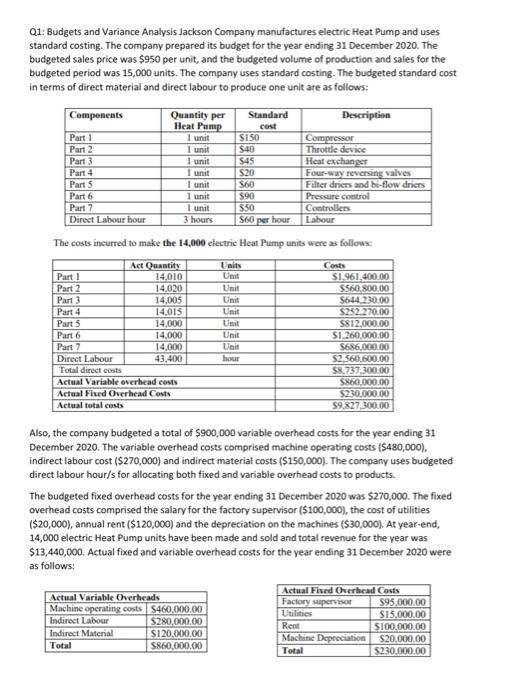

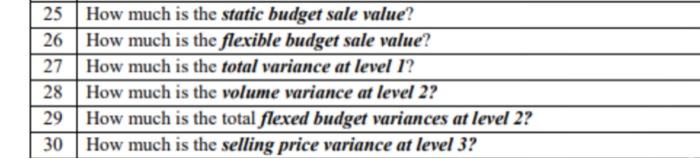

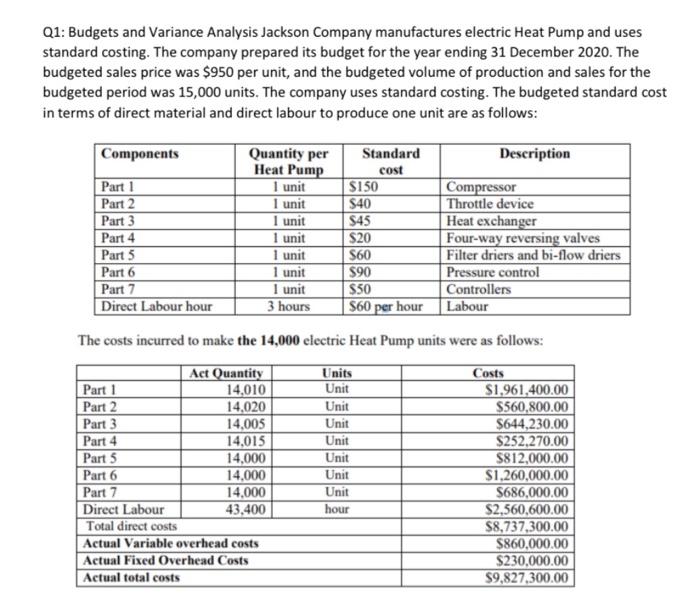

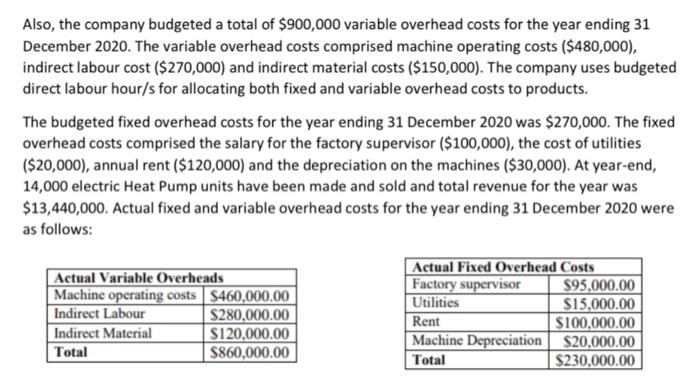

CON Q1: Budgets and Variance Analysis Jackson Company manufactures electric Heat Pump and uses standard costing. The company prepared its budget for the year ending 31 December 2020. The budgeted sales price was $950 per unit, and the budgeted volume of production and sales for the budgeted period was 15,000 units. The company uses standard costing. The budgeted standard cost in terms of direct material and direct labour to produce one unit are as follows: Components Quantity per Standard Description Heat Pump Part 1 1 unit $150 Compressor Part 2 $40 Throttle device Part 3 545 Heat exchanger Part 4 S20 Four-way reversing valves Part 5 1 unit 560 Filter dress and bi-flow driers Part 6 1 unit $90 Pressure control Part 7 1 unit $50 Controllers Direct Labour hour 3 hours S60 per hour Labour The costs incurred to make the 14,000 electric Heat Pump units were as follows: 1 unit 1 unit 1 unit Unit Unit Unit Unit Liar Act Ouantity Part 1 14,010 Part 2 14.020 Part 3 14.005 Part 4 14.015 Parts 14,000 Part 6 14,000 Part 7 14.000 Direct Labour 43.400 Total direct costs Actual Variable overhead costs Actual Fixed Overhead Costs Actual total costs Cont S1.961.400.00 S560,800.00 S644 230,00 $252.270.00 SS12.000.00 $1.260,000.00 $686.000.00 $2.560.600.00 $8.737,300.00 S860,000.00 $230.000,00 59.827300.00 Unit hour Also, the company budgeted a total of $900,000 variable overhead costs for the year ending 31 December 2020. The variable overhead costs comprised machine operating costs ($480,000). indirect labour cost ($270,000) and indirect material costs ($150,000). The company uses budgeted direct labour hour/s for allocating both fixed and variable overhead costs to products. The budgeted fixed overhead costs for the year ending 31 December 2020 was $270,000. The fixed overhead costs comprised the salary for the factory supervisor ($100,000), the cost of utilities ($20,000), annual rent ($120,000) and the depreciation on the machines ($30,000). At year-end, 14,000 electric Heat Pump units have been made and sold and total revenue for the year was $13,440,000. Actual fixed and variable overhead costs for the year ending 31 December 2020 were as follows: Actual Variable Overheads Machine operating costs $460,000.00 Indirect Labour $280,000.00 Indirect Material S120.000,00 Total S860,000.00 Actual Fired Overhead Costs Factory supervisor 595,000.00 Utilities $15.000.00 Rent S100,000.00 Machine Depreciation $20,000.00 Total $230,000.00 25 26 27 How much is the static budget sale value? How much is the flexible budget sale value? How much is the total variance at level 1? How much is the volume variance at level 2? How much is the total flexed budget variances at level 2? How much is the selling price variance at level 3? 28 29 30 Q1: Budgets and Variance Analysis Jackson Company manufactures electric Heat Pump and uses standard costing. The company prepared its budget for the year ending 31 December 2020. The budgeted sales price was $950 per unit, and the budgeted volume of production and sales for the budgeted period was 15,000 units. The company uses standard costing. The budgeted standard cost in terms of direct material and direct labour to produce one unit are as follows: Components Description Part 1 Part 2 Part 3 Part 4 Part 5 Part 6 Part 7 Direct Labour hour Quantity per Heat Pump 1 unit 1 unit 1 unit 1 unit 1 unit 1 unit 1 unit 