Answered step by step

Verified Expert Solution

Question

1 Approved Answer

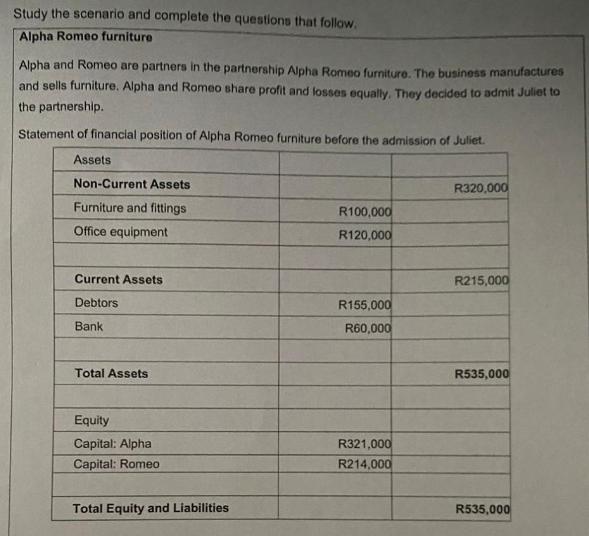

Study the scenario and complete the questions that follow. Alpha Romeo furniture Alpha and Romeo are partners in the partnership Alpha Romeo furniture. The

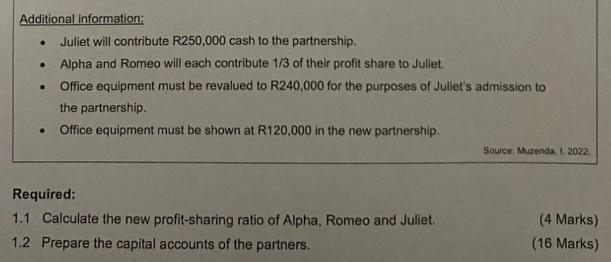

Study the scenario and complete the questions that follow. Alpha Romeo furniture Alpha and Romeo are partners in the partnership Alpha Romeo furniture. The business manufactures and sells furniture. Alpha and Romeo share profit and losses equally. They decided to admit Juliet to the partnership. Statement of financial position of Alpha Romeo furniture before the admission of Juliet. Assets Non-Current Assets Furniture and fittings Office equipment Current Assets Debtors Bank Total Assets Equity Capital: Alpha Capital: Romeo Total Equity and Liabilities R100,000 R120,000 R155,000 R60,000 R321,000 R214,000 R320,000 R215,000 R535,000 R535,000 Additional information: . Juliet will contribute R250,000 cash to the partnership. Alpha and Romeo will each contribute 1/3 of their profit share to Juliet. Office equipment must be revalued to R240,000 for the purposes of Juliet's admission to the partnership. Office equipment must be shown at R120,000 in the new partnership. . Required: 1.1 Calculate the new profit-sharing ratio of Alpha, Romeo and Juliet. 1.2 Prepare the capital accounts of the partners. Source: Muzenda, 1. 2022. (4 Marks) (16 Marks)

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

11Juliet will contribute R250000 cash to the partnership Alpha and Romeo will each contribute 13 of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started