Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Concept of registration, What is taxable supply? What is input tax? Positive and negative lens. what is GST-free? what is fringe benefit? who pays

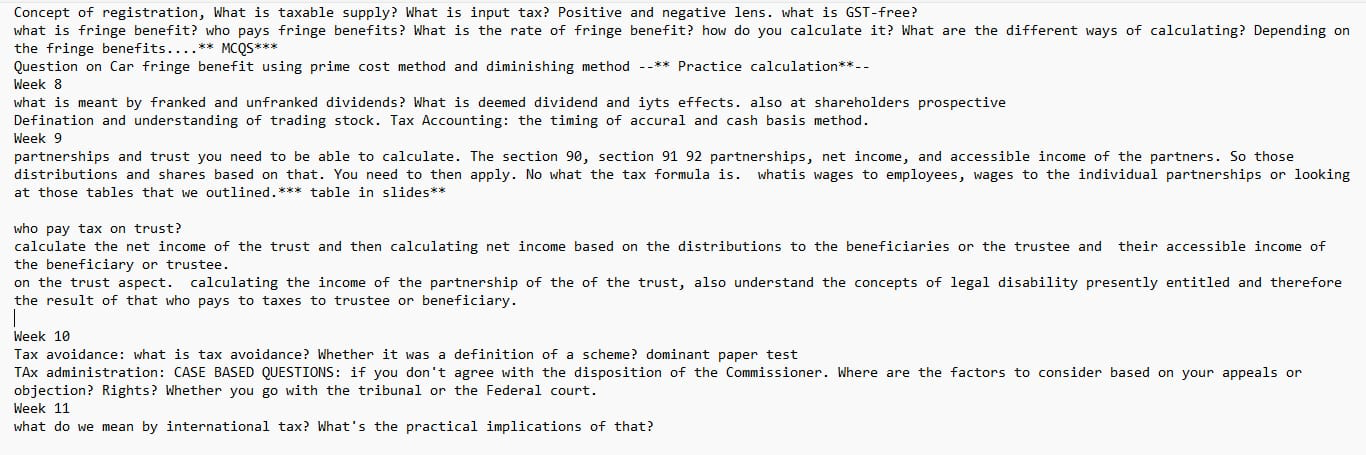

Concept of registration, What is taxable supply? What is input tax? Positive and negative lens. what is GST-free? what is fringe benefit? who pays fringe benefits? What is the rate of fringe benefit? how do you calculate it? What are the different ways of calculating? Depending on the fringe benefits....** MCQS*** Question on Car fringe benefit using prime cost method and diminishing method --** Practice calculation**-- Week 8 what is meant by franked and unfranked dividends? What is deemed dividend and iyts effects. also at shareholders prospective Defination and understanding of trading stock. Tax Accounting: the timing of accural and cash basis method. Week 9 partnerships and trust you need to be able to calculate. The section 90, section 91 92 partnerships, net income, and accessible income of the partners. So those distributions and shares based on that. You need to then apply. No what the tax formula is. whatis wages to employees, wages to the individual partnerships or looking at those tables that we outlined.*** table in slides** who pay tax on trust? calculate the net income of the trust and then calculating net income based on the distributions to the beneficiaries or the trustee and their accessible income of the beneficiary or trustee. on the trust aspect. calculating the income of the partnership of the of the trust, also understand the concepts of legal disability presently entitled and therefore the result of that who pays to taxes to trustee or beneficiary. Week 10 Tax avoidance: what is tax avoidance? Whether it was a definition of a scheme? dominant paper test Tax administration: CASE BASED QUESTIONS: if you don't agree with the disposition of the Commissioner. Where are the factors to consider based on your appeals or objection? Rights? Whether you go with the tribunal or the Federal court. Week 11 what do we mean by international tax? What's the practical implications of that?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started