Answered step by step

Verified Expert Solution

Question

1 Approved Answer

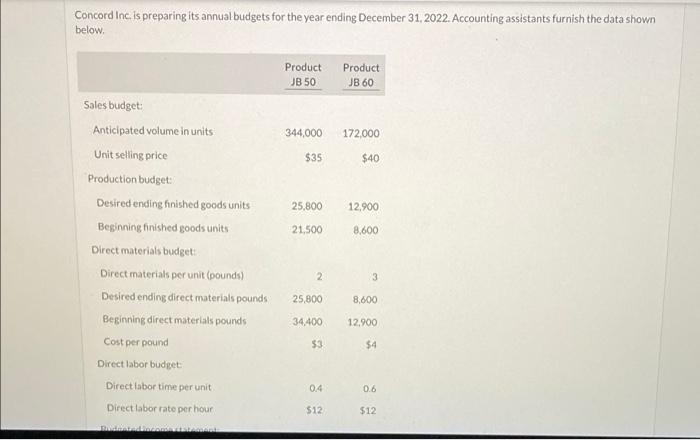

Concord Inc. is preparing its annual budgets for the year ending December 31, 2022. Accounting assistants furnish the data shown below. Product JB 50

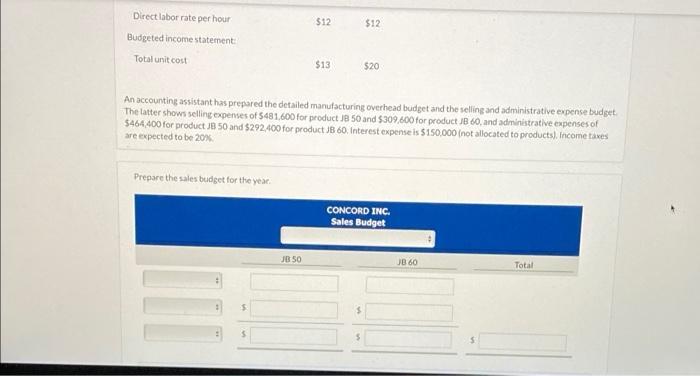

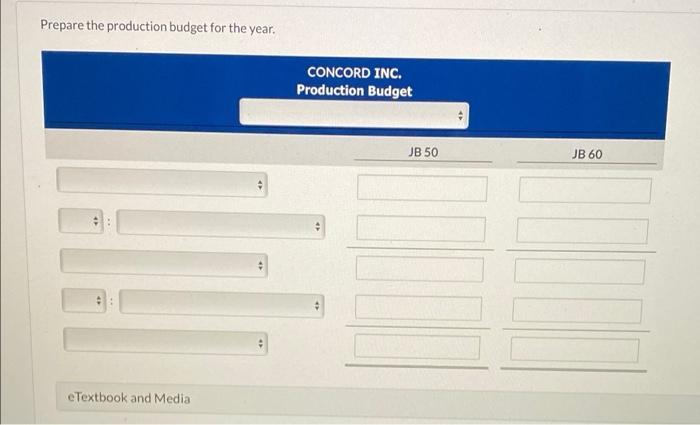

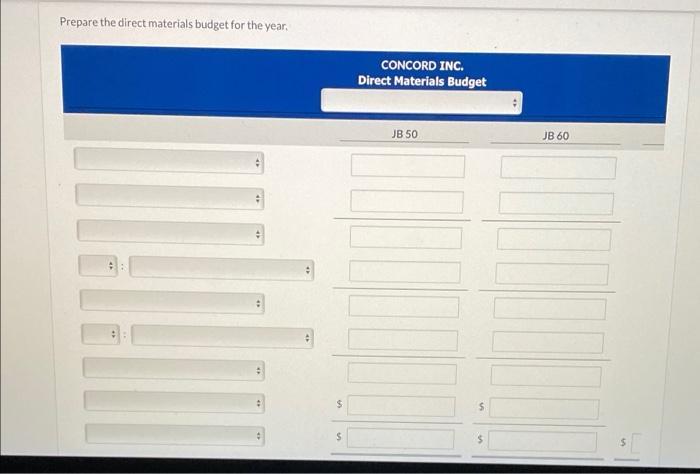

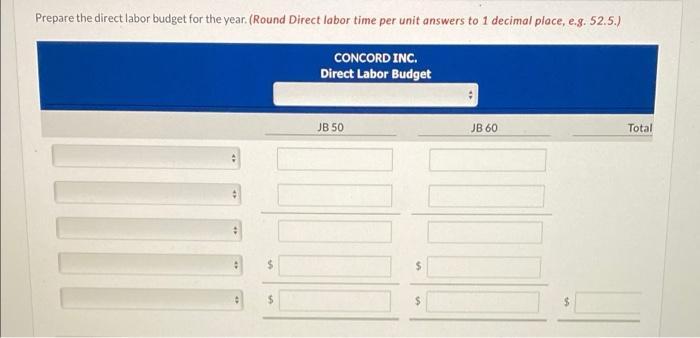

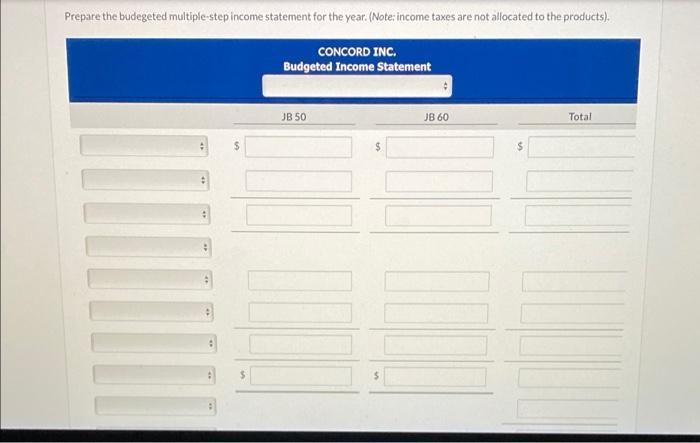

Concord Inc. is preparing its annual budgets for the year ending December 31, 2022. Accounting assistants furnish the data shown below. Product JB 50 Product JB 60 Sales budget: Anticipated volume in units 344,000 172,000 Unit selling price $35 $40 Production budget: Desired ending finished goods units 25,800 Beginning finished goods units 21,500 Direct materials budget: Direct materials per unit (pounds) 2 Desired ending direct materials pounds 25,800 Beginning direct materials pounds 34,400 Cost per pound $3 Direct labor budget Direct labor time per unit 04 Direct labor rate per hour $12 12,900 8,600 3 8,600 12,900 $4 0.6 $12 Direct labor rate per hour $12 $12 Budgeted income statement: Total unit cost $13 $20 An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget. The latter shows selling expenses of $481,600 for product JB 50 and $309,600 for product JB 60, and administrative expenses of $464,400 for product JB 50 and $292,400 for product JB 60. Interest expense is $150,000 (not allocated to products). Income taxes are expected to be 20% Prepare the sales budget for the year. CONCORD INC. Sales Budget Total $ JB 50 JB 60 Prepare the production budget for the year. eTextbook and Media CONCORD INC. Production Budget JB 50 JB 60 CAD Prepare the direct materials budget for the year. $ $ CONCORD INC. Direct Materials Budget JB 50 $ JB 60 $ Prepare the direct labor budget for the year. (Round Direct labor time per unit answers to 1 decimal place, e.g. 52.5.) CONCORD INC. Direct Labor Budget JB 50 JB 60 Total $ $ Prepare the budegeted multiple-step income statement for the year. (Note: income taxes are not allocated to the products). CONCORD INC. Budgeted Income Statement JB 50 Total $ $ JB 60 eTextbook and Media $

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Sales Budget For the year ending Dec 31 2022 JB 50 JB 60 Expected unit sales 344000 1720...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started