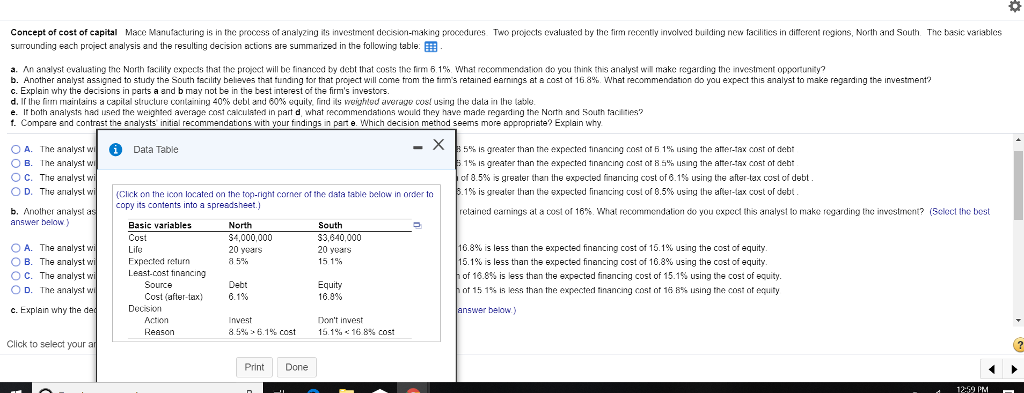

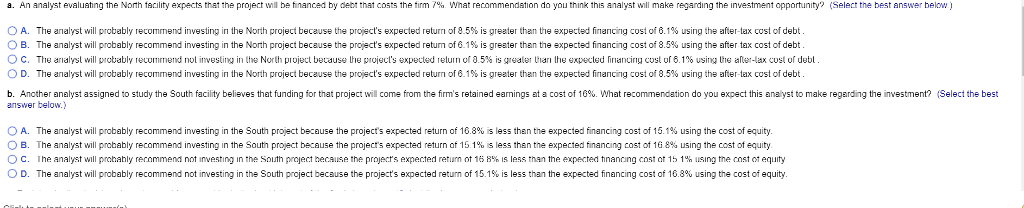

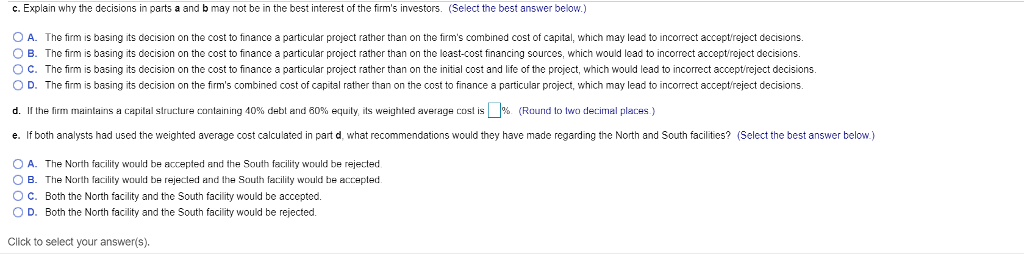

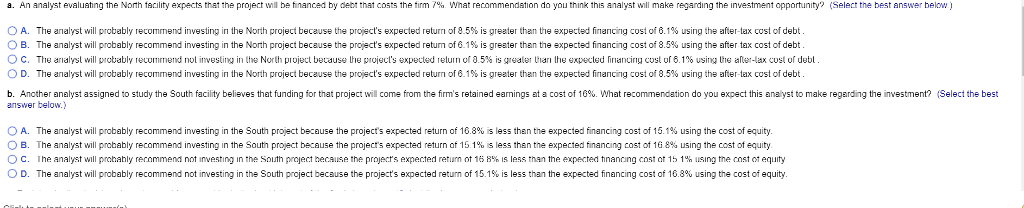

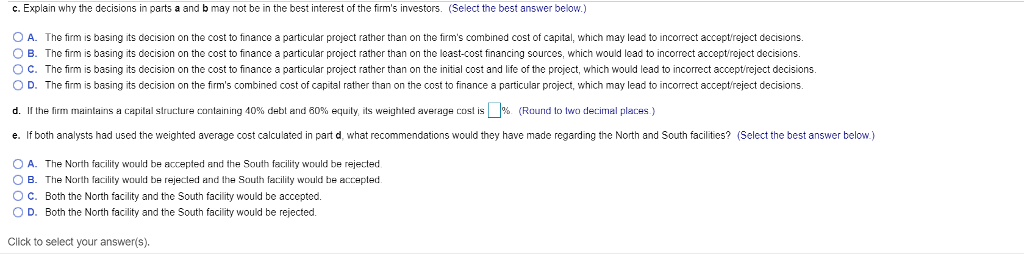

Concept of cost of capital Macc Manufacturing is in the proccss of analyzing its investment decision-making procedures Two projects valuated by the firm recently invlved building new facilitics in diferent regions, Norh and South Tc basic variables surrounding each project analysis and the resulting decision actions are summarized in the following table: E! a. An analyst evaluating the North facility expects lhal lhe pro ct will be financed by debt that costs the m 6 1% Wha commendation do you lhink the analyst wil make garding the n estment opportunity? b. Another anah st assigned to study the South tecil y be eves that tunding tor tinat pro ect will come om he ti s retained earnings at a cost o 1 8% Wha recommendation do ou ex ect this analys to make regarding the investment c. Explain why the decisions in parts a and b may not be in the best interest of the firm's investors d. ir lhe firm rmainlains capital structure u nlarling 40% debl and 60% equity find is ve hted averag cos! usrig lhB dala lhB labe. e. It both analysts had used tne weighted average rst caculated in part d, what recommendations would they have made regarding the Narth and South tac t. Compare and contrast the analyst nitial recommendations witn your t dings n -e. Which decson metod seems more ppropriate? Explain why O A. The analyst w Data Table B. Tne analyst w O C. The analyst w O D. The analyst w b, Another analysta answer below 5% is greater than the expected tinancing cost of 6 1 % using the atter-tax cost of debt 1%)s greater than the expected tinancing cost t 8 5% using the atte-tax cost of debt of 8.5% is greater than the expected financing cost of 6.1% using the fter-tax cost of debt 1% is greater than the expected financing cost of 8.5% using the after-tax cost of debt retained carnings at a cost of 16% What recommondation do you expect this analyst to makc regarding the investment? Select the best (Clkk on the icon located on the top-right corner of the data table belaw in order to copy its contents into a spreedsheet. Basic variables North S4,000,000 20 years 85% South S3,640,000 20 years 15 1% Cost A. O B. C. O D. The analyst w The analyst w The analyst w The analyst w 6.8% is less tan th expected financing cost of 15.1% using the cost of equity 5.1% is less tan th. expected financing cost of 16.8% using the cost of equity of 16.8% is less than the expected financing cost of 15.1% using the cost of equity nt 15 1% is ie58 than the expected financing cnst nt les 856 using the cost of equity nswer belowy Expected return Least-cost tinancing Source Cost (after-tax) Oser 6.1% 16.8% D c. Explain why the d Action Reason on't inwest 85%-61% cost 15.1% 168% cost Click to select your a PrintDone a. An analyst evaluating he North tac t ex ects that the pr t w l be hnanced by debt tha costs the rm % w at recommendation do you think this analyst will make re arding the investment opportunit ? Select the best answer bei A. The analyst will