3 hours Standard cost S150 $40 S45 S20 S60 $90 $50 $60 per hour Compressor Throttle device Heat exchanger Four-way reversing valves Filter driers and bi-flow driers Pressure control Controllers Labour The costs incurred to make the 14,000 electric Heat Pump units were as follows: Act Quantity Units Costs Part 1 14,010 Unit $1,961,400.00 Part 2 14,020 Unit $560,800.00 Part 3 14,005 Unit $644,230.00 Part 4 14,015 Unit $252,270.00 Part 5 14,000 Unit $812,000.00 Part 6 14.000 Unit $1.260,000.00 Part 7 14.000 Unit $686,000.00 Direct Labour 43,400 hour $2,560,600.00 Total direct costs $8,737,300.00 Actual Variable overhead costs $860,000.00 Actual Fixed Overhead Costs $230,000.00 Actual total costs $9,827,300.00 Also, the company budgeted a total of $900,000 variable overhead costs for the year ending 31 December 2020. The variable overhead costs comprised machine operating costs ($480,000), indirect labour cost ($270,000) and indirect material costs ($150,000). The company uses budgeted direct labour hour/s for allocating both fixed and variable overhead costs to products. The budgeted fixed overhead costs for the year ending 31 December 2020 was $270,000. The fixed overhead costs comprised the salary for the factory supervisor ($100,000), the cost of utilities ($20,000), annual rent ($120,000) and the depreciation on the machines ($30,000). At year-end, 14,000 electric Heat Pump units have been made and sold and total revenue for the year was $13,440,000. Actual fixed and variable overhead costs for the year ending 31 December 2020 were as follows: Actual Variable Overheads Machine operating costs $460,000.00 Indirect Labour $280,000.00 Indirect Material $120,000.00 Total $860,000.00 Actual Fixed Overhead Costs Factory supervisor $95,000.00 Utilities $15,000.00 Rent $100,000.00 Machine Depreciation $20,000.00 Total $230,000.00 CON Q1: Budgets and Variance Analysis Jackson Company manufactures electric Heat Pump and uses standard costing. The company prepared its budget for the year ending 31 December 2020. The budgeted sales price was $950 per unit, and the budgeted volume of production and sales for the budgeted period was 15,000 units. The company uses standard costing. The budgeted standard cost in terms of direct material and direct labour to produce one unit are as follows: Components Quantity per Standard Description Heat Pump Part 1 1 unit $150 Compressor Part 2 $40 Throttle device Part 3 545 Heat exchanger Part 4 S20 Four-way reversing valves Part 5 1 unit 560 Filter dress and bi-flow driers Part 6 1 unit $90 Pressure control Part 7 1 unit $50 Controllers Direct Labour hour 3 hours S60 per hour Labour The costs incurred to make the 14,000 electric Heat Pump units were as follows: 1 unit 1 unit 1 unit Unit Unit Unit Unit Liar Act Ouantity Part 1 14,010 Part 2 14.020 Part 3 14.005 Part 4 14.015 Parts 14,000 Part 6 14,000 Part 7 14.000 Direct Labour 43.400 Total direct costs Actual Variable overhead costs Actual Fixed Overhead Costs Actual total costs Cont S1.961.400.00 S560,800.00 S644 230,00 $252.270.00 SS12.000.00 $1.260,000.00 $686.000.00 $2.560.600.00 $8.737,300.00 S860,000.00 $230.000,00 59.827300.00 Unit hour Also, the company budgeted a total of $900,000 variable overhead costs for the year ending 31 December 2020. The variable overhead costs comprised machine operating costs ($480,000). indirect labour cost ($270,000) and indirect material costs ($150,000). The company uses budgeted direct labour hour/s for allocating both fixed and variable overhead costs to products. The