Answered step by step

Verified Expert Solution

Question

1 Approved Answer

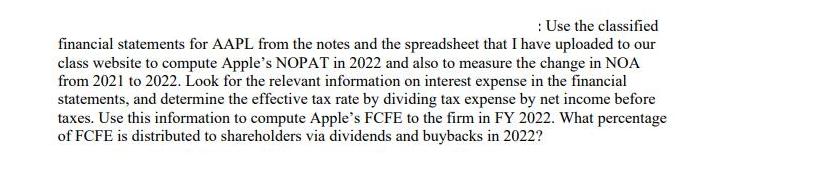

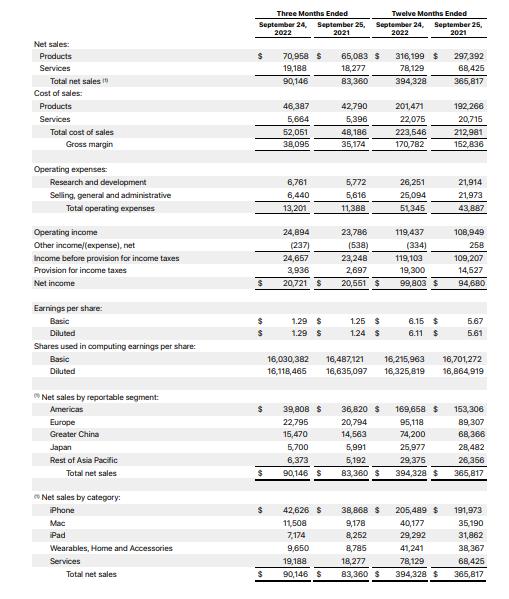

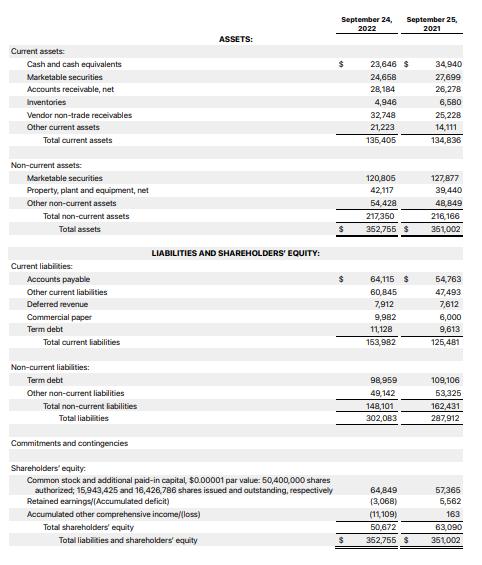

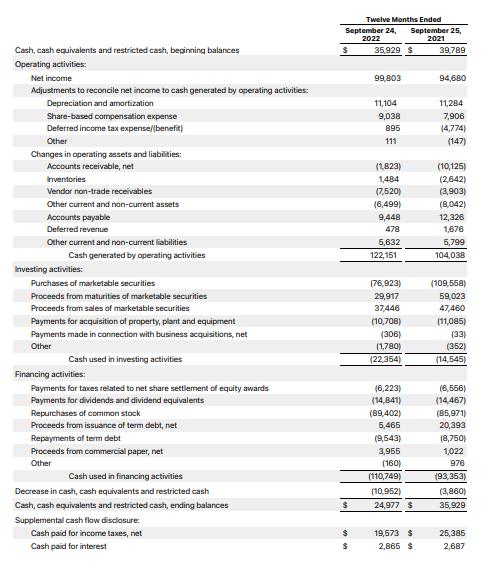

: Use the classified financial statements for AAPL from the notes and the spreadsheet that I have uploaded to our class website to compute

