Answered step by step

Verified Expert Solution

Question

1 Approved Answer

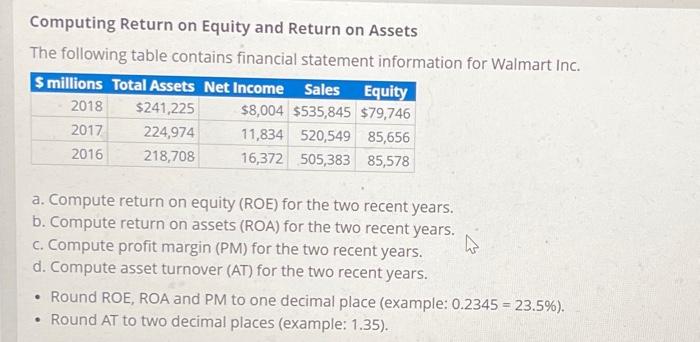

Computing Return on Equity and Return on Assets The following table contains financial statement information for Walmart Inc. $ millions Total Assets Net Income Sales

Computing Return on Equity and Return on Assets The following table contains financial statement information for Walmart Inc. $ millions Total Assets Net Income Sales Equity 2018 $241,225 $8,004 $535,845 $79,746 2017 224,974 11,834 520,549 85,656 2016 218,708 16,372 505,383 85,578 a. Compute return on equity (ROE) for the two recent years. b. Compute return on assets (ROA) for the two recent years. 4 c. Compute profit margin (PM) for the two recent years. d. Compute asset turnover (AT) for the two recent years. Round ROE, ROA and PM to one decimal place (example: 0.2345 = 23.5%). Round AT to two decimal places (example: 1.35).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started