Answered step by step

Verified Expert Solution

Question

1 Approved Answer

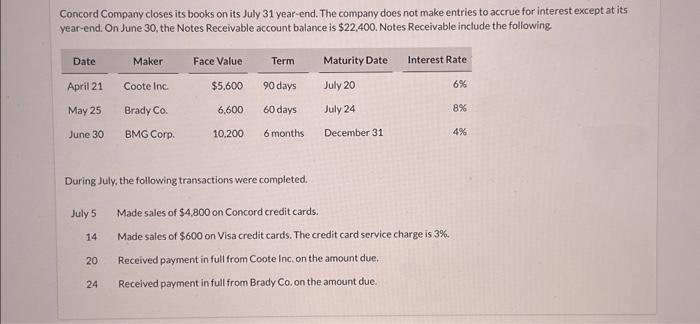

Concord Company closes its books on its July 31 year-end. The company does not make entries to accrue for interest except at its year-end. On

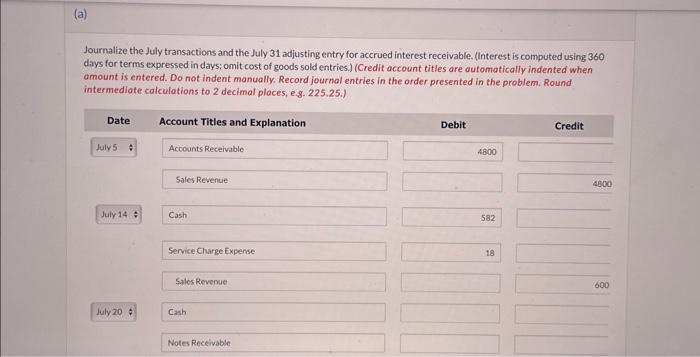

Concord Company closes its books on its July 31 year-end. The company does not make entries to accrue for interest except at its year-end. On June 30, the Notes Receivable account balance is $22,400. Notes Receivable include the following. Date April 21 May 25 June 30 July 5 14 20 Maker 24 Coote Inc. Brady Co. BMG Corp. Face Value $5,600 6,600 During July, the following transactions were completed. 10,200 Term 90 days 60 days 6 months Maturity Date July 20 July 24 December 31 Interest Rate Made sales of $4,800 on Concord credit cards. Made sales of $600 on Visa credit cards. The credit card service charge is 3%. Received payment in full from Coote Inc. on the amount due. Received payment in full from Brady Co. on the amount due. 6% 8% 4%

please help with all parts, i tried part a but i keep getting stuck. THANK YOU SO MUCH!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started