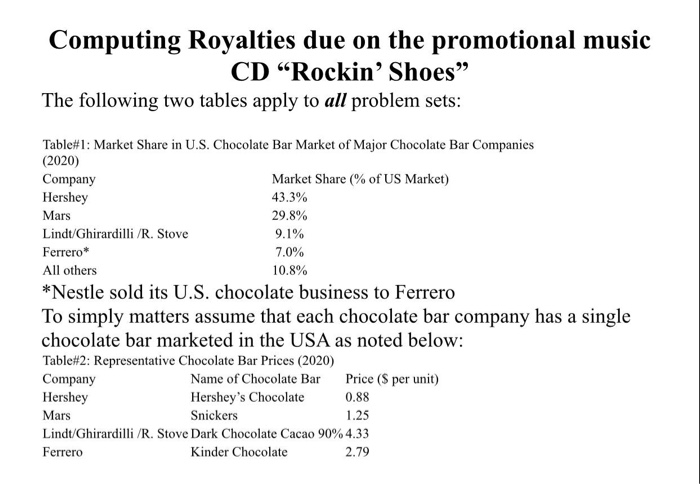

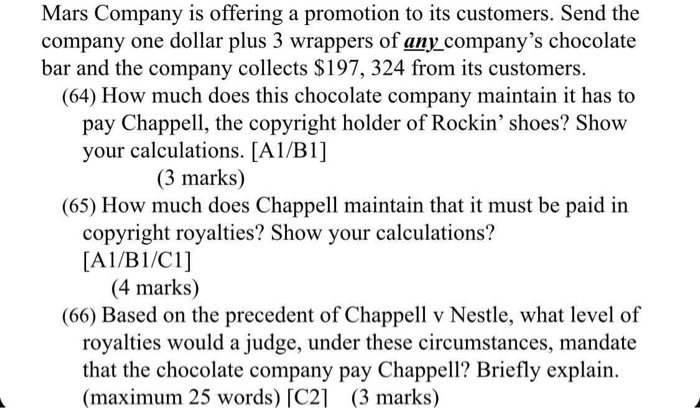

Computing Royalties due on the promotional music CD "Rockin' Shoes The following two tables apply to all problem sets: Table#1: Market Share in U.S. Chocolate Bar Market of Major Chocolate Bar Companies (2020) Company Market Share % of US Market) Hershey 43.3% Mars 29.8% Lindt/Ghirardilli /R. Stove 9.1% Ferrero* 7.0% All others 10.8% *Nestle sold its U.S. chocolate business to Ferrero To simply matters assume that each chocolate bar company has a single chocolate bar marketed in the USA as noted below: Table#2: Representative Chocolate Bar Prices (2020) Company Name of Chocolate Bar Price ($ per unit) Hershey Hershey's Chocolate 0.88 Mars Snickers 1.25 Lindt/Ghirardilli /R. Stove Dark Chocolate Cacao 90% 4.33 Ferrero Kinder Chocolate 2.79 Mars Company is offering a promotion to its customers. Send the company one dollar plus 3 wrappers of any company's chocolate bar and the company collects $197, 324 from its customers. (64) How much does this chocolate company maintain it has to pay Chappell, the copyright holder of Rockin' shoes? Show your calculations. [A1/B1] (3 marks) (65) How much does Chappell maintain that it must be paid in copyright royalties? Show your calculations? [A1/B1/C1] (4 marks) (66) Based on the precedent of Chappell v Nestle, what level of royalties would a judge, under these circumstances, mandate that the chocolate company pay Chappell? Briefly explain. (maximum 25 words) [C2] (3 marks) Computing Royalties due on the promotional music CD "Rockin' Shoes The following two tables apply to all problem sets: Table#1: Market Share in U.S. Chocolate Bar Market of Major Chocolate Bar Companies (2020) Company Market Share % of US Market) Hershey 43.3% Mars 29.8% Lindt/Ghirardilli /R. Stove 9.1% Ferrero* 7.0% All others 10.8% *Nestle sold its U.S. chocolate business to Ferrero To simply matters assume that each chocolate bar company has a single chocolate bar marketed in the USA as noted below: Table#2: Representative Chocolate Bar Prices (2020) Company Name of Chocolate Bar Price ($ per unit) Hershey Hershey's Chocolate 0.88 Mars Snickers 1.25 Lindt/Ghirardilli /R. Stove Dark Chocolate Cacao 90% 4.33 Ferrero Kinder Chocolate 2.79 Mars Company is offering a promotion to its customers. Send the company one dollar plus 3 wrappers of any company's chocolate bar and the company collects $197, 324 from its customers. (64) How much does this chocolate company maintain it has to pay Chappell, the copyright holder of Rockin' shoes? Show your calculations. [A1/B1] (3 marks) (65) How much does Chappell maintain that it must be paid in copyright royalties? Show your calculations? [A1/B1/C1] (4 marks) (66) Based on the precedent of Chappell v Nestle, what level of royalties would a judge, under these circumstances, mandate that the chocolate company pay Chappell? Briefly explain. (maximum 25 words) [C2]