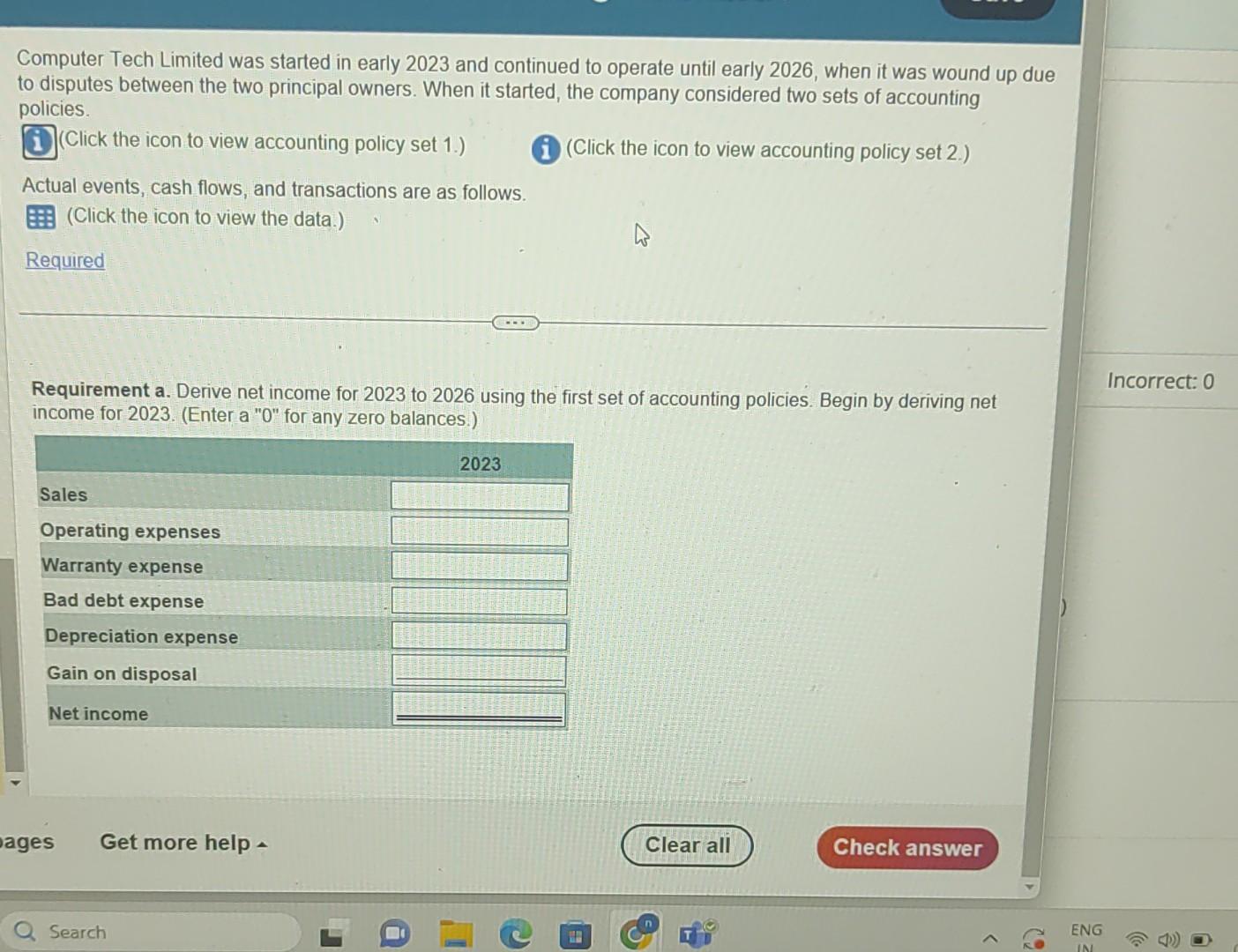

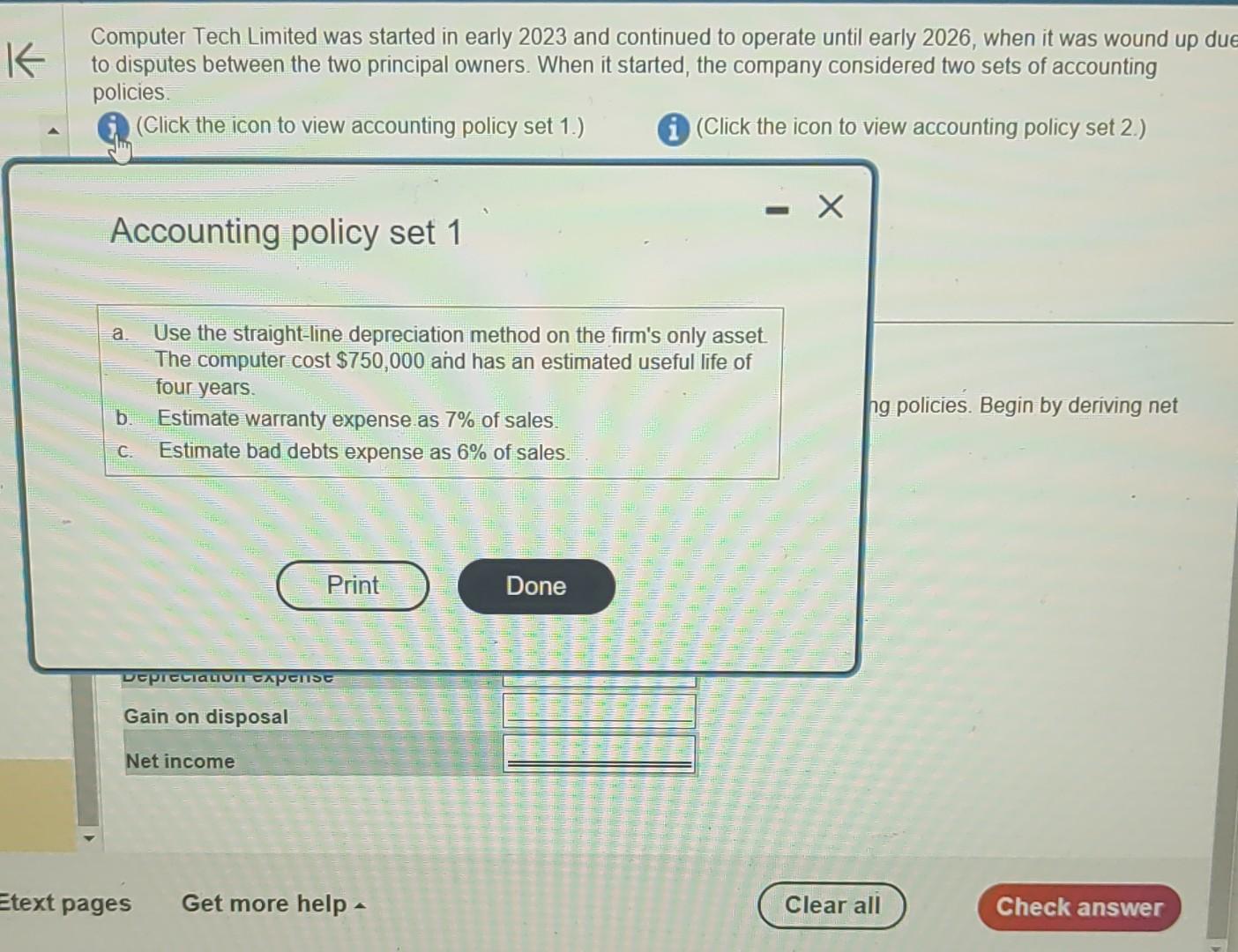

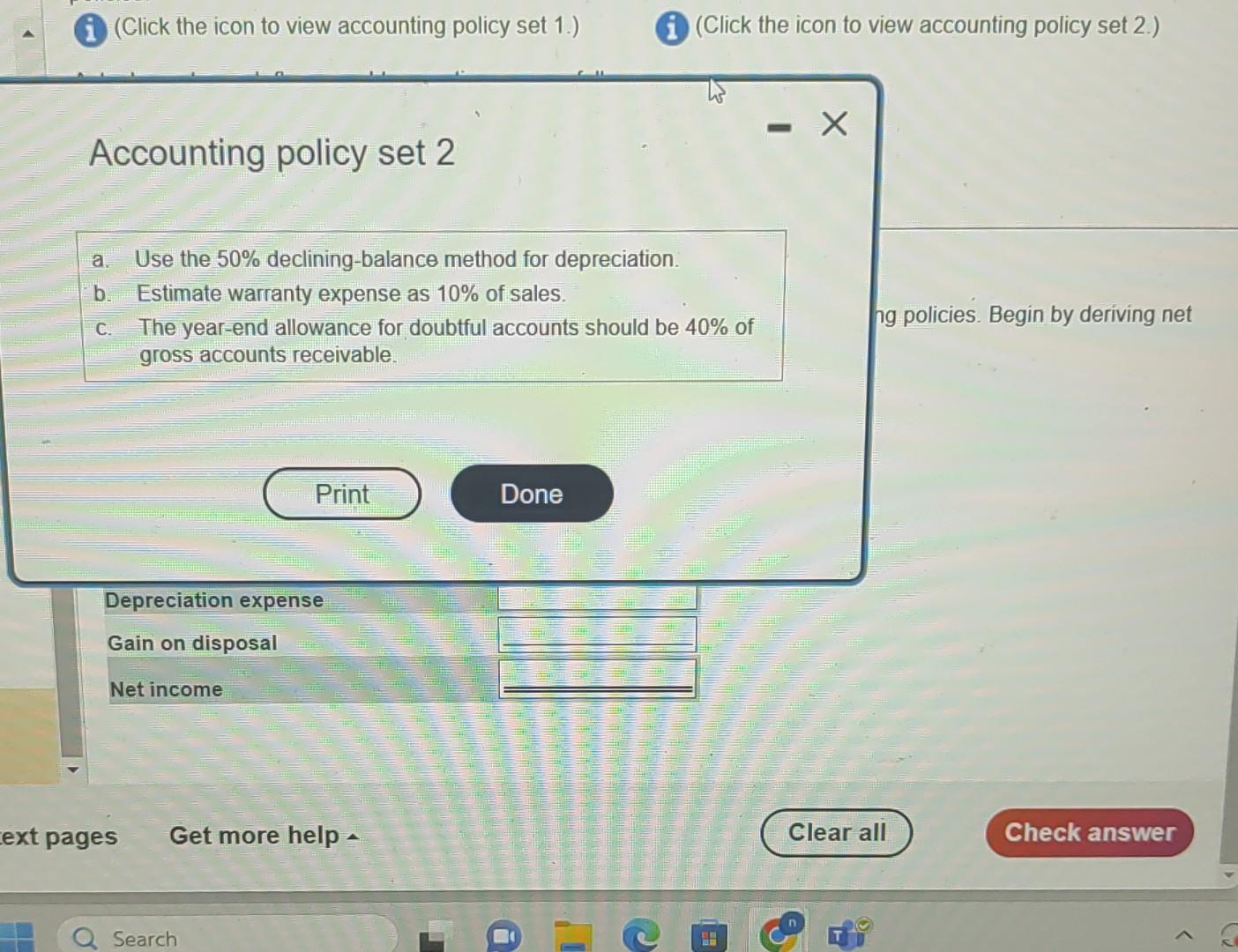

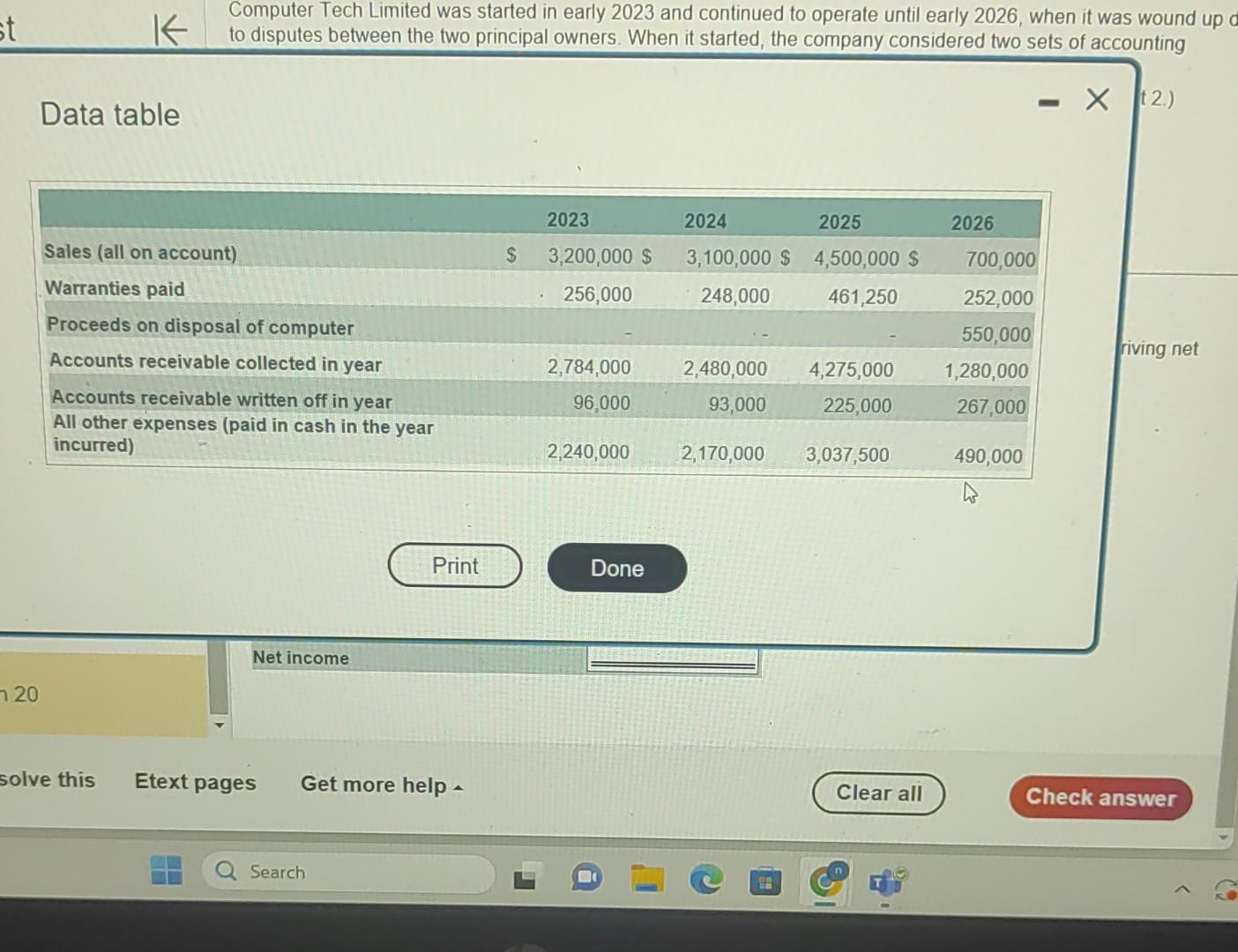

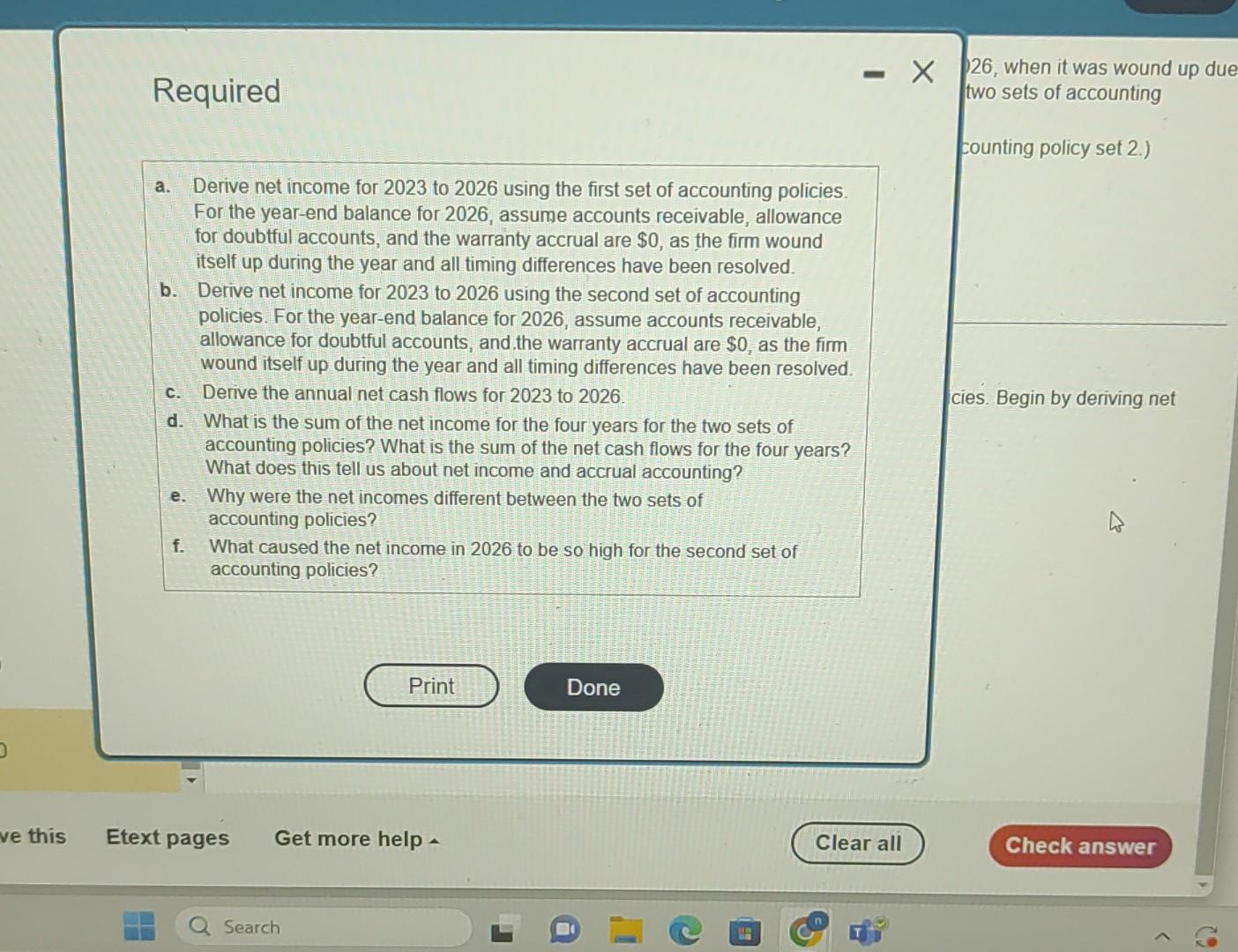

Computer Tech Limited was started in early 2023 and continued to operate until early 2026, when it was wound up due to disputes between the two principal owners. When it started, the company considered two sets of accounting policies. (Click the icon to view accounting policy set 1.) (Click the icon to view accounting policy set 2.) Actual events, cash flows, and transactions are as follows. (Click the icon to view the