Question

On June 29, 2024 the Forte Mutual Fund purchased $200,000 of 10-year Marge Maturity 4.5% bonds. The purchase price was 103 and the coupon

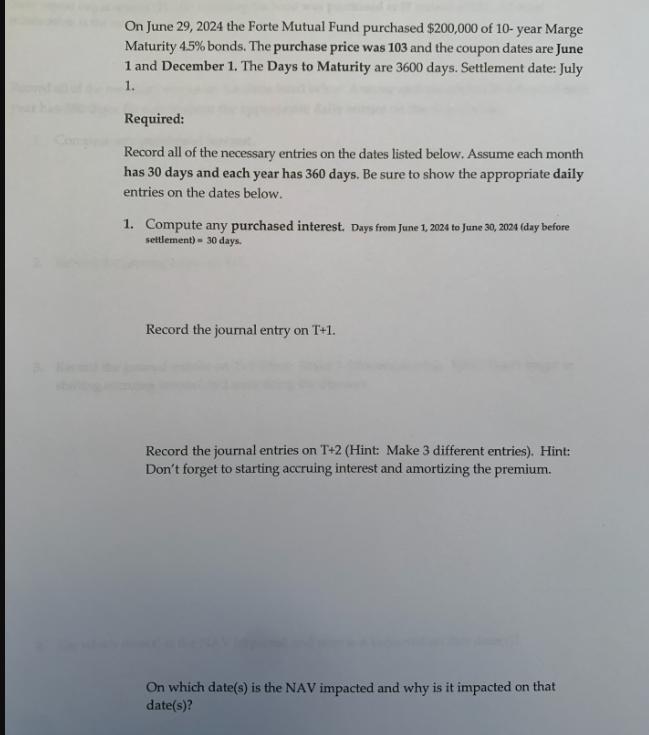

On June 29, 2024 the Forte Mutual Fund purchased $200,000 of 10-year Marge Maturity 4.5% bonds. The purchase price was 103 and the coupon dates are June 1 and December 1. The Days to Maturity are 3600 days. Settlement date: July 1. Required: Record all of the necessary entries on the dates listed below. Assume each month has 30 days and each year has 360 days. Be sure to show the appropriate daily entries on the dates below. 1. Compute any purchased interest. Days from June 1, 2024 to June 30, 2024 (day before settlement) 30 days. Record the journal entry on T+1. Record the journal entries on T+2 (Hint: Make 3 different entries). Hint: Don't forget to starting accruing interest and amortizing the premium. On which date(s) is the NAV impacted and why is it impacted on that date(s)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Debra C. Jeter, Paul Chaney

5th Edition

1118022297, 9781118214169, 9781118022290, 1118214161, 978-1118098615

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App