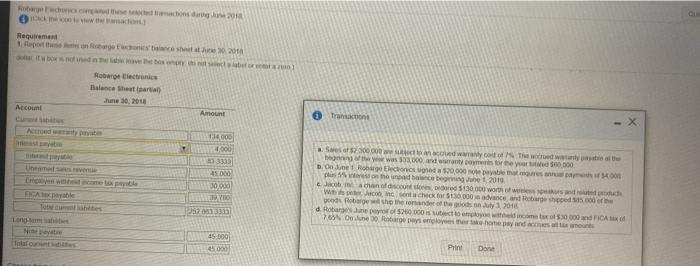

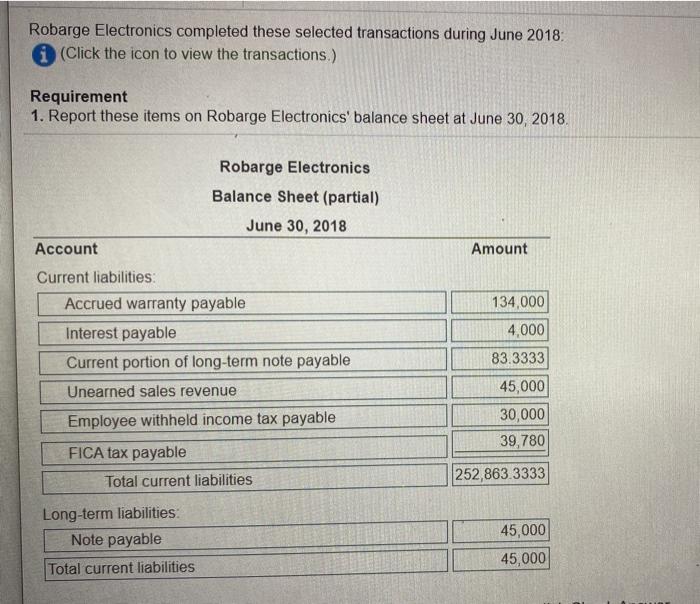

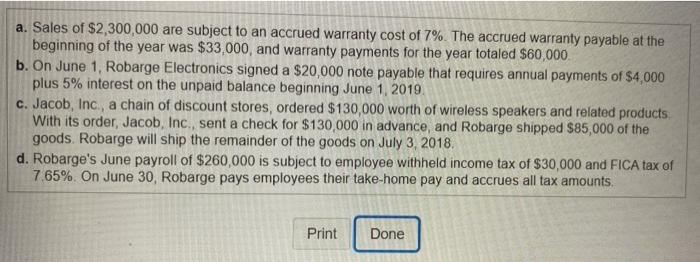

con du Hequirement Horolectronics Balance Sheet June 30, 2018 Account Amount Trani 4000 0001 CCC Sweat 300 Cod with wood way to bo was 33.000 for 500.000 Donne Renowa 0000 plus banget 2010 Jacobi lored 130.000 worth of w cinc on check for 30 000 wood Roberge with the contenul 2016 d. Rotage 520 000 como cm 30.000 and FICA 2015 June pasmo homepada 450 30,000 12 YO 1520 CAL Long 19.000 5.000 Print Done Robarge Electronics completed these selected transactions during June 2018 1 (Click the icon to view the transactions.) Requirement 1. Report these items on Robarge Electronics' balance sheet at June 30, 2018, Robarge Electronics Balance Sheet (partial) June 30, 2018 Account Amount Current liabilities: Accrued warranty payable Interest payable Current portion of long-term note payable Unearned sales revenue Employee withheld income tax payable FICA tax payable Total current liabilities 134,000 4,000 83.3333 45,000 30,000 39,780 252,863.3333 45,000 Long-term liabilities: Note payable Total current liabilities 45,000 a. Sales of $2,300,000 are subject to an accrued warranty cost of 7%. The accrued warranty payable at the beginning of the year was $33,000, and warranty payments for the year totaled $60,000 b. On June 1, Robarge Electronics signed a $20,000 note payable that requires annual payments of $4,000 plus 5% interest on the unpaid balance beginning June 1, 2019 c. Jacob, Inc., a chain of discount stores, ordered $130,000 worth of wireless speakers and related products With its order, Jacob, Inc., sent a check for $130,000 in advance, and Robarge shipped $85,000 of the goods. Robarge will ship the remainder of the goods on July 3, 2018 d. Robarge's June payroll of $260,000 is subject to employee withheld income tax of $30,000 and FICA tax of 7.65%. On June 30, Robarge pays employees their take-home pay and accrues all tax amounts Print Done con du Hequirement Horolectronics Balance Sheet June 30, 2018 Account Amount Trani 4000 0001 CCC Sweat 300 Cod with wood way to bo was 33.000 for 500.000 Donne Renowa 0000 plus banget 2010 Jacobi lored 130.000 worth of w cinc on check for 30 000 wood Roberge with the contenul 2016 d. Rotage 520 000 como cm 30.000 and FICA 2015 June pasmo homepada 450 30,000 12 YO 1520 CAL Long 19.000 5.000 Print Done Robarge Electronics completed these selected transactions during June 2018 1 (Click the icon to view the transactions.) Requirement 1. Report these items on Robarge Electronics' balance sheet at June 30, 2018, Robarge Electronics Balance Sheet (partial) June 30, 2018 Account Amount Current liabilities: Accrued warranty payable Interest payable Current portion of long-term note payable Unearned sales revenue Employee withheld income tax payable FICA tax payable Total current liabilities 134,000 4,000 83.3333 45,000 30,000 39,780 252,863.3333 45,000 Long-term liabilities: Note payable Total current liabilities 45,000 a. Sales of $2,300,000 are subject to an accrued warranty cost of 7%. The accrued warranty payable at the beginning of the year was $33,000, and warranty payments for the year totaled $60,000 b. On June 1, Robarge Electronics signed a $20,000 note payable that requires annual payments of $4,000 plus 5% interest on the unpaid balance beginning June 1, 2019 c. Jacob, Inc., a chain of discount stores, ordered $130,000 worth of wireless speakers and related products With its order, Jacob, Inc., sent a check for $130,000 in advance, and Robarge shipped $85,000 of the goods. Robarge will ship the remainder of the goods on July 3, 2018 d. Robarge's June payroll of $260,000 is subject to employee withheld income tax of $30,000 and FICA tax of 7.65%. On June 30, Robarge pays employees their take-home pay and accrues all tax amounts Print Done