data.) Requirement a. Derive net income for 2023 to 2026 using the first set of accounting policies. Begin by deriving net income for 2023. (Enter a "0" for any zero balances.) Get more help . Computer Tech Limited was started in early 2023 and continued to operate until early 2026, when it was wound up du to disputes between the two principal owners. When it started, the company considered two sets of accounting policies. i. (Click the icon to view accounting policy set 1.) (Click the icon to view accounting policy set 2.) Accounting policy set 1 a. Use the straight-line depreciation method on the firm's only asset. The computer cost $750,000 and has an estimated useful life of four years. b. Estimate warranty expense as 7% of sales. c. Estimate bad debts expense as 6% of sales. (Click the icon to view accounting policy set 1 .) (Click the icon to view accounting policy set 2 .) Accounting policy set 2 a. Use the 50% declining-balance method for depreciation. b. Estimate warranty expense as 10% of sales. c. The year-end allowance for doubtful accounts should be 40% of g policies. Begin by deriving net gross accounts receivable. Computer Tech Limited was started in early 2023 and continued to operate until early 2026 , when it was wound up to disputes between the two principal owners. When it started, the company considered two sets of accounting Data table 2.) Required 26 , when it was wound up due two sets of accounting a. Derive net income for 2023 to 2026 using the first set of accounting policies. For the year-end balance for 2026 , assume accounts receivable, allowance for doubtful accounts, and the warranty accrual are $0, as the firm wound itself up during the year and all timing differences have been resolved. b. Derive net income for 2023 to 2026 using the second set of accounting policies. For the year-end balance for 2026, assume accounts receivable, allowance for doubtful accounts, and the warranty accrual are $0, as the firm wound itself up during the year and all timing differences have been resolved. c. Derive the annual net cash flows for 2023 to 2026 . d. What is the sum of the net income for the four years for the two sets of accounting policies? What is the sum of the net cash flows for the four years? What does this tell us about net income and accrual accounting? e. Why were the net incomes different between the two sets of accounting policies? f. What caused the net income in 2026 to be so high for the second set of accounting policies

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started