budgeted fixed overhead costs for the year ending 31 December 2020 was $270,000. The fixed overhead costs comprised the salary for the factory supervisor ($100,000), the cost of utilities ($20,000), annual rent ($120,000) and the depreciation on the machines ($30,000). At year-end, 14,000 electric Heat Pump units have been made and sold and total revenue for the year was $13,440,000. Actual fixed and variable overhead costs for the year ending 31 December 2020 were as follows: Actual Variable Overheads Machine operating costs $460,000.00 Indirect Labour $280,000.00 Indirect Material S120.000,00 Total S860,000.00 Actual Fired Overhead Costs Factory supervisor 595,000.00 Utilities $15.000.00 Rent S100,000.00 Machine Depreciation $20,000.00 Total $230,000.00 25 26 27 How much is the static budget sale value? How much is the flexible budget sale value? How much is the total variance at level 1? How much is the volume variance at level 2? How much is the total flexed budget variances at level 2? How much is the selling price variance at level 3? 28 29 30 Q1: Budgets and Variance Analysis Jackson Company manufactures electric Heat Pump and uses standard costing. The company prepared its budget for the year ending 31 December 2020. The budgeted sales price was $950 per unit, and the budgeted volume of production and sales for the budgeted period was 15,000 units. The company uses standard costing. The budgeted standard cost in terms of direct material and direct labour to produce one unit are as follows: Components Description Part 1 Part 2 Part 3 Part 4 Part 5 Part 6 Part 7 Direct Labour hour Quantity per Heat Pump 1 unit 1 unit 1 unit 1 unit 1 unit 1 unit 1 unit 3 hours Standard cost S150 $40 S45 S20 S60 $90 $50 $60 per hour Compressor Throttle device Heat exchanger Four-way reversing valves Filter driers and bi-flow driers Pressure control Controllers Labour The costs incurred to make the 14,000 electric Heat Pump units were as follows: Act Quantity Units Costs Part 1 14,010 Unit $1,961,400.00 Part 2 14,020 Unit $560,800.00 Part 3 14,005 Unit $644,230.00 Part 4 14,015 Unit $252,270.00 Part 5 14,000 Unit $812,000.00 Part 6 14.000 Unit $1.260,000.00 Part 7 14.000 Unit $686,000.00 Direct Labour 43,400 hour $2,560,600.00 Total direct costs $8,737,300.00 Actual Variable overhead costs $860,000.00 Actual Fixed Overhead Costs $230,000.00 Actual total costs $9,827,300.00 Also, the company budgeted a total of $900,000 variable overhead costs for the year ending 31 December 2020. The variable overhead costs comprised machine operating costs ($480,000), indirect labour cost ($270,000) and indirect material costs ($150,000). The company uses budgeted direct labour hour/s for allocating both fixed and variable overhead costs to products. The budgeted fixed overhead costs for the year ending 31 December 2020 was $270,000. The fixed overhead costs comprised the salary for the factory supervisor ($100,000), the cost of utilities ($20,000), annual rent ($120,000) and the depreciation on the machines ($30,000). At year-end, 14,000 electric Heat Pump units have been made and sold and total revenue for the year was $13,440,000. Actual fixed and variable overhead costs for the year ending 31 December 2020 were as follows: Actual Variable Overheads Machine operating costs $460,000.00 Indirect Labour $280,000.00 Indirect Material $120,000.00 Total $860,000.00 Actual Fixed Overhead Costs Factory supervisor $95,000.00 Utilities $15,000.00 Rent $100,000.00 Machine Depreciation $20,000.00 Total $230,000.00