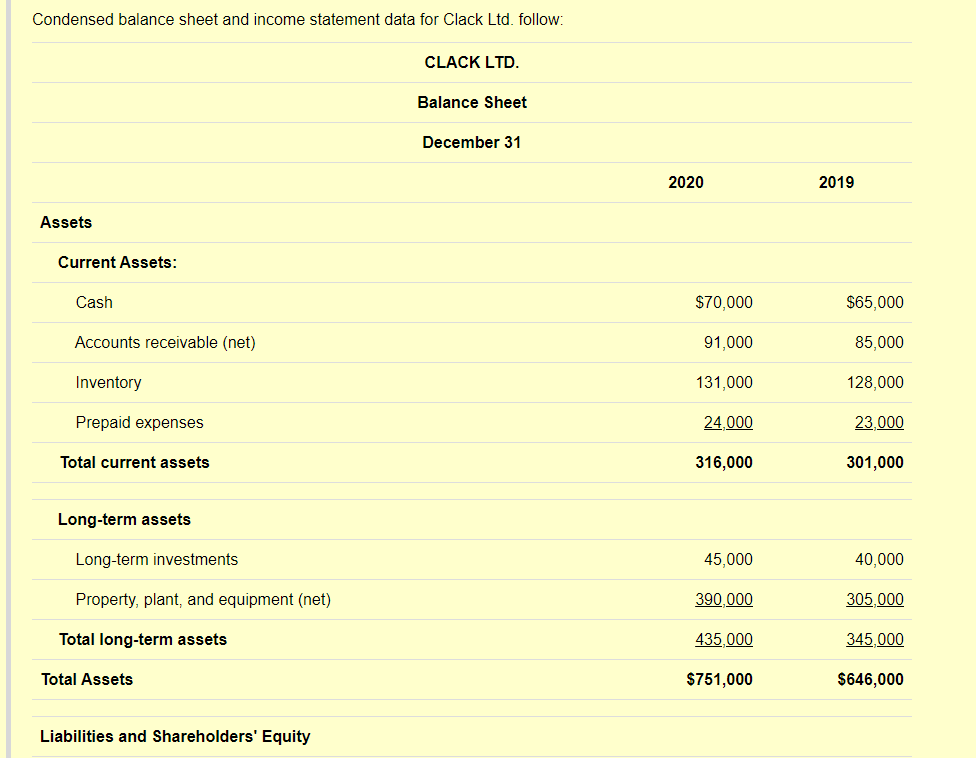

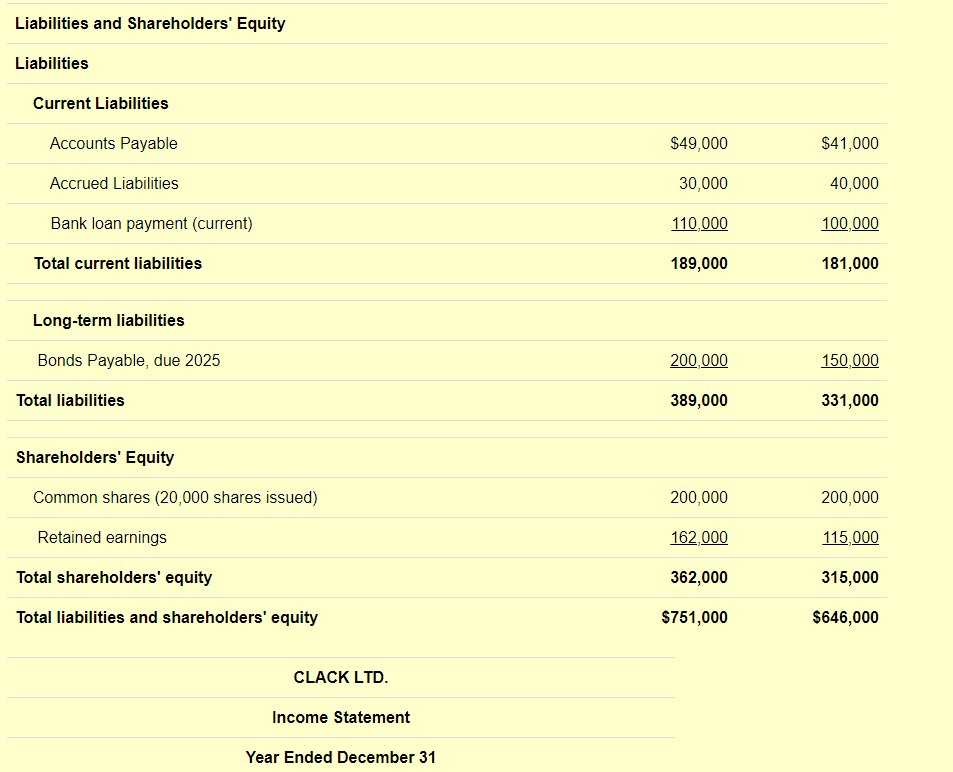

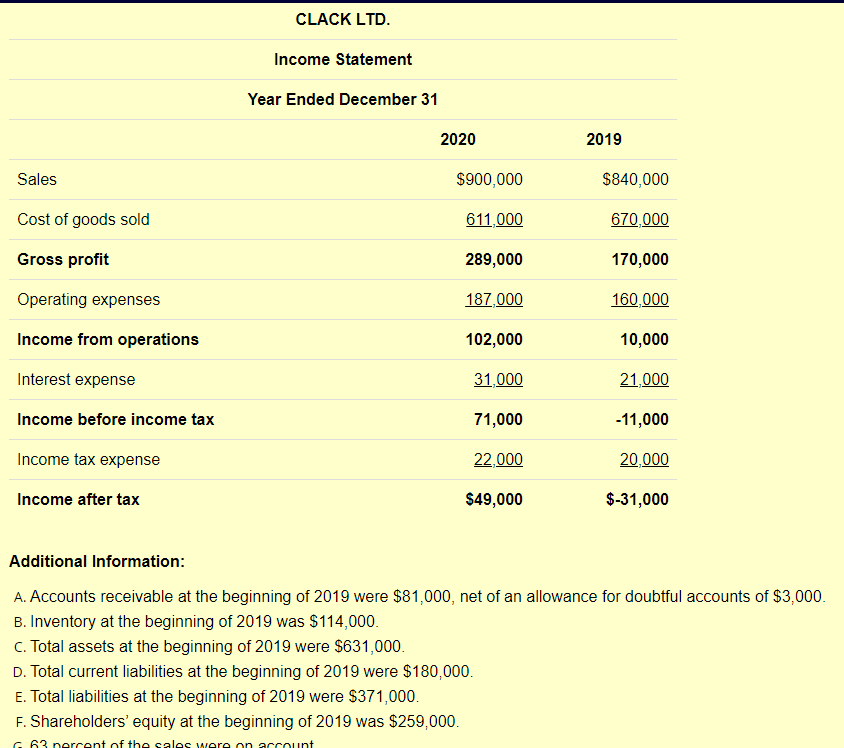

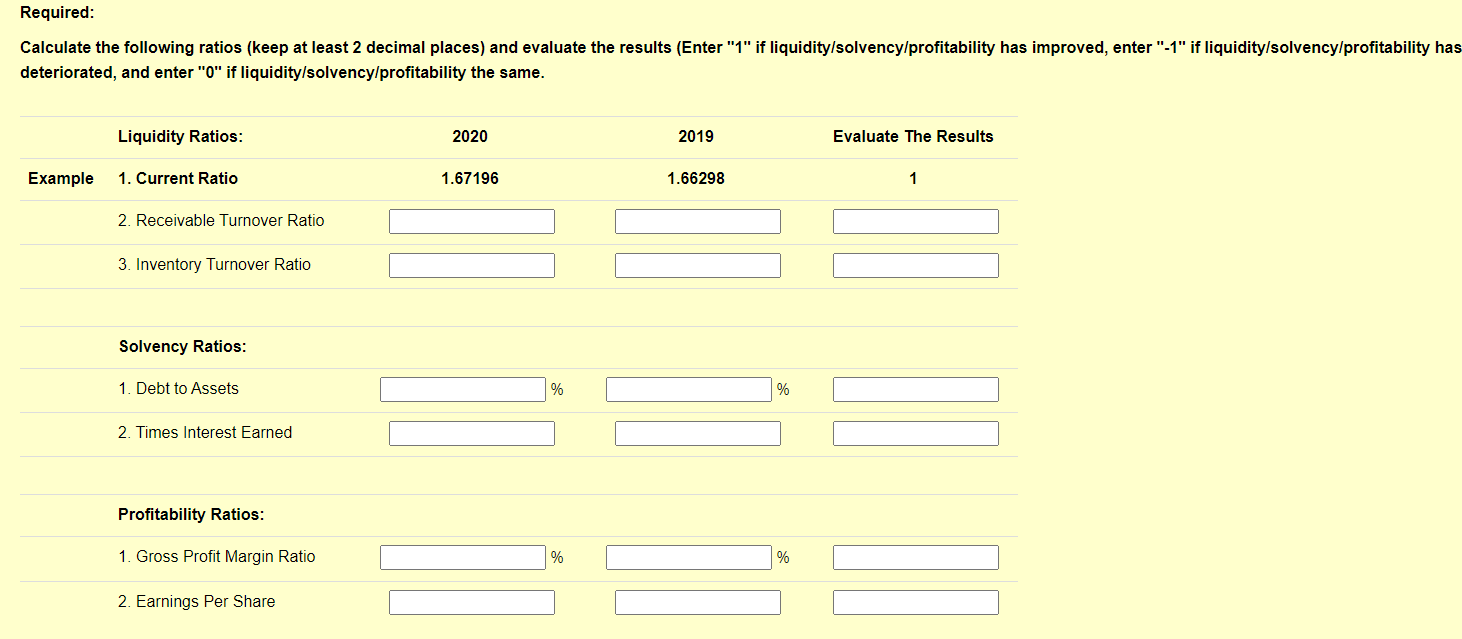

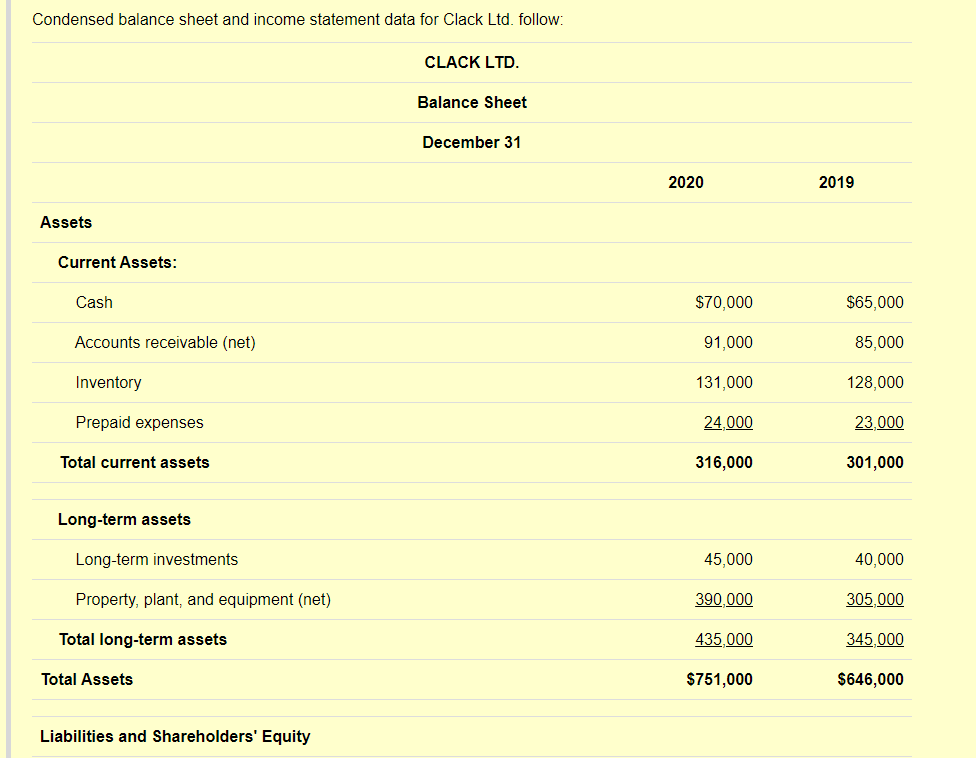

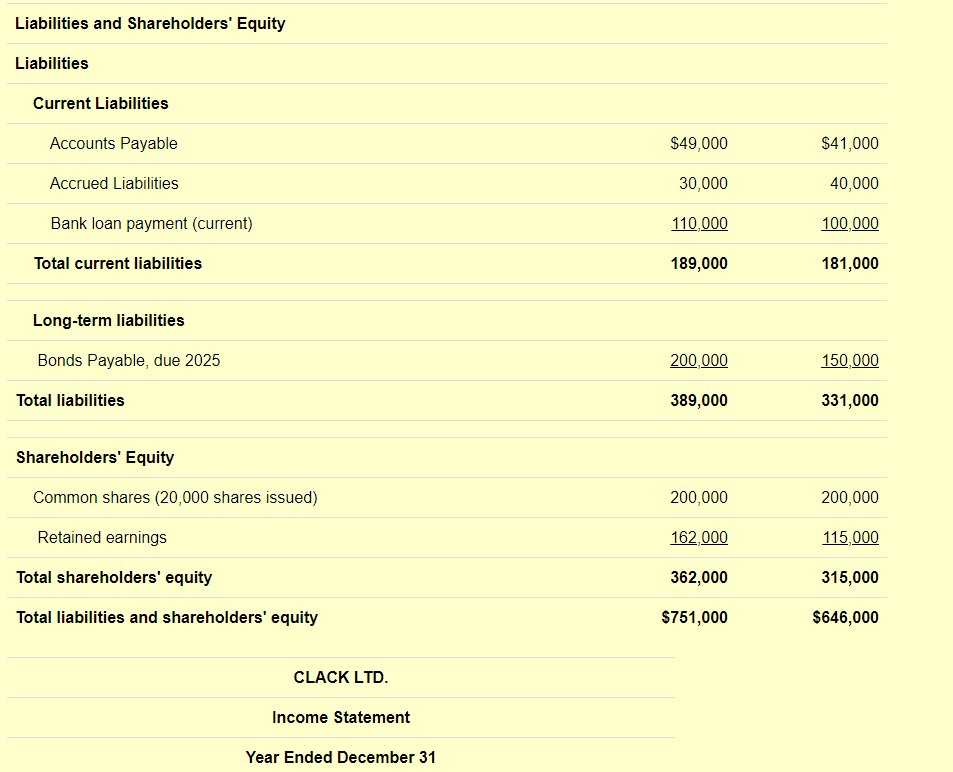

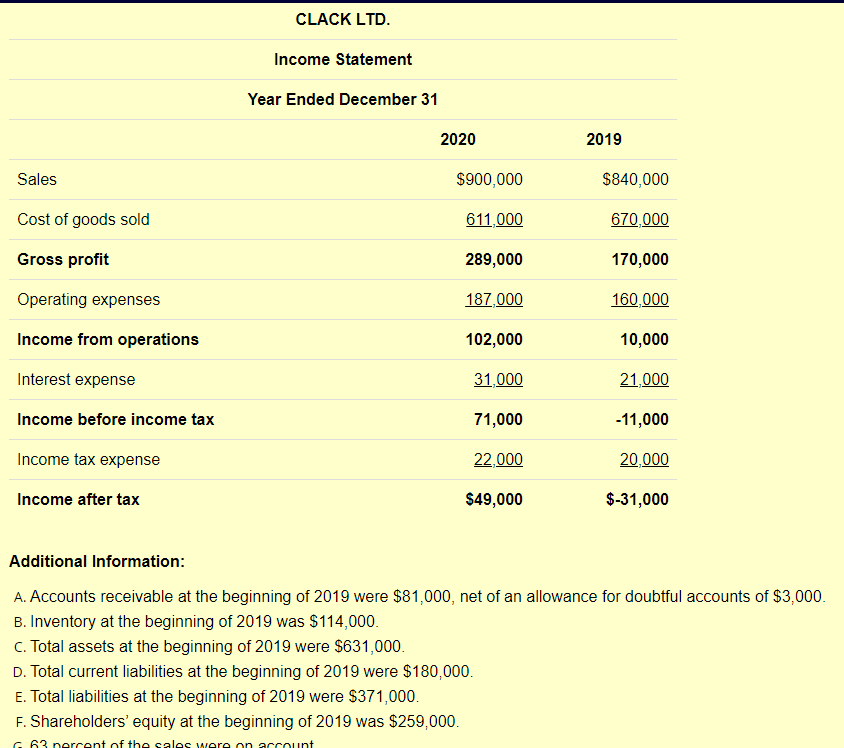

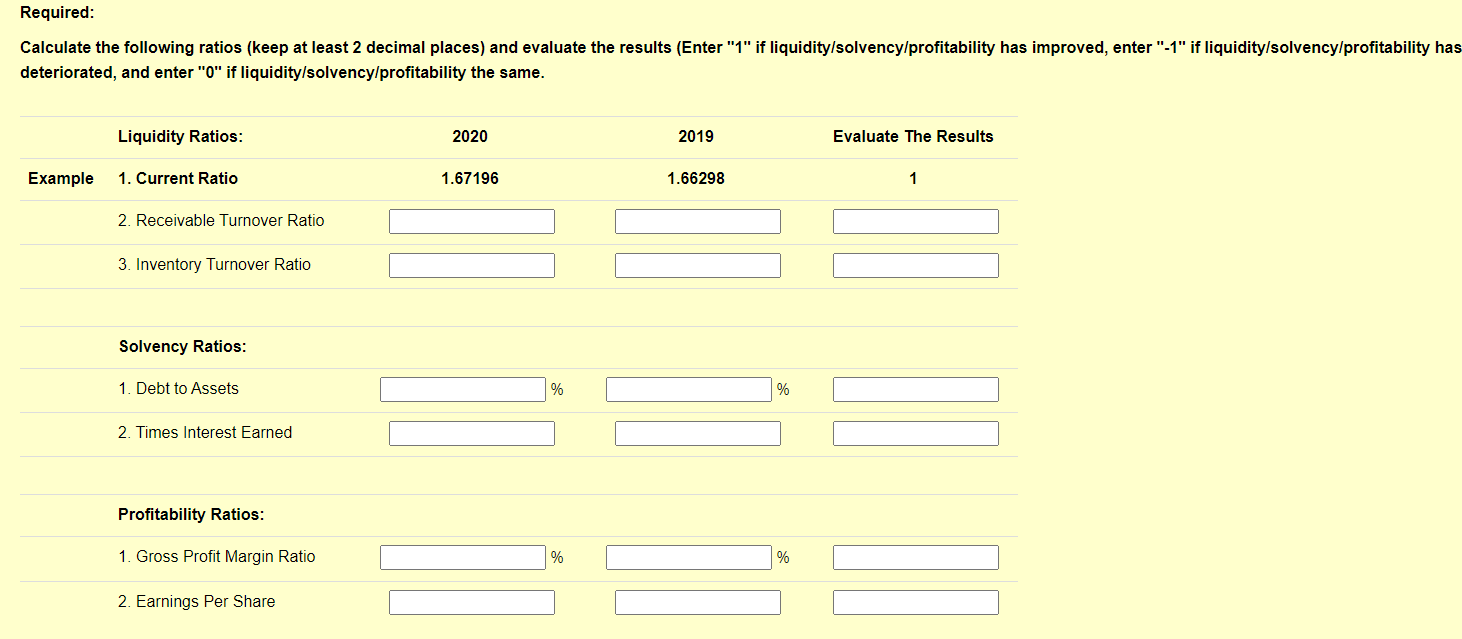

Condensed balance sheet and income statement data for Clack Ltd. follow: CLACK LTD. Balance Sheet December 31 2020 2019 Assets Current Assets: Cash $70,000 $65,000 Accounts receivable (net) 91,000 85,000 Inventory 131,000 128,000 Prepaid expenses 24,000 23,000 Total current assets 316,000 301,000 Long-term assets Long-term investments 45,000 40,000 Property, plant, and equipment (net) 390,000 305.000 Total long-term assets 435,000 345,000 Total Assets $751,000 $646,000 Liabilities and Shareholders' Equity Liabilities and Shareholders' Equity Liabilities Current Liabilities Accounts Payable $49,000 $41,000 Accrued Liabilities 30,000 40,000 Bank loan payment (current) 110,000 100,000 Total current liabilities 189,000 181,000 Long-term liabilities Bonds Payable, due 2025 200,000 150,000 Total liabilities 389,000 331,000 Shareholders' Equity Common shares (20,000 shares issued) 200,000 200,000 Retained earnings 162,000 115,000 Total shareholders' equity 362,000 315,000 Total liabilities and shareholders' equity $751,000 $646,000 CLACK LTD. Income Statement Year Ended December 31 CLACK LTD. Income Statement Year Ended December 31 2020 2019 Sales $900,000 $840,000 Cost of goods sold 611,000 670,000 Gross profit 289,000 170,000 Operating expenses 187,000 160,000 Income from operations 102,000 10,000 Interest expense 31,000 21,000 Income before income tax 71,000 -11,000 Income tax expense 22.000 20.000 Income after tax $49,000 $-31,000 Additional Information: A. Accounts receivable at the beginning of 2019 were $81,000, net of an allowance for doubtful accounts of $3,000. B. Inventory at the beginning of 2019 was $114,000. C. Total assets at the beginning of 2019 were $631,000. D. Total current liabilities at the beginning of 2019 were $180,000. E. Total liabilities at the beginning of 2019 were $371,000. F. Shareholders' equity at the beginning of 2019 was $259,000. G63 percent of the sales were on account Required: Calculate the following ratios (keep at least 2 decimal places) and evaluate the results (Enter "1" if liquidity/solvency/profitability has improved, enter"-1" if liquidity/solvency/profitability has deteriorated, and enter "0" if liquidity/solvency/profitability the same. Liquidity Ratios: 2020 2019 Evaluate The Results Example 1. Current Ratio 1.67196 1.66298 1 2. Receivable Turnover Ratio 3. Inventory Turnover Ratio Solvency Ratios: 1. Debt to Assets % % 2. Times Interest Earned Profitability Ratios: 1. Gross Profit Margin Ratio % 2. Earnings Per Share