pro ably recor O B e d inves ng the Norih project because the pro ct's expected et r of 8 5% s greeter than he expected nong cost of 1% us g he after ax collie The analyst will probably recommend investing in the North project because the pro ect s expected return o 6.1 C. The ari ysl will probably re un rnen nol r esl ng in the North pl lect because IB olec s expected 'elum 5 is realet han lhe expect d nanuru cost o 6.1 using 16 al -la cos of debl D he analyst wil probably recommen investing n he North project because the pro ect's expected retur ofe 1% s greater than expected a n costo, 5% using he after ax colt at Is greater than e expected financng cost of 8.5% using th-after tax cost of debt b. Another analyst assigned to stu y the Southfacity be e es that funingfor answer below.) at project wil me om the fr 's reanede mingseta costot 10% what re o men ond you expect hisa ays tomaker ger ing themes ment? ei thebest A O The analyst wil probably recommend investing in he South pr The analyst will probably recommend investing in the South pro ect because the projects expected return of 15.1% s less than the expected financing cost o ect because the proects expected eturn o 16.8% s ess than the expected financing cost o 1 1% using 16 8 he cost o equity. using the cost o equity ne analyst will preta ly recommend not nvesting in tre som niect b M e me pr ers expected etum ot 15 8% is less man me e pected t nanong cost ot 15 1% using me coster-oury The analyst will probably recommend no esting in the South project because he project's expected e m o 15.1% s less than the expected financing cost of-3% sing the costo e u . D. c. Explain why the decisions in parts a and b may not be in the best interest of the firm's investors. (Select the best answer below.) OA. The firm is basing its decision on the cost to finance a particular project rather than on the firm's combined cost of capital, which may lead to incorrect acceptreject decisions O B. The firm is basing its decision on the cost to financc a particular project rather than on the least-cost financing sources, which would load to incorrect accept/rejoct decisions. O C. The firm is basing its decision on the cost to finance a particular project rather than on the initial cost and life of the project, which would lead to incorrect acceptireject decisions. D The rm is basing its decision on the rm's combined cost o capital rather han on he cost finance a particular pro ec which may lead incorrect accept elect decisi ns. d. If the firm mantans n capital structure contain ng 40% debt and 60% equity its weighted average cost is % Round to two decimal places e. If both analysts had used the weighted average cost calculated in part d, what recommendations would they have made regarding the North and South facilities? (Select the best answer below.) O A. The North facility would be accepted and the South facility would be rejected O B. The Northacilty would be rejected and the South facility would be accepted O C. Both the North facility and the South facility would be accepted. O D. Both the North faility and the South facility would be rejected. Click to select your answer(s)