Answered step by step

Verified Expert Solution

Question

1 Approved Answer

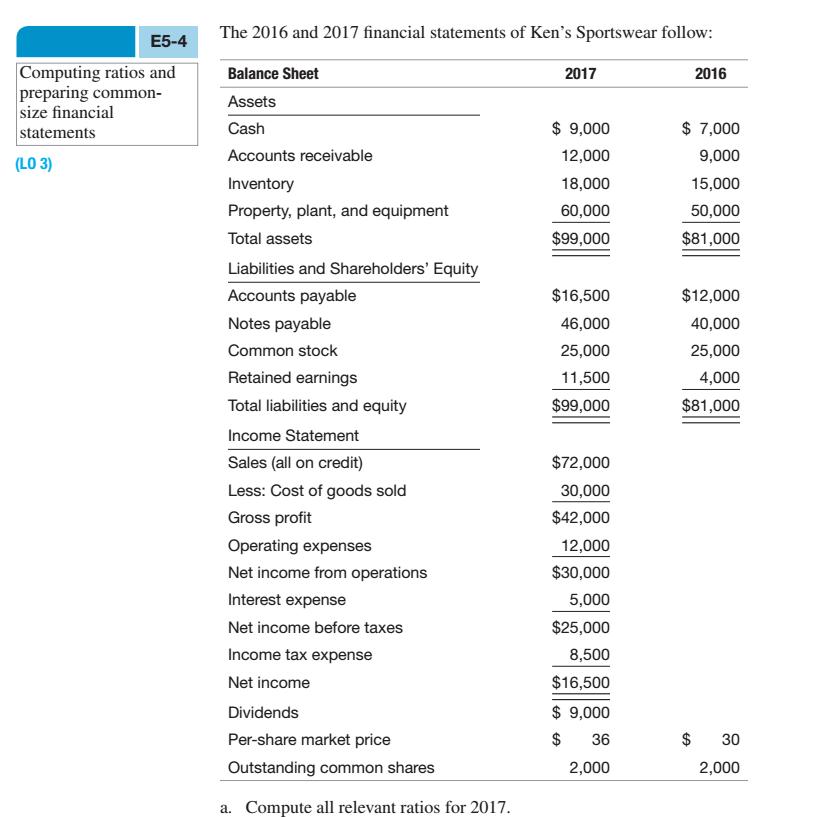

E5-4 Computing ratios and preparing common- size financial statements (LO 3) The 2016 and 2017 financial statements of Ken's Sportswear follow: Balance Sheet Assets

E5-4 Computing ratios and preparing common- size financial statements (LO 3) The 2016 and 2017 financial statements of Ken's Sportswear follow: Balance Sheet Assets Cash Accounts receivable Inventory Property, plant, and equipment Total assets Liabilities and Shareholders' Equity Accounts payable Notes payable Common stock Retained earnings Total liabilities and equity Income Statement Sales (all on credit) Less: Cost of goods sold Gross profit Operating expenses Net income from operations Interest expense Net income before taxes Income tax expense Net income Dividends Per-share market price Outstanding common shares a. Compute all relevant ratios for 2017. 2017 $ 9,000 12,000 18,000 60,000 $99,000 $16,500 46,000 25,000 11,500 $99,000 $72,000 30,000 $42,000 12,000 $30,000 5,000 $25,000 8,500 $16,500 $ 9,000 $ 36 2,000 2016 $ 7,000 9,000 15,000 50,000 $81,000 $12,000 40,000 25,000 4,000 $81,000 $ 30 2,000

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Return on Equity Return on Equity Net Income Average stockholders equity 100 Aver...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started