Question

Concord Company issued $6,400,000 of 6%, 10-year bonds on January 1, 2020, for $5,760,000 to yield an effective annual rate of 9%. The effective-interest

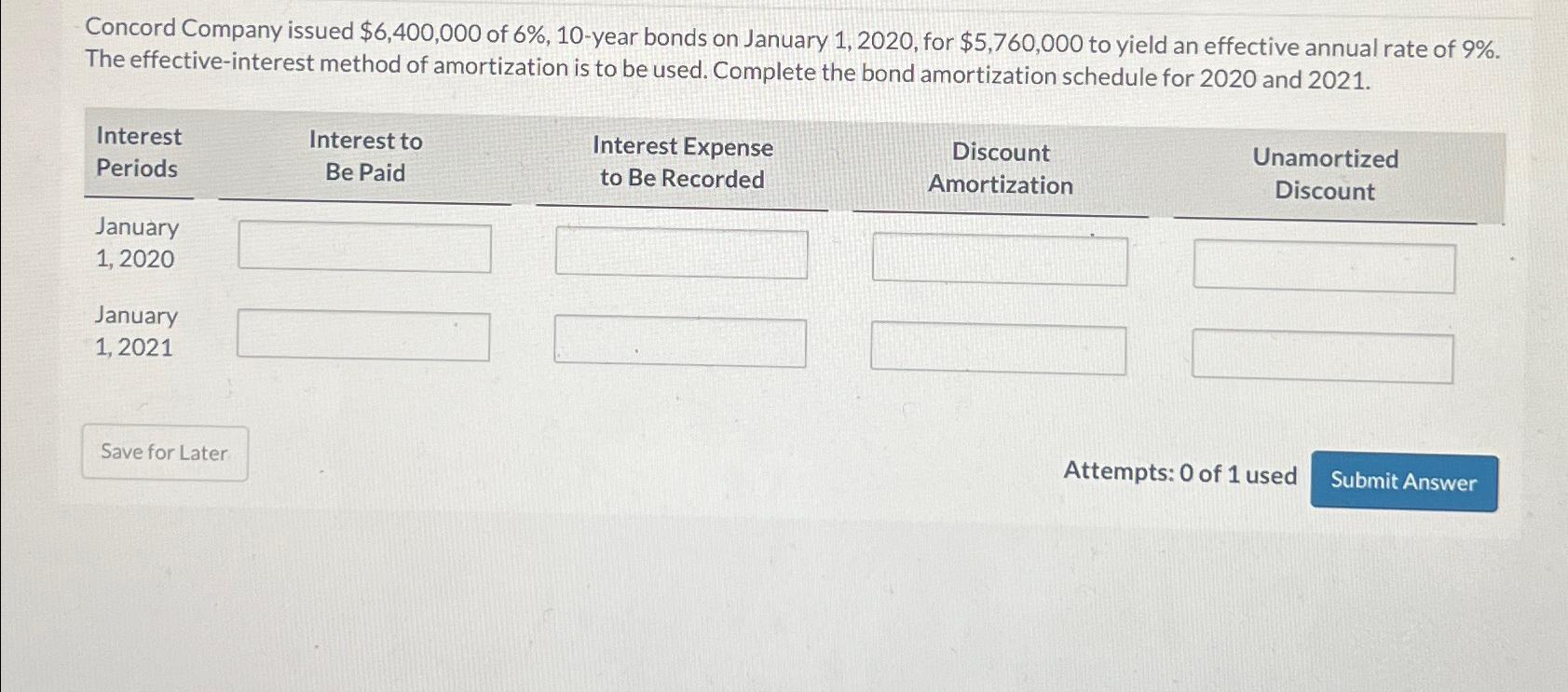

Concord Company issued $6,400,000 of 6%, 10-year bonds on January 1, 2020, for $5,760,000 to yield an effective annual rate of 9%. The effective-interest method of amortization is to be used. Complete the bond amortization schedule for 2020 and 2021. Interest Periods January 1, 2020 January 1, 2021 Save for Later Interest to Be Paid Interest Expense to Be Recorded Discount Amortization Unamortized Discount Attempts: 0 of 1 used Submit Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the bond amortization schedule for 2020 and 2021 well need to calculate the interest exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

3rd edition

1119372933, 978-1119372936

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App