: Use the classified financial statements for AAPL from the notes and the spreadsheet that I have uploaded to our class website to compute Apple's NOPAT in 2022 and also to measure the change in NOA from 2021 to 2022. Look for the relevant information on interest expense in the financial statements, and determine the effective tax rate by dividing tax expense by net income before taxes. Use this information to compute Apple's FCFE to the firm in FY 2022. What percentage of FCFE is distributed to shareholders via dividends and buybacks in 2022? Net sales: Products Services Total net sales Cost of sales: Products Services Total cost of sales Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses Operating income Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Shares used in computing earnings per share: Basic Diluted Net sales by reportable segment: Americas Europe Greater China Japan Rest of Asia Pacific Total net sales Net sales by category: iPhone Mac iPad Wearables, Home and Accessories Services Total net sales Three Months Ended September 24, September 25, 2022 2021 $ 70,958 S 19,188 90,146 $ $ $ $ $ 46,387 5,664 52,051 38,095 6,761 6,440 13,201 24,894 (237) 24,667 3,936 20,721 $ 1.29 $ 1.29 $ 16,030,382 16,118,465 39,808 $ 22,795 15,470 5,700 6,373 90,146 $ 42,626 $ 11,508 7,174 9,650 19,188 90,146 $ 65,083 $ 18,277 83,360 42,790 5,396 48,186 35,174 5,772 5,616 11,388 Twelve Months Ended September 24, September 25, 2022 2021 23,786 (538) 23,248 2,697 20,551 $ 1.25 $ 1.24 $ 20,794 14,563 316,199 $ 78,129 394,328 5,991 5,192 83,360 $ 201,471 38,868 $ 9,178 8,252 8,785 18,277 83,360 $ 22,075 223,546 170,782 26,251 25,094 51,345 119,437 (334) 119,103 16,487,121 16,215,963 16,635,097 16,325,819 19,300 99,803 $ 6.15 $ 6.11 $ 95,118 74,200 25,977 29,375 394,328 $ 205,489 $ 40,177 29,292 297,392 68,425 365,817 41,241 78,129 394,328 $ 192,266 20,715 212,981 152,836 36,820 $ 169,668 $ 153,306 89,307 68,366 21,914 21,973 43,887 108,949 258 109,207 14,527 94,680 5.67 5.61 16,701,272 16,864,919 28,482 26,356 365,817 191,973 35,190 31,862 38,367 68,425 365,817 Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities Commitments and contingencies LIABILITIES AND SHAREHOLDERS' EQUITY: ASSETS: Shareholders' equity. Common stock and additional paid-in capital, $0.00001 par value: 50,400,000 shares authorized; 15,943,425 and 16,426,786 shares issued and outstanding, respectively Retained earnings/(Accumulated deficit) Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity September 24, 2022 $ 23,646 $ 24,658 28,184 4,946 32,748 21,223 135,405 120,805 42,117 54,428 217,350 352,755 $ September 25, 2021 64,115 $ 60,845 7,912 9,982 11,128 153,982 98,959 49,142 148,101 302,083 64,849 (3,068) (11,109) 50.672 352,755 $ 34,940 27,699 26,278 6,580 25,228 14,111 134,836 127,877 39,440 48,849 216,166 351,002 54,763 47,493 7,612 6,000 9,613 125,481 109,106 53,325 162,431 287,912 57,365 5,562 163 63,090 351,002 Cash, cash equivalents and restricted cash, beginning balances Operating activities: Net income Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense/(benefit) Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities Cash generated by operating activities Investing activities: Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Other Cash used in investing activities Financing activities: Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock Proceeds from issuance of term debt, net Repayments of term debt Proceeds from commercial paper, net Other Cash used in financing activities Decrease in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash, ending balances Supplemental cash flow disclosure: Cash paid for income taxes, net Cash paid for interest Twelve Months Ended September 24, September 25, 2022 2021 35,929 $ 39,789 $ $ $ $ 99,803 11,104 9,038 895 111 (1,823) 1,484 (7,520) (6,499) 9,448 478 5,632 122,151 (76,923) 29,917 37,446 (10,708) (306) (1,780) (22,354) (6,223) (14,841) (89,402) 5,465 (9,543) 3,955 (160) (110,749) (10,952) 24,977 $ 19,573 $ 2,865 $ 94,680 11,284 7,906 (4,774) (147) (10,125) (2,642) (3,903) (8,042) 12,326 1,676 5,799 104,038 (109,568) 59,023 47,460 (11,085) (33) (352) (14,545) (6,556) (14,467) (85,971) 20,393 (8,750) 1,022 976 (93,353) (3,860) 35,929 25,385 2,687

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Net Operating Profit After Tax NOPAT To compute Apples NOPAT in 2022we can use the following formula NOPAT Net income Income taxes Interest expense